ACCOUNTS FOR BCOM/MCOM ENTRANCE EXAM 2022

- If You Are (Youtuber,content Writer, Web Developer) Copying this information from our website We will take a legal Action Against You. Please Don’t copy this information. for any Copyright Agreement Please mail Us help@luupdate.com

- Book-Keeping – Systematic recording and classification of the transactions that can measured in money. Its stage is primary.

- Basic objective of book-keeping is to maintain systematic records of financial transactions

- Father of Book-keeping– Lucas F Pacioli

- His book name is De Computiset Scripturis published in 1494 in Italy.

- Accounting – Accounting is the process of recording, classifying, summarising and analysing the transactions that can measured in money. Accounting is the secondary stage.

- Basic objective of accounting is to know the net results of operation and financial position.

- Where book-keeping ends, accounting starts and where accounting ends, auditing starts.

- Account – Account is a place where we record the monetary transactions of particular person, institution, firm, bank, etc.

- Accountancy – system or method of doing accounting.

- Transactions – It is divided in two parts-

- Monetary transactions

- Non-monetary transactions

Accounting Process—

- Recording – Journal

- Classifying – Ledger

- Summarizing – Trial Balance

- Analyzing – Final Account

- Interpretation – Auditing

Users of Accounting Information

1. Internal Users

Management, Employees, Partners or Propritors

2.External Users

Customers, Lenders, Suppliers, Govt., Public, Tax Authorities, Researchers, Investors

Qualitative Characteristics of Accounting Information—

- Understandability

- Relevance

- Reliability

- Comparability

Branches of Accounting—

- Financial Accounting

- Management Accounting

- Cost Accounting

- Tax Accounting

- Government Accounting

- Inflation Accounting

- Social Responsibility Accounting

- Environmental Accounting

Accounting Methods

1.Mercantile method – recorded cash and credit transactions both

2.Cash System of Accounting – record only cash transactions

System of Financial Accounting

- Cash System

- Single Entry System

- Double Entry System

- Indian System of Accounting

Single Entry System of Accounting

- It is also known as incomplete system of accounting

- Useful for small businessman

- Both the aspects of transactions are not recorded

- Only personal account and cash account are kept

- Profit only an estimate

- Financial statement is disclosed by preparing the Statement of Affairs

- P & L is calculated by following two methods:

- Net Worth Method

- Conversion Method

Double Entry System of Accounting-

- Every business transaction affects two accounts

- Each transaction has two aspects, i.e. debit and credit

- Whole system is always in balance

- It maintains the complete record of each transaction.

Indian System of Accounting- Under this system of accounting, transactions are recorded in any Indian language, like Hindi, Urdu, Bengali, etc. It is also based on principle of double entry system where each transaction has two fold or aspects i.e. ZAMA (Debit) and NAM (Credit).

Recording—

- Small firms record the transaction only in journal. It is known as primary entry or principle book where transactions are recorded in chronological order.

- Large firms maintain different books. It is known as books of original entry or subsidiary books. There are eight subsidiary books—

- Cash book

- Purchase book – record only credit purchase of goods

- Sales book – record only credit sales of goods

- Purchase Return book – record only those goods which have purchase on credit

- Sales Return book – record only those goods which have sold only on credit

- Bills Receivable book

- Bills Payable book

Journal Proper book— Followings transactions are recorded under this book –Opening entry, Closing entry, Transfer entry, Adjustment entry, Rectifying entry, Omission entry, Purchase or sale of assets on credit, Discount allowed or received entry, Bad debts entry, Provisions entry

Cash Book—

- Single Column Cash book

- Double Column Cash book

- Three Column Cash book

- Petty Cash Book – A. Simple Petty Cash Book

B. Analytical Petty Cash Book

- It performs both functions as journal and ledger

- Only cash transactions are recorded

- Balance of cash book can never show a credit balance, it shown only Debit Balance

- In case of single column cash book, there is only one column of amount, i.e. cash or bank

- In case of two column cash book, there are two column of amount, i.e. cash and bank or cash and discount

- While preparing cash book, we do not find the balance of discount column

- In case of three column cash book, there are three column of amount, i.e. cash, bank and discount.

- Contra entry – A contra entry is an entry which is recorded to reverse or offset an entry on the other side of an account. Example: Cash deposited into the bank and cash withdrawn from bank.

- Petty cash book is the book which is used for the purpose of recording the payment of petty cash expenses or daily basis expenses

- Petty cash book is based on the Imprest System

- Petty cash book is both a book of original entry as well as a book of final entry. It serves the purpose of both journal and ledger

Two type of discount-

1. Trade discount 2. Cash discount

| Trade Discount | Cash Discount |

| 1. It is given to increase sale | 1. It is given in consideration of prompt payment |

| 2. It is not opened in the ledger | 2. It is opened in the ledger |

| 3. It is allowed on purchase of goods | 3.. It is allowed on immediate payment |

| 4. It may change with quantity | 4.. It may change with the time. |

Journal—

- Journal means a day book or daily book of accounting

- There are 5 columns in journal

- The process of recording transaction in it is journalising

- Transactions are recorded in chronological (date-wise) order

- Journal is first stage of accounting process (Recording).

- Types of Journal Entry –

- Simple Journal Entry

- Compound Journal Entry (two or more accounts are debited or credited in an entry)

Ledger

Principal book

- Permanent summary of individual transaction

- From journal to ledger is called Posting

- There are 8 columns in ledger

- Classification of different transactions are done at this stage

- It is also called Book of Final Entry

Trial Balance—

- List of account

- List of debit and credit balance of transaction

It is statement not an account

- It is prepare to ascertain the arithmetical accuracy

- It is prepared on a particular date and not for a particular period

- It helps in preparing the financial statements

- Summarisation of all account is done at this stage

- If trail balance does not tally, then we open a new account and it is called Suspense account

- Balance of Suspense account may be debit or credit. If it shows debit balance, then record it into assets side of balance sheet. And, if it shows credit balance then it will recorded in liabilities side of balance sheet.

- Closing stock does not appear in trial balance

- Dr. items of trial balance – Assets, Purchase, Expenses, Loss Drawing, Sales Return

- Cr. Items of trial balance – Liabilities, Sales, Income, Profit, Capital, Purchase Return

- Methods of Trial Balance – there are three methods of trial balance – 1. Total Method

- Balance Method

- Total and balance method

Rectification of Errors

Accounting errors may be classified as follows –

- Errors affecting the Trial Balance

- Errors not affecting the Trial Balance

Errors affecting the Trial Balance can be categorised in two parts:

- Errors of Partial omission: It may occur where omission of posting in any one account of a transaction has done

- Error of Commission: It may occur where amount has over-casted or under- casted in any one account or posting is done in wrong account or wrong side.

Errors not affecting Trial Balance can be categorised in two parts:

- Error of Principle: It may arise just because of lack of knowledge. For example, capital expenditure is treated as revenue expenditure.

- Compensating Errors: It may arise in such a way where two or more errors committed in such a way that the net effect of these errors of the debit and credits of account is nil.

- Error of Complete omission: This error arises when any particular transactions is not recorded in the books of original entry at all.

- Error of Commission: This error arises due to wrong recording, wrong casting, wrong carry forward, wrong posting, etc.

Types of Account—

Two types of account-

- Personal Account

- Impersonal Account

- Personal Account is that account which is related to individual, firm, company, institution, bank, etc. Personal account can be categorised into three parts:

- Natural Personal Account – Ram, Shyam, Sita, etc.

- Artificial Personal Account – Company, Bank, Institution, etc.

- Representative Personal Account – Capital, Drawings, Outstanding expenses, Prepaid Expenses, etc.

Accounting Rules-

Debit the Receiver, Credit the Giver

- Impersonal Account can be categorised in two parts-

- Real Account

- Nominal Account

- Real Account is related to the assets of the firm. It can be divided in two parts – 1. Tangible Assets – Land. Machine, Furniture, etc.

2. Intangible Assets – Goodwill, Patent, trademark.

Accounting Rules –

What comes in Debit, What goes out Credit

- Nominal account is related to the income, expenses, profit and loss of the firm. Example- salary, interest, commission, etc.

Accounting Rules –

Expenses and Losses will be Debited, Income and Profit will be Credited

NOTE: If we add the adjustment with nominal account items, then it will be treated as Personal Account, i.e. outstanding wages.

Rules for Debit and Credit

| Types of Accounts | Rules for Debit | Rules for Credit |

| 1. For Assets A/c | Debit the increase | Credit the decrease |

| 2. For Liabilities A/c | Debit the decrease | Credit the increase |

| 3. For Capital A/c | Debit the decrease | Credit the increase |

| 4. For Revenue A/c | Debit the decrease | Credit the increase |

| 5. For Expenses A/c | Debit the increase | Credit the decrease |

Accounting Concepts and Conventions— Accounting Concepts –

- Business Entity Concept – A business is treated as a separate entity that is distinct from its owners.

- Money Measurement Concept – Only those transactions are included in accounting which can express in terms of money.

- Accounting Period Concept – Entire life of the firm is divided into time intervals for ascertaining the profits or losses are known as accounting periods.

- Going Concern Concept –The enterprise is normally viewed as a going concern that is, continuing in operation for longer period.

- Accrual Concept – Incomes and expenses should be recognised as and when they are earned and incurred, irrespective of whether the money is received or put for it.

- Historical Cost Concept – An asset is ordinarily recorded in the records at its cost price and the cost becomes the basis of accounting.

- Matching Principle – The expenses paid in an accounting period should be matched with the revenue in that period.

- Dual Aspect Concept – All transactions have two dimensions. This follows from the basic accounting equation:

Assets = Capital + Liabilities

- Objective Verifiable Concept – Accounting data should be definite, verifiable and free from personal bias of the accountant.

- Realization Concept – Revenues should be recognised when the major economic activities have been completed.

Accounting Conventions:

- Convention of Consistency – Once an entity has selected an accounting method for a kind of event, that same method should be followed on a horizontal basis for future events.

- Convention of Conservatism or Prudence – The principle of ‘anticipate no profit but provide for all probable losses’ C

- Convention of Full Disclosure – All relevant facts concerning financial position must be communicated to users.

- Convention of Materiality – Only those events should be recorded which have a significant bearing and insignificant things should be ignored.

GAAP – Generally Accepted Accounting Principle

Types of Assets and Liabilities— ASSETS

| Current Assets | FIXED Assets | Fictitious Assets | Liquid Assets | Absolute Liquid A | Wastin g Assets | Tangible Assets | Intangible Assets |

| Cash & Bank | Machine | Share issue Exp | Cash | Cash | Mines | Plant | Goodwill |

| Inventory | Land | R & D | Bank | Bank | Oil | Furniture | Copyright |

| Debtor | Truck | Preliminary Expenses | BR | Current Investme Nt | Timber | Machine | Trademark |

| Prepaid expenses | Furnitur e | Underwriting Commission | Debtors | Coal | Stock | Software | |

| Bills receivabl e | Building | Advertisemen t | Current Investme nt | Computer | Patents |

Liabilities

| Current Liabilities | Fixed Liabilities | Contingent Liabilities |

| Creditors | Debentures | Bank Guarantee |

| Bills Payable | Long term loan | Product Warranty |

| Outstanding Expenses | Bonds | Lawsuit |

| Short term loan | Change in Foreign Exchange |

Utilisation of Security Premium Account – As per under section 52(2) of the Companies Act 2013 – (Security Premium is Capital Profit)

- For issuing fully paid bonus shares

- Writing off preliminary expenses

- Writing off the expenses of or discount allowed on any issue of shares or debentures

- For redemption of shares or debenture on premium

- For the Buyback of own shares.

Negotiable Instruments Act, 1881

- Bill of Exchange-

- It is negotiable instruments

- Unconditional

- Written by Drawer(Creditor) on drawee (Debtor)

- It is an order to pay

- Acceptance is compulsory

- Number of parties—three (Drawer, Drawee & Payee)

- Grace period—three days

- Given – Under section 5 of NI Act, 1881

- Price, person and period are fixed while writing this bill

1. Promissory Note—

- It is negotiable instruments

- Unconditional instruments

- It is promise to pay

- Written by maker (buyer/debtor) on payee (seller/creditor)

- It is request to pay

- No need of acceptance

- Number of parties – two (Maker & Payee)

- Days of Grace– three

- Given – under section 4 of NI Act, 1881

- Price, person and period are fixed while writing this bill

2. Cheque-

- It is negotiable instrument

- Unconditional

- Written by accountholder on bank

- It is an order to pay

- A cheque is valid up to 3 months of the stated date

- Given – under section 6 of NI Act, 1881

- Price, period, and person are fixed while writing this instrument

- Three parties to a cheque(apart from this, there are two more parties i.e. endorser and endorsee)

- Types of Cheque –

- Open Cheque

- Bearer Cheque

- Order Cheque

- Crossed Cheque

- Self Cheque

- Blank Cheque

- Stale Cheque

- Post-dated Cheque

- Ante-dated Cheque

- Banker’s Cheque

- Cancelled Cheque

- Mutilated Cheque

- Traveler’s Cheque

- Gift Cheque

- Drawing two parallel lines on the left corner of the cheque with or without additional words is called crossed cheque. A cheque is crossed due to its safety purpose.

- A crossed cheque can’t be en-cashed at the counter of bank but it can be credited only to the payee’s account.

- The process of transferring an instrument is called an endorsement. Every sole maker, drawer, payee or endorsee of negotiable instrument may endorse and negotiate the bill.

- A bill is endorsed in the favour of creditor

- Making the payment of bill before the date of maturity is called retirement of a bill. Drawee of the bill gets consideration for premature payment is known as REBATE

- A Bill of Exchange may be dishonoured by (a) non-payment or by (b) non- acceptance

- A promissory note and cheque can be dishonoured by non-payment only

- Cancellation of the original bill and drawing a fresh bill for another period on a request from the drawee is called renewal of a bill

- Bill of Exchange is also known as trade bill, mercantile bill, business bill, commercial bill.

Difference of Bills of Exchange and Promissory Note

| Trade Bill | Accommodation Bill |

| 1. Drawn to settle business transaction | 1. Drawn to meet the financial needs |

| 2. These bills are accepted for a consideration | 2.These bills are accepted without any consideration |

| 3. Act as an evidence of indebtedness | 3.Act as a source of finance |

Consignment Account

When goods are send by the owner to agent to sale on his behalf for commission is called consignment business.

- Goods send by owner to agent

Goods send to sale

- Risk is borne by owner

- Two parties (Consignor & Consignee)

- Relationship between consignor and consignee is called principal and agent

- To know profit, consignor prepares Consignment account and the nature of consignment account is Nominal account

- Consignee gets commission for his services. There are three types of commission—

- Simple commission

- Del credere commission

- Over riding commission

- Simple commission is that which is given by consignor to consignee on total sales (cash sales+ credit sales)

- Del credere commission is that commission which is given on credit sale

and in this case all risk related to bad debts will be borne by consignee

- When consignee sales goods more than its invoice price, then he gets extra some special commission and this commission is called over riding commission.

Calculation of Cost of Closing Stock—

Cost Price of Remaining Goods + Proportionate Expenses of Consignor + Proportionate Expenses of Consignee

Calculation of Cost of Abnormal Loss—

Cost Price of Lost Goods + Proportionate Expenses of Consignor

Loss can be categorised in two parts:

- Normal Loss ( No accounting record)

- Abnormal Loss (Recorded in books of account)

Bank Reconciliation Statement

Bank Reconciliation Statement is prepared to reconcile the bank balance as per cash book with the balance as per pass book.

Bank Reconciliation is prepared by Customer or Trader or Businessman

Reason of difference between the balance of Cash Book and Pass Book:

- Cheques issued but not yet presented for payment into the bank

- Cheques deposited but not yet collected by bank

- Directly deposited by customer

- Bank charges charged by the bank

- Directly payment made by bank on behalf of customer

- Interest given by the bank

Methods to prepare BRS:

- Balance as per Cash Book or Debit balance as per Cash Book or favourable balance as per Cash Book

- Balance as per Pass Book or Credit balance as Pass Book or favourable balance as per Pass Book

- Overdraft as per Cash Book or Credit balance as per Cash Book or Unfavourable balance as per Cash Book

- Overdraft as per Pass Book or Debit balance as per Pass Book or Unfavourable balance as per Pass Book

Note:

- Dr. Bank balance as per Cash Book = Cr. Bank balance as per Pass Book

- Cr. Bank balance (Overdraft) as per Cash Book = Dr. Bank balance (Overdraft) as per Pass Book

Joint Venture

- Two or more than two persons work together to achieve the goal

- It is also called Temporary Partnership

- Business runs without using name

- No any specific act

- After achieving the objective, business will be closed

- No need of registration

Ø Partners are called Co-Venture

- To know the Profit or Loss of this business, Joint Venture Account is prepared and nature of Joint Venture A/c is nominal account

Financial Statement

- It is prepared to know the detailed information about the financial position and performance of an enterprises

- Traditionally includes- Balance Sheet and P/L Account

- Balance sheet (or Position Statement) which shows the financial position of the firm at a particular point of time

- Trading and Profit and Loss Account (or Income Statement) which shows the financial performance of the firm’s operation during an accounting year.

Trading Account-

- It shows the results of buying and selling of goods or services during an accounting year

- It is prepared to know the amount of Gross Profit or Gross Loss

- Under this account, we record all direct expenses

- Nature of Trading A/c is Nominal Account

- Gross Profit means excess of operating revenues over direct operating expenses

- Adjustment Purchase = Net Purchase + Opening Stock – Closing Stock

- Cost of Goods Sold = Opening Stock + Purchase + Direct Expenses – Closing Stock

- If Closing Stock is given in trial balance, then it will shown in Balance Sheet

Profit and Loss Account-

- It shows the financial performance of business during an accounting period

- It is prepared to know the amount of Net profit or Net Loss

- Under this account, we record indirect expenses and indirect income

- Nature of P/L Account is Nominal account

- Net Profit means the excess of all revenue (whether operating or non- operating) over expenses & losses

Balance Sheet-

- It is statement and not an account

- A statement of financial position of an enterprise at given date

- It is a sheet of Balances of those ledger accounts which are never closed

- Under balance sheet, we record all items related to Personal A/c, Real A/c, Fictitious Assets A/c

- Prepared at a particular point of time

- Balance sheet shows the nature and value of assets and nature and amount of liabilities

- Balance sheet contents two heads i.e. assets and liabilities. In India right hand side of Balance Sheet is Assets and left hand side of Balance Sheet is Liabilities. While in Australia, right hand side of Balance Sheet is Liabilities and left hand side of Balance Sheet is Assets.

- Marshalling of Assets and Liabilities- It refers to the order in which various assets and liabilities are shown in the Balance Sheet

- Order of Assets and Liabilities

- 1.Order of Liquidity

- Order of Permanance

Assets

Start with most Liquid Assets e.g.. Cash in hand

Liabilities

Start with most urgent payment e.g. Creditors

Assets

Start with least Liquid Assets e.g. Goodwill

Liabilities

Start with the least urgent payment e.g. Owners

Methods of Presenting the Final Account-

Trading and Profit and Loss account and the Balance Sheet

Horizontal Format

Items are presented in ‘T’ shape

Vertical Format

Items are presented in Single Column Statement

Note:

- The banking and

financial companies, sole proprietorship and the

partnership concerns prepare their Balance Sheets in the order of Liquidity

- The company as defined under the Companies Act, 2013

prepare the Balance Sheet in order of Permanence.

is required to

Adjustments—

- Normally we record adjustment at two place, first in Trading or Profit &Loss A/c and then Balance sheet

- If any adjustment is given in Trial Balance, it will record in Balance Sheet except depreciation. Depreciation records in Profit & Loss account.

- According to Prudence Principle, the stock of finished goo cost or net realisable value whichever is lowers is valued at

| Given in Information | RECORD |

| 1. Closing Stock | Credit side of Trading AccountAssets side of Balance Sheet |

| 2. Outstanding Expenses | Add it given expenses Liabilities side of Balance Sheet |

| 3. Prepaid Expenses | Minus in given expensesAssets side of Balance Sheet |

| 4. Accrued Income Or Earned Income | Add in given incomeAssets side of Balance Sheet |

| 5. Unearned or Advance Income | Minus in given incomeLiabilities side of Balance Sheet |

| 6. Depreciation | Dr. Side in P/L A/cMinus in given assets in Balance Sheet |

| 7. Interest on Capital | Dr. Side of P/L A/cAdd in Capital in Balance Sheet |

| 8. Interest on Drawings | Cr. Side of P/L A/cMinus in Capital in Balance Sheet |

| 9. Abnormal Loss of Stock | Minus in Purchase in Trading AccountLoss that can’t be recoveredRecovered amount shown in Balance Sheet |

| 10.Bad Debt | Dr. Side in P/L A/cMinus in Debtors in Balance Sheet |

| 11.Manager’s Commission | Dr. Side of P/L A/cShown in Liabilities side of Balance Shee |

Accounting Standards

- Selected set of accounting policies

- Uniformity and comparability in the preparation of financial statements

- ICAI constituted an Accounting Standards Board (ASB) on April 21, 1977

- In India, Accounting Standard (AS) is framed by Institute of Chartered Accountants of India (ICAI). ICAI Act, 1949.

| AS-1 | Disclosure of Accounting Policies |

| AS-2 | Valuation of Inventories |

| AS-3 | Cash Flow Statement |

| AS-4 | Contingencies and Events Occurring after B/S date |

| AS-5 | Net P/L for the period, Prior Period |

| AS-6* | Depreciation Accounting |

| AS-7 | Accounting for Construction Contracts |

| AS-8* | Accounting for Research &Development |

| AS-9 | Revenue Recognition |

| AS-10 | Accounting for Fixed Assets |

| AS-11 | Effects of Foreign Changes in Exchange Rates |

| AS-12 | Accounting for Government Grants |

| AS-13 | Accounting for Investments |

| AS-14 | Accounting for Amalgamations |

| AS-15 | Accounting for Retirement Benefits |

| AS-16 | Borrowing Costs |

| AS-17 | Segment Reporting |

| AS-18 | Related Parties Disclosure |

| AS-19 | Leases |

| AS-20 | Earnings Per Share |

| AS-21 | Consolidated Financial Statements |

| AS-22 | Accounting for Taxes on Income |

| AS-23 | Accounting for Investments |

| AS-24 | Discontinuing Operations |

| AS-25 | Interim Financial Reporting |

| AS-26* | Intangible Assets |

| AS-27 | Financial Reporting of Interest in Joint Venture |

| AS-28 | Impairment of Assets |

| AS-29 | Provision, Contingent Liabilities and Contingent Assets |

Financial Statement Analysis

Financial statement analysis is a technique of reviewing and analyzing a company’s financial statements to make better financial decisions regarding future aspects.

Tools of Financial Analysis- Seven tools-

- Comparative Statement

- Common Size Statement

- Cash Flow Statement

- Fund Flow Statement

- Trend Analysis

- Break Even Analysis

- Ratio Analysis

Types or Methods of Financial Analysis

| Horizontal Analysis | Vertical Analysis |

| It is also known as Dynamic Analysis, Trend Analysis, Cross Sectional Analysis, Time Series AnalysisFinancial data for number of years are analyzedChanges in figures are expressed in percentageExample – Comparative Statement, trend Analysis | It is also known as Static Analysis, Common Size Statement, Structure AnalysisFinancial data for single year is analyzedChanges in figured are expressed in percentage to totalExample – Common Size Statement, Ratio Analysis, Cash Flow Statement |

Financial Statement of Companies

- Financial statements are the end products that provide information about the financial health of the business

- As per Section 2(40) of the Companies Act, 2013, Financial Statement includes the following-

- A Balance Sheet as at the end of financial year

- A Statement of Profit or Loss for the financial year

- Cash Flow Statement for the financial year

- A Statement of changes in Equity, if applicable, and

- Explanatory Notes

Note- One Person Company (OPC), Small Company and Dormant Company are exempted from preparing Cash Flow Statement

- As per Section 129(1) of the Companies Act, 2013, there is prescribed form of Balance Sheet in Schedule III

- Schedule has two parts –

Part I for Balance Sheet and Part II for Statement of P/L

Note: The auditor’s report and director’s report must be attached to the Financial Statement of the Company.

Cash Flow Statement

- The statement which shows the movement of cash and cash equivalents between two accounting period, is called Cash Flow Statement

- Here flow means inflow and outflow of cash

- Cash and cash equivalent includes cash and the assets which are near to cash. Example- cash, bank, treasury bills, cheques, marketable securities, commercial papers, call deposits, short term investment, current investment

- Cash and cash equivalents are highly liquid assets

- Maturity date of Cash and Cash Equivalents – must not be more than three months (90 days)

- Cash flow statement is useful for short term financing

- Cash flow statement is based on the Cash Basis of Accounting

- Cash flow statement is mentions in AS- 3

- There are two methods to prepare Cash Flow Statement-

- Direct Method

- Indirect Method

- The AS-3 has been mandatory for certain enterprises, these enterprises are

- Enterprises whose equity or debt securities are listed on a Recognized Stock Exchange in India

- All other commercial, industrial and business enterprises, whose turnover for the accounting period exceeds ₹50 crores.

- AS-3 categorized the Cash Flow Activities in three parts, they are –

- Operating Activities

- Investing Activities

- Financing Activities

Items included in different Activities

Cash flow from Operating Activities—

•Cash receipts from sale of goods and the rendering of services

•Cash receipts from royalties, fees, commissions and other revenues

•Cash payments for purchase of goods and services

•Cash payment of wages, salaries and other payment to employees

•Cash payment or refund of income taxes unless they can be specifically identified with financing and investing activities

Cash flow from Investing Activities—

•Cash payment to acquire fixed assets

•Cash receipts from sale of fixed assets

•Cash payment to acquire shares, warrants or debt instruments of other enterprises

•Cash receipts from disposal of shares, warrants or other debt instruments of other enterprises

•Cash receipts of interest and dividend

Cash flow from Financing Activities—

•Cash proceeds from issuing shares or other similar instruments

•Cash proceeds from issuing debentures, loans, notes, bonds, and other short or long run borrowings

•Cash payment of interest and dividends

•Payment of preliminary expenses

Points to Remember—

| S.No. | Items | For Financing Comp. | For Non-Financing Comp. |

| 1 | Interest Received | Operating Activity | Investing Activity |

| 2 | Dividend Received | Operating Activity | Investing Activity |

| 3 | Interest Paid | Operating Activity | Financing Activity |

| 4 | Dividend Paid | Financing Activity | Financing Activity |

· When does the flow of cash arise? –

Cash flow arises when a transactions results in either

- Treatment of Goodwill-

- If value of goodwill increases – it is treated as Investing Activities

- If value of goodwill decreases – it is treated as Operating Activities

· When does the flow of cash arise? –

Cash flow arises when a transactions results in either

- Treatment of Goodwill-

- If value of goodwill increases – it is treated as Investing Activities

- If value of goodwill decreases – it is treated as Operating Activities

Cash Flow Statement

Operating Activities

Related to principle revenue generating items

Investing Activities

Related to change in the value of fixed assets

Financing Activities

Related to change in the value of Debt AND equity

Add and Minus items while calculating Operating Profit Before Working Capital Changes–

| Particulars | Amount |

| Net Profit Before Tax Add items— Depreciation Loss on Sale of Fixed Assets Underwriting Commission Preliminary Expenses Discount on Issue of Share or Debenture Goodwill written off Transfer to Reserve Minus items— Profit on Sale of Fixed Assets Interest or Dividend Received |

- Adjustment in respect of changes in Current Assets and Current Liabilities while preparing Cash Flow From Operating Activities—

- Increase in Current Assets means Decrease in Cash From Operating Activities

- Decrease in Current Assets means Increase in Cash From Operating Activities

- Increase in Current Liabilities means Increase in Cash From Operating Activities

- Decrease in Current Liabilities means Decrease in Cash From Operating Activities

- We need to prepare the Fixed Assets Account to know the amount of purchase or sale of fixed assets

Fund Flow Statement

- A statement showing changes in the financial position of a business and indicates the various means through which funds were collected and the ways to which these funds were used.

- Fund flow statement is known by different names- Sources and Application of Funds, Summary of Financial Operations, Statement of Changes in Financial Position, Movement of Funds Statement.

- The term funds has been defined in number of ways—

Funds

In Narrow Sense

Funds means Cash only

In broader Sense

Funds means all Resoures used in Busuness

Modern sense

Funds= Current Assets– Current Liabilitis

- It is complementary to income statement

- It is dynamic in nature

- There is no prescribes format for preparing a fund flow statement

- It is based on Accrual Basis of Accounting

- It is useful in planning intermediate and long term financing

- It is based on wider concept of funds

Note- The flow of funds occurs when a transaction changes on the one hand a

non-current account and on the other hand a current account and vice-versa. In simple language, funds move when a transaction affects –

- A current asset and a fixed liability

- A fixed asset and a current liability

- A current asset and a fixed asset

- A fixed liability and a current liability Example-

| Flow of Funds | No Flow of Funds |

| Issue of shares for cash Raising of long term loans Sale of fixed assets Redemption of Preference shares Payment of Bonus in cash Repayment of long term loan Sale of long term investmentIssue of Debenture for cashIssue of shares against purchase of stock-in-trade | Cash collected form debtors Issued bills payable to creditors Raising short term loans Sale of Marketable securities Goods purchased on cash or creditPurchase of fixed assets by issue of shares Conversion of debentures into shares |

Procedures of Preparing Fund Flow Statement—

- Statement of changes in Working Capital

- Funds from operations

- Statement of Sources and Application of funds

Note— With the help of statement of changes in Working Capital, we can find four conclusions-

- Increase in Current Assets means Increase in Working Capital

- Decrease in Current Assets means Decrease in Working Capital

- Increase in Current Liabilities means Decrease in Working Capital

- Decrease in Current Liabilities means Increase in Working Capital

Format of Fund Flow Statement (For the year ended…………. )

| Sources of Funds | Amount | Application of Funds | Amount |

| Funds from Operations | —. | Funds lost in operation | ….. |

| Issue of share capital | —- | Redemption of Preference shares | ….. |

| Long term loan raised | —- | Payment of dividend | …. |

| Sale of Non-current assets | —- | Redemption of Debentures | ….. |

| Sale of long term investment | — | Payment of long term borrowing | …… |

| Decrease in Working Capital | —- | Purchase of fixed assets | ….. |

| Non-trading income | Increase in Working Capital | ….. | |

| Total | Total |

Fund flow statement is not as account but it is the statement.

Transactions

It can be divided in two parts-

- Capital transactions

- Revenue transactions

Capital transactions can be divided in four parts:

- Capital Expenditure

- Capital Receipts

- Capital Profits

- Capital Loss

Revenue transactions can be divided in four parts:

- Revenue Expenditure

- Revenue Income

- Revenue Profit

- Revenue Loss

- Expenditures are divided in two parts (capital expenditure and revenue expenditure) on the basis of Going Concern Concept.

Capital Expenditure-

- Non-recurring items

- Incurred in long term

- Amount is large

- Effects the business for number of years

- Record in balance sheet

- Helps in increasing the profit

- Increase the value of fixed assets

- Example- Purchase of Machinery, Land & Building, etc.

Revenue Expenditure-

- Recurring items

- Incurred on short term or on daily basis

- Amount is small

- Effects the business for current year only

- Record in Trading & P/L A/c

- Helps in maintaining the profit

- Maintain the value of fixed assets

- Maintain the earning capacity of the firm

- Example – Purchase of Goods, payment of salary, etc.

Deferred Revenue Expenditure-

Deferred revenue expenditures are those expenditures which are basically in the nature of revenue expenditure but whose benefits covers a number of years i.e. their benefit may extend over a number of years.

Example- Advertisement, Discount on issue of shares or debentures, Underwriting commission, Preliminary expenses, Research & Development, Heavy Repairs, etc.

Depreciation

- Depreciation means decrease in the value of fixed assets due to wear & tear, lapse of time, obsolescence, usage, accident, etc

- Depreciation is the process of allocation of value of fixed assets over its useful life

- Depreciation is fall in the book value of fixed assets rather than market value

- Depreciation charged on fixed assets except land and goodwill

- Depreciation is also called non-cash expenditure

- Accounting for depreciation is given under Accounting Standard 6

- Depreciation is revenue expenditure

- Amount of depreciation transferred to Profit & Loss A/c

- If depreciation is given in trial balance, then it will recorded in Profit & Loss Account

- Scrap Value or Residual Value or Salvage Value – The value which can be recovered from the sale of assets after the expiry of its useful life

- Entry — Depreciation A/c……………. Dr.

To Assets A/c

Fall in the value of Assets

Depreciation

Useful for Tangible Assets

Depletion

Useful for Wasting Assets

Amortization

Useful for Intangible Assets

Causes of Depreciation—

- Wear & tear

- Accident

- Expiration of the term

- Obsolescence or out of date

- Inadequacy

- Depletion

- Usage

Objective of Charging Depreciation—

- To know true Profit or Loss

- To replacement of assets

- To know present value of assets

- To show true financial position

| Methods | Explanation |

| 1. Straight Line Method | It is also known as Simple Method, Original Cost Method, Fixed Instalment Method Depreciation charged on its original cost every yearValue of depreciation remains constant every yearThe value of assets is reduced to zero at the end of useful life |

| 2. Diminishing Method | It is also known as Written Down Value Method, Balancing MethodDepreciation charged on the balance of assets every yearValue of depreciation decreases every yearValue of assets would never be zero under this method |

| 3. Annuity Method | Amount of depreciation remains fixed every yearIt is called a scientific methodUseful for long term lease |

| 4. Depreciation Fund Method | It is also known as Sinking Fund MethodAmount of depreciation remains fixed every yearUseful for wasting assetsThe amount of depreciation invested outside in any securities |

| 5. Revaluation Method | This method is useful for live stockUnder this method, value of assets can be appreciatedUseful for specific assets like, Loose tools, Horse, Copyright, Trade mark, etc. |

| 6. Depletion Method | 1. Useful for wasting assets or natural resources like, Mines, Quarries, Sandpits, etc. |

Break Even Analysis

- It is also known as Cost Volume Profit Analysis

Break Even Analysis

In Narrow Sense

No Profit, No Loss

TR=TC

In Broad Sense

Study Cost Volume Profit

Analysis at different sale level

Assumptions of Cost Volume Profit Analysis-

- All element of cost

- Variable cost and fixed cost remain constant

- Selling price remain fixed

- Synchronisation

Computation of BEP-

- By Algebraic Method

- By Graphic Method

BEP = Fixed Cost ÷ Contribution

Contribution = Selling Price – Variable Cost

Types of Stock as per Valuation

- Opening Stock

- Closing Stock

Types of Stock as per Physical Unit

- Raw Materials

- Work-in-progress

- Finished Goods

- Spare Parts

Valuation of Stock

- First in First out (FIFO)- This method is applicable when price is falling and useful from tax point of view

- Last in First out (LIFO)- This method is useful when price is rising

- Minimum in First out (MIFO)

- Highest in First Out (HIFO)

- Average Stock Method

- Base Stock Method

Tools and Techniques of Inventory Control

- ABC Analysis- It is a type of inventory categorization method in which inventory is divided into three categories, A, B and C, descending value. It is also known as Selective Inventory Control (SIC).

| A | B | C | |

| % in Cost | 70% | 20% | 10% |

| % in Unit | 10% | 20% | 70% |

- Vital, Essential, Desirable (VED)- This method is used generally for spare parts. The requirements and urgency of spare parts is different from that of materials. The demand for spares depends upon the performance of machinery. Spare parts are classified as-

Vital – must maintained for smooth running of business

Essential – necessary but their stocks must kept in low figures

Desirable – Stocking of this type of spares may be avoided at times.

- Just in time (JIT)—JIT is an inventory management system which aims at procuring raw material and labour as and when require without investing in stocking it. First introduced in Tokyo, Japan 1950.

- Economic Order Quantity (EOQ)—EOQ is one of the techniques of inventory control which minimizes total holding and ordering cost for the year. Introduced by Ford W Harris in 1913.

- Determination of stock level

- Determination of safety level

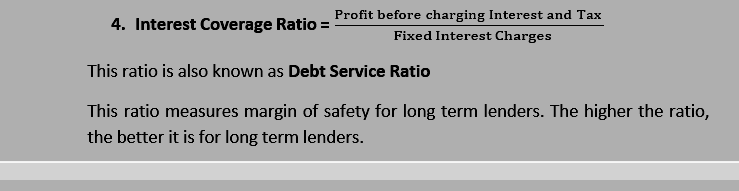

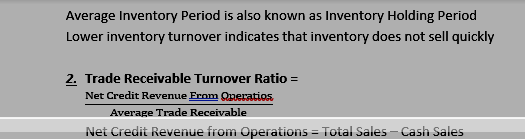

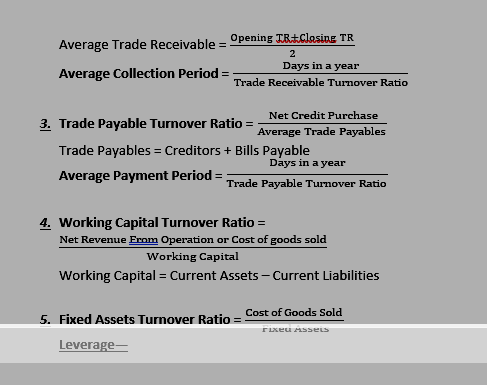

Ratio Analysis or Financial Ratios

- Ratio analysis is a tool used to determine the financial health and operational efficiency of a company

- It is an important tools for financial analysis

- Father of Ratio Analysis – Alexander Wall, given this concept In 1909

- Ratio analysis is a quantitative method of gaining insight into a company’s liquidity, operational efficiency, and profitability by studying its financial statements

- Inter firm and intra firm comparison is possible with the help of ratio analysis

- Ratio may be expressed in proportion or pure ratio, rate, percentage, fraction.

- Limitations of Ratio analysis – Window dressing, ignore qualitative data, based on historical data, accuracy of data, ignore price level changes.

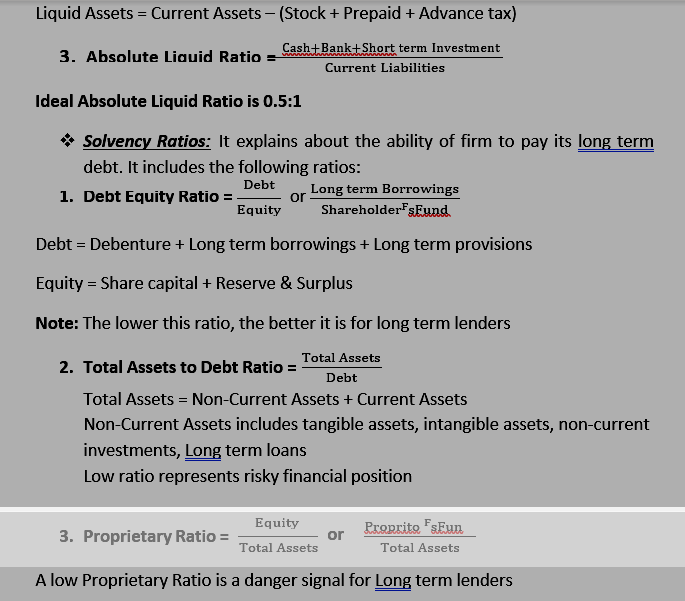

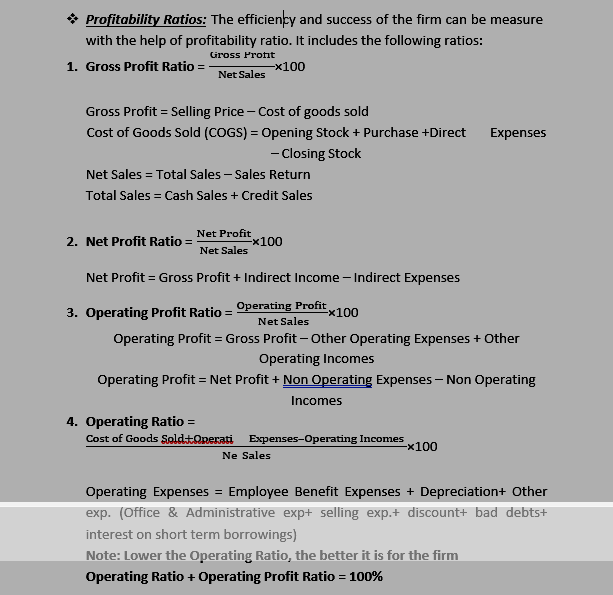

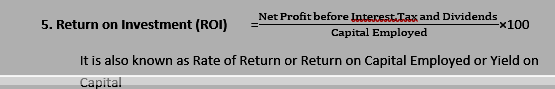

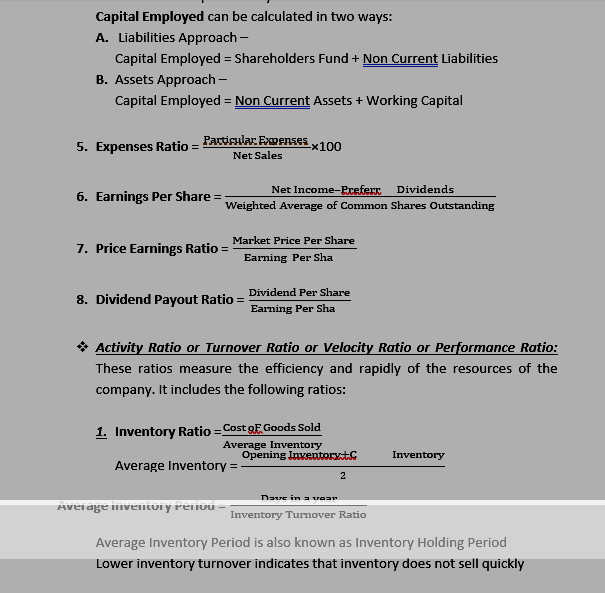

Types of Ratio Analysis:

Types of Ratio Analysis:

- Liquidity Ratios

- Solvency Ratios

- Profitability Ratios

- Activity Ratios

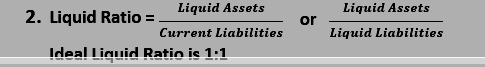

Liquidity Ratios:It explains about the ability of firm to pay its short term debt. It includes number of ratios:-

Current Ratio =Current Assets/Current Liabilities

ideal Current Ratio is 2:1

Current asset includes Cash, Bank, Stock, Debtors, Bills Receivable, Short Term Investment, Prepaid expenses, Advance paid.

Current liabilities include Creditors, Bills Payable, Bank Overdraft, Short Term Loan, Short Term Provision, Outstanding Expenses

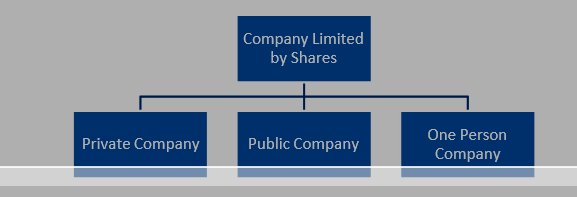

Company

Prof. Haney-“A company is an artificial person created by law, having separate entity with perpetual succession and a common seal”.

Companies Registered under Companies Act, 2013—

- Unlimited Company – A company not having any limit on the liability of its members is called an unlimited company. It is not found in India even though permitted by Act.

- Company Limited by Guarantee – Each member is liable to contribute the amount guaranteed by him to be paid in the event of the winding up of the company.

- Company Limited by Shares – Each member is liable to pay the full nominal value of shares held by him.

| Private Company | Public Company |

| 1. Section 2(68) | 1. Section 2(71) |

| 2. Members- Minimum -2 Maximum – 200 | 2. Members – Minimum -7 Maximum – No Limit |

| 3. It Can’t issue prospectus to inviting public | 3. It issues prospectus inviting to public |

| 4. Shares can’t transferred | 4.Shares can be freely transferred |

| 5. Compulsory to use the word Pvt. Ltd. at the end Of name | 5.Compulsory to use the word Limited at the end of name |

| 6. Mandatory to prepare their AOA | 6.Not mandatory to prepare their AOA |

| 7. Not required to hold statutory meeting | 7.Required to hold statutory meeting within six month of getting the certificate of |

| commencement. | |

| 8. A private company can start its business just after incorporation | 8.A public company can start its business after getting the letter of commencement of business |

| 9. Shares can’t be quoted in the stock market | 9.Shares are quoted in the stock market |

| 10. Minimum 2 directors are mandatory | 10.Minimum 3 directors are mandory |

| 11.No restriction on managerial remuneration | 11. Managerial remuneration cannot exceed 11% of net profit |

One Person Company

· Section 2(62)

One Person Company

- Private limited company

- One person member

- Natural and Resident

- Minimum paid up capital ₹1 lakh

- Directors – 1 to 15

- No requirement of cash flow statement

- An OPC can convert into Private Limited Company or Public Limited Company, when –

- Two year has expired

- Paid-up capital increased beyond ₹50 Lakh or

- Average annual turnover exceeds ₹ 2 crore

Shares

- Share is the small denomination of capital of company

- Movable property

- Transferrable as per Articles of Association(AOA)

- Treated as goods under Sale of Goods Act, 1930

- These can be bought, sold, hypothecated, bequeathed

Types of Share – Under Section 43 of Companies Act, 2013

- Equity Shares

- Preference Shares

Preference Shares-

- Preference shares are paid dividend before payment of equity share capital

- Preference shares are paid capital at the time of winding up before payment of equity share capital

- Preference shareholders have limited voting right

- Rate of dividend on preference shares is predetermined

- It can be converted into equity share

- The risk is lower

- Cumulative preference shares get arrears

- No control over management

- It can be redeem

Equity Shares-

- Real owner of the firm

- Get dividend in return

- Enjoy full voting right

- Right to participate in management

- It cannot convert into preference share

Ø Maximum risk

- Rate of dividend is not fixed

- No right of arrears of dividend

- It cannot redeem

Right Shares-

- Shares for existing shareholders

- Object of issue of this shares is to increase subscribed capital

- Right shares must be in the ratio of equity shares of the existing shareholders

- Regulated by Section 81 of the Companies Act

- These shares can be renounced by a member in favour of his nominee

Bonus Shares-

- When company paid bonus in the form of shares is called bonus shares

- These are issued to existing shareholders free of cost

- No minimum subscription is required

It is also called capitalisation of profit

- Bonus shares are always fully paid up

Deferred Shares-

- Issued to founders or promoters of the company

- Rate of dividend is not fixed

- Dividend is paid at the last (after payment to equity and preference shares)

- No Public Company can issue deferred shares

- Deferred shares are not a common source of equity

Ø Highest risk

- These shares are also called Founder shares or Management shares

Sweat Equity Shares-

- Sec. 54 of Companies Act 2013

- Issued to employees or Directors at discount or for consideration other than cash

- For making available Intellectual Property Right (IPR)

Ø Lock-in-period – 3 years

Blue Chip Shares-

- Shares of companies with large market capitalization

- Continuously growing value of shares

- Blue chip Companies are leaders in their field

- Lower risk due to financially stable company

Employee Stock Option Plan (ESOP)–

- Employee benefit scheme

- Issue to employees, directors, officers at a rate considerably lesser than the prevailing market rate

- Section 62(1)(b) of the Companies Act, 2013

- Passed resolution at general meeting

- The options cannot be pledged, hypothecated, mortgaged or otherwise alienated in any respect

Lock-in-period – 1 year

According to Section 55 of the Companies Act 2013, no company limited by shares shall issue any Preference Share which is irredeemable or redeemable after the expiry of 20 years.

Types of Capital-

- Authorised Capital or Maximum Capital or Nominal Capital or Registered Capital – stated in MOA

- Issued Capital

- Subscribed Capital

- Called up Capital – called by directors from shareholders

- Paid up Capital

- Reserve Capital

- Fixed Capital

- Working Capital

Reserve Capital – As per Sec.65 of Companies Act 2013, only an unlimited company having a share capital while converting into limited company may have reserve capital.

Difference between Reserve Capital and Capital Reserve

| Reserve Capital | Capital Reserve |

| 1. Not necessary to create | 1. Necessary to create |

| 2. A resolution is required to create | 2. No resolution is required to create |

| 2. Not shown in Balance Sheet | 3. Shown in Balance Sheet |

| 4. Used at the time of winding up | 4.Used to write off capital loss |

Private Placement of Shares-

- Sec. 42 of the Companies Act 2013

Used by Public Company

- Issued to Promoters, Friends, Relatives, Shareholders of group of Companies, Mutual Funds, NRIs, FIs (LIC, GIC, UTI, ICICI) etc.

- Need not issued prospectus

- Prepare a draft prospectus known as ‘Statement in Lieu of Prospectus’

Lock-in period – 3 years

Public Subscription of Shares— by a Public Company

- To issue Prospectus – prospectus is an invitation to public

- To Receive Applications – should not less than 25% of issue price

- To Make Allotment of Shares –

- Companies Act 2013 has not prescribed the minimum subscription

- According to SEBI guidelines – minimum subscription is 90%

- As per Sec. 39(3) of company has to get minimum subscription within 30 days from the date of issue, otherwise returned within next 15 days. If there will be delay in refunding amount, interest will be charged @ 15% per annum

- To Make Calls – Calls must be made according to AOA

Point to Remember –

- Amount on application, allotment and calls should not exceed 25% of issue price

- From the date of allotment, all calls should be made within a period of 12 months

- There should be a gap of at least one month between two calls

- At least 14 days notice to pay calls

Prohibition on Issue of Shares at Discount—

Sec. 53 of Companies Act 2013 –

- No permission to issue of share at discount

Only Sweat Equity Shares are issued at discount

As per Table F of Schedule I of Companies Act 2013—

- Interest on calls in Arrears – 10% per annum

- Interest on call in Advance – 12% per annum

Forfeiture of Shares –

- Cancel the shares when shareholders unable to pay amount on calls on due date

- Forfeiture is allowed only when AOA permit

- 14 days prior notice given to pay otherwise it will cancel

- Share Capital A/c (called up amount)……… Dr.

To Calls in Arrears A/c (unpaid amount) To Share Forfeiture A/c (paid amount)

- After forfeiting the shares, company may re-issue the shares and balance will transfer to Capital Reserve Account.

- Nature of Share Application Account is Personal Account

Question 1- Y Ltd. forfeited 400 shares of ₹10 each, ₹7 called up, for non- payment of first call of ₹2 per share. Out of these, 300 shares were reissued for

₹6 per share as ₹7 paid up. What is the amount to be transferred to Capital Reserve A/c. Ans. ₹1200

Question 2- X Ltd. forfeited 500 shares of ₹10 each, ₹8called-up on which Vikash has paid application and allotment money of ₹6per share. Of these, 400 shares were re-issued to Ravi as fully paid for ₹9 per share. Amount transferred to Capital Reserve??? Ans. ₹₹2000

Debentures

- Debenture is a certificate of loan

- It represents borrowing capital of the firm

- Debenture holders get interest in return

- Rate of interest is fixed

- Debenture holders do not have any voting right and power in management

- Debenture holders are creditors of the firm

- No company is allowed to issue debenture having a maturity date of more than 10 years but in case of infrastructure company, it should be more than 10 years but not exceeding 30 years

- Specified rate of interest – Coupon rate

- A bond without rate of interest is deep discount bonds or zero coupon bonds.

Types of Debentures:

- Redeemable and Irredeemable Debenture

- Convertible and Non-convertible Debenture

- Secured and Unsecured Debenture

- Registered and Bearer Debenture

- Fixed and Floating Debenture

- Callable, Puttable, Subordinated and Participating Debentures

Source of Finance for Redemption of Debenture-

- By fresh issue of share or debenture

- Out of Capital

- Out of Profits

- Creation of Debenture Redemption Reserve (DRR) is obligatory only for non-convertible debenture

- A company shall create DRR equivalent to at least 25% of the amount of debentures issued

Ø Exemption from creating DRR –

- All India Financial Institutions regulated by RBI

- Other Financial Institutions regulated by RBI

- Banking Company

- Housing Finance Company registered with National Housing Bank.

- When all debentures have been redeem – Debenture Redemption Reserve (DRR) A/c is closed by transferring the amount to General Reserve Account

- As per Rule 18(7)(C) of Companies Rule, 2014 – every company required to created DRR and invest not less than 15%

Methods of Redemption of Debentures—

- By lump sum method

- By instalment

- By purchase of own debentures in open market

By conversion into shares

NOW FOR MCOM ENTRANCE STUDENT

- Hire Purchase Act, 1972

- Assets are sold on credit

- Payment is made in instalment

- Instalment may be monthly, quarterly, half yearly or yearly

- Initial payment is made called down payment

- Relationship between buyer and seller is—Bailor(seller) & Bailee(Buyer)

Ø Possession of assets will transfer at the time of signing of contract

- Ownership will transfer after payment of last instalment

- All maintenance expenses related to assets will be borne by seller

- If buyer fail to pay any instalment then seller will repossessed the assets

- All the instalments are treated as hire charges till the last instalment is paid off

- In this case, buyer can terminate the contract and return the goods

- It is like as agreement of hiring goods

- No right to hire out, sell, transfer, destroy, pledge, the asset to the purchaser

Methods—

- Assets Accrual Method-Here, it is considered that the hire purchaser is the owner of the asset up to the value of cash price paid by him

- Sales Method- In this method, transactions treated as actual sales from beginning and assume that ownership of the asset is also transferred to the purchaser

Ø Hire Purchase Price – Cash Price + Interest

- Cash Price = Hire Purchase Price – Interest

- Interest = HPP – CP

- Cash Price – Price at the time of Cash Transaction

- Hire purchase price is more than cash price

- Calculation of interest and insurance is done on the basis of Cash Price on due amount every year

- Depreciation is also calculated on Cash Price

- Balance of Hire Sales account is transferred to Trading Account

- Balance of interest and depreciation account is transferred to Profit & Loss Account

- In case of Annuity Method,

HPP = Instalment Price × Present Value of ₹1 as per Annuity Table

- When Rate of Interest is not given in the question, following methods are useful to find interest:

- Product Method – when time is unequal

- Proportion Method – when time is equal

- Inverse Progressive Method – when instalment and time both are equal

When Repossession of Goods

he Hire Purchaser does not pay the instalment, the Hire Vendor may repossess the goods sold

Full Repossession

When the whole goods os repossessed

Partial Repossession

When only a part of goods sold is repossessed

Instalment Payment System

Regulated by Sale of Goods Act, 1930

Assets are sold on credit

It is also called Outright Credit Sales

Payment made in instalment

In this case, possession and ownership both will transfer at the time of sales

- Default in payment of any instalment –sue against buyer for remaining amount

- Instalment cannot be forfeited

- Under this system, purchaser is the owner of the assets

- Buyer may use property for loan as mortgage or security before clearing the instalment

- All maintenance expenses will be borne by buyer

- It is contract of sales

- In this case, buyer cannot terminate the contract and can’t return the goods

- In this case, Interest Suspense Account is open

Royalty

- Royalty is a fee paid to acquire the right to use of any property

- Royalty is based on production

- Minimum Rent is also called Fixed Rent, Dead Rent, Flat Rent, Contract Rent

Ø Short Working = Minimum Rent – Royalty

- Surplus = Royalty – Minimum Rent

- Balance of Short Working Un-recouped transferred to Profit Loss Account

- Royalty is based on production whereas rent is based on time

- Recoupment of short working – It means the recovery of short working of the previous years out of surplus royalty of subsequent yearly.

- Types of Royalty:

- Mining Royalty

- Copyright Royalty

- Patent Royalty

Journal Entries

| Royalty is less than Minimum Rent | Royalty is more than Minimum Rent | Royalty is equal to Minimum Rent |

| Due entry— Royalty A/c……………….. Dr Short working A/c……… Dr To Landlord A/c | Due entry— Royalty A/c…………….. Dr To Landlord A/c | Due entry— Royalty A/c…………… Dr To Landlord A/c |

| Paid entry— Landlord A/c……………… Dr | Paid entry— Landlord A/c………….. Dr | Paid entry— Landlord A/c…………. Dr |

| To Bank A/c | To Bank A/c To Short working A/c | To Bank A/c |

| Transfer entry— Profit &Loss A/c………… Dr To Royalty A/c To SWUR | Transfer entry— Profit & Loss A/c…….. Dr To Royalty A/c To SWUR | Transfer entry— Profit & Loss A/c…….. Dr To Royalty A/c To SWUR |

SWUR = Short working un-recouped

- Strike is done by worker while lockout is done by owner of the firm

- Nazarana – The excess of royalty over minimum rent is called surplus. This extra payment in addition to royalties is known as Nazarana or Lease Premium or Goodwill

- Amount of Nazarana will be set off by transferring it in to Profit & Loss a A/c every year

Branch Accounting

- Branch accounting is an accounting system in which separate account is maintained for each branch of a corporate entity.

- A branch is a subordinate division of an organization

- Nature of Branch A/c is Nominal A/c

- Branches are controlled by Head Office

- Inter – Branch Transactions – When a branch sends goods or cash to another branch is called inter-branch transactions

| Branch | Departmental |

| Established by separating them from the head office | Run by attaching them with the main organization under a single roof |

| Branches are geographically separated | Departments are not separated rather existed under a same roof |

| Object is to expand the business | Result of the fast human life |

Types of Branch

Inland Branch

1.Dependent Branch

2.Independent Branch

Foreign Branch

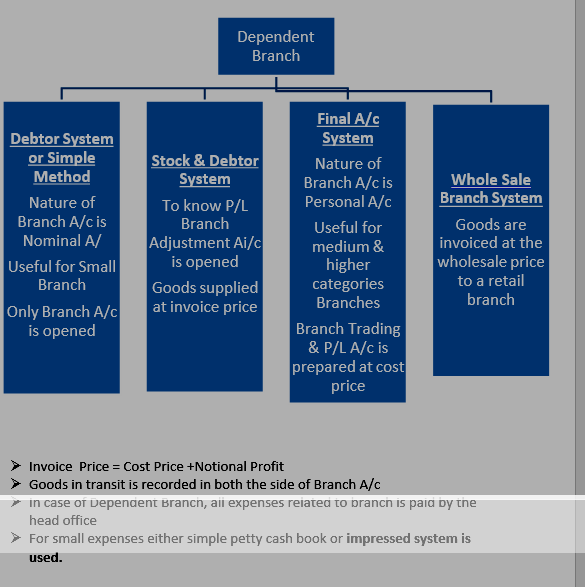

Dependent Branch— A branch which does not maintain its own set of books. All records have to be maintained by the head office.

System of Maintaining Books of Account in case of Dependent Branch—

Foreign Branch—

Departmental Accounting

- It provides separate data about the revenue and expenses of each department.

- Purpose of preparing Departmental A/c –

- To plan

- To control

- To performance evaluation

- To help in formulating policy to expand the business

- Methods –

- When individual set of books are maintained

- When all departmental accounts are maintained in Columner-wise

Direct Expenses- Expenses relating to a particular department are called direct

expenses. They charged to respective department. For Example, wages, staff salaries.

Indirect Expenses- Expenses relating to more than one department are called indirect expenses.

Expenses which can be allocated –

- On Sales Basis—Discount allowed, bad debts, selling commission, carriage on sales, advertisement, distribution expenses, etc

- On time Basis—Rent, Salary

Expenses which can not allocated-

- Interest on Capital

- Interest on debenture

- Loss on sale of assets

- Interest on Loan

- General Manager Commission

These expenses are recorded in General P/L A/c.

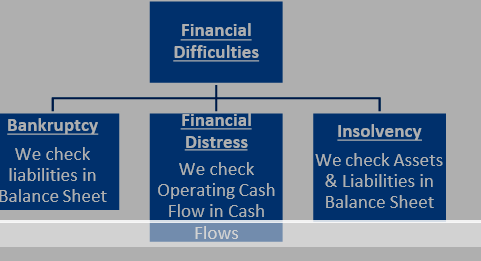

Insolvency Accounting

- Accounting insolvency refers to a situation where the value of company’s

liabilities exceeds the value of its assets

- A situation in which a firm or individual has a negative net worth

- A person is said to be insolvent when he commits an act of insolvency

- A business becomes due

insolvent when it unable to pay debts as they come

- An insolvent business can either cease t exist, or can seek a legal remedy called bankruptcy

- It is possible for a company t be insolvent even if their assets outweigh their liabilities if the assets are not easily converted to cash needed in order for the company to make the necessary payments

- Bankruptcy – when a person is declared incapable of paying their due and payable bills

- Insolvency – The inability of a person or corporation to pay their bills as and when they become due and payable.

Insolvency

Cash Flow Insolvency

Unable to pay debts Bad liquidity position

Balance Sheet Insolvency

Liability > Assets

Accounting treatment—

- Statement of Affairs

- Deficiency A/c

Statement of Affairs

| Liabilities | ₹ | Assets/Realised | ₹ |

| List A- Unsecured Creditors | List E- Property | ||

| List B- Fully Secured Creditors | List F- Book Debt | ||

| List C- Partly Secured Creditors | List G- Bill of Exchange | ||

| List D- Preferential Creditors | List H- Deficiency | ||

| Total | Total |

Deficiency—

- It does not follow double entry system

- Does not use To or By word

There are two Acts to know Preferential Creditors-

| Presidency Towns Insolvency Act, 1909 (Applicable in Kolkata, Bombay, Madras) | Provincial Insolvency Act, 1920 (Applicable in all other State) |

| 1. Government dues | 1. Government dues |

| 2. Workmen Compensation | 2. Workmen Compensation |

| 3. One month’s rent | 3. No rent is preferential |

| 4. Salary ₹300 per month before 4 months of filing petition | 4. Salary ₹20 per month before 4 months of insolvency |

| 5. Wages ₹100 per month before 4 month of filing petition | 5. Wages ₹20 per month before 4 months of insolvency |

Banking Companies

- Bank Balance Sheet is given in Form A and Profit & Loss A/c is given in Form B of Schedule III of the Banking Regulation Act, 1949

| Particulars | Schedule Number |

| Capital | 1 |

| Reserve & Surplus | 2 |

| Deposits | 3 |

| Borrowings | 4 |

| Other Liabilities | 5 |

| Cash and Balance with RBI | 6 |

| Balance with Bank and money at call | 7 |

| Investments | 8 |

| Advances | 9 |

| Fixed Assets | 10 |

| Other Assets | 11 |

| Contingent Liabilities | 12 |

| Interest Earned | 13 |

| Other Income | 14 |

| Interest Expended | 15 |

| Operating Expenses | 16 |

- Bank creates Statutory Reserve 25% or 1/4 of Current Year profit

- Bank’s paid-up capital should not be less than 50% of subscribed capital

Banking Assets

Assets

Performing or Standard Assets

Non-Performing Assets

Standard Assets- Standard Assets generate continuous income. Such assets carry

a normal risk and are not

NPA in the real sense. So, no special

provisions are

required for standard assets.

Sub- Standard Assets- All those assets (loans and advances) which are considered as non-performing for a period of 12 months are called as sub-standard assets.

Doubtful Assets- All those assets which are considered as non-performing for a period of more than 12 months are called as doubtful assets.Loss Assets- All those assets which cannot be recovered at all are known as loss assets.

Types of Non-Performing Assets

Gross NPA- Sum total of all loan assets that are classified as NPAs as per RBI guidelines as on balance sheet date. GNPA reflect the quality of loans made by banks. It includes all non-standard assets like sub-standard assets, doubtful assets and loss assets

Net NPA- Those types of NPAs in which the bank has deducted the provision regarding NPAs. Net NPA shows the actual burden on banks.

- NPA are loan that are not being repaid or serviced through interest payments on time. When interest or other dues to a bank remain unpaid for more than 90 days the entire bank loan automatically turns a “NPA”.

Accounting for Amalgamation

- When two or more existing companies go into liquidation and a new company is formed to take over their business, it is known as amalgamation

- ICAI has issued AS-14 on accounting for Amalgamation

Amalgamation = A Ltd. + B Ltd. =AB Ltd.

- Absorption = A Ltd. +B Ltd. = B Ltd.

- In accounting an amalgamation or consolidation, refers to the combination of financial statements

- Two parties- transferor company (Vendor) and transferee company(Purchaser)

Amalgamation

AS-14

In the Nature of Merger

A+B = AB Ltd.

- Existance of both the company will remain same

- Differnce between Purchase Consideration and

Net Assets is General Reserve

- All reserve of transferor company will transfer to

- transferee company

- Controlling power of transferor company will

- remain same after amalgamation

In the Nature of Purchase

A+B = ALtd.

- One company will lose its existance after amalgamation

- Difference between Purchase Consideration and

Ne Assets transferred to Capital Reserve (Cr. bal)or Goodwill(Dr. bal)

- Only Statutory Reserve of transferor company will transferred to transferee

company

- Transferor company will lose its controlling power

after amalgamation

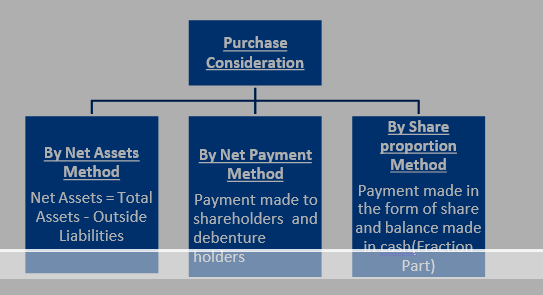

Methods of Purchase Consideration- There are three methods

There are five conditions to satisfy Amalgamation in the nature of Merger–

- All assets and liabilities of the transferor company become the assets and liabilities of the transferee company,

- Shareholders holding not less than 90% of the face value of equity share of transferor’s company become the equity shareholder of transferee’s company,

- Consideration receivable by those equity shareholders of transferor company who agree to become equity shareholders of transferee’s company,

- The business of transferor’s company will continue after amalgamation, and

No adjustment to be made to the book value of assets & liabilities of transferor’s company

No adjustment to be made to the book value of assets & liabilities of transferor’s company

Accounting MethodsPooling of Interest Method

Useful for the Amalgamation in the nature of Merger

Purchase Method

Useful for the Amalgamation in the nature of Purchase

Pooling of Interest Method- Under this method, the assets, liabilities and

reserves of the transferor company are recorded by the transferee company at

their existing carrying amounts.

Purchase Method- Under this method, the transferee company accounts for the

amalgamation either by incorporating the assets and liabilities at their existing

carrying amounts or by allocating the consideration to individual assets and liabilities of the transferor company on the basis of their fair values at the date of amalgamation.

- Statutory reserve transferred to Amalgamation adjustment account

- In the book of transferor’s company, Realisation account

is opened to

record the value of assets, liabilities and purchase consideration. Profit or Loss of Realisation A/c is transferred to Equity shareholders A/c. Nature of Realisation A/c is Nominal A/c.

- Statutory Reserve includes development allowance reserve, Investment allowance reserve, etc.

Ø Goodwill = Purchase Consideration – Value of Net Assets

Capital Reserve = Value of Net Assets – Purchase Consideration

Holding Company

- Under the Companies Act, 1956, a holding company is any company which holds more than half of the equity share capital of other companies or controls the composition of the board of directors of other companies

- Holding company first came into existence in the U.S.

- A holding company is a parent company designed to own or control other businesses. A subsidiary is owned or controlled by a parent company, but that parent company might not be a holding company

- When one company controls another company, it is called holding company

- A subsidiary company or daughter company is a company that is owned or controlled by another company which is called parent or holding company

Accounting Treatment-

- Capital Profit (profit before acquisition)

- Revenue Profit (profit after acquisition)

- Minority Interest

- Cost of Control

- Consolidate Balance Sheet(AS-21)

1. Calculation of Capital Profit-

- Opening balance of P/L or P/L at the date of acquisition

- Opening balance of Reserve or Reserve at the date of acquisition

- Capital part of Current year profit

- Increase or decrease in the value of assets

Note: Capital part of Current Year profit will not calculate din three cases-

- When opening balance of P/L or Reserve is given

- When closing balance of P/L or Reserve is given

- When P/L or Reserve is given at the date of acquisition

2. Calculation of Revenue Profit-

Total profit at the end of the year – Capital Profit

3. Calculation of Minority Interest-

- Face Value of shares acquired by minor

- Capital profit of minor

- Revenue profit of minor

2. Cost of Control-

Cost of Acquisition – Face value of shares acquired by holding company – Capital Profit of holding company

- Balance of cost of control may be positive or negative. If it is positive, then we say it Goodwill and if it is negative, then we say it Capital Reserve.

- Consolidated Balance Sheet (AS-21)- Combined balance of holding company and subsidiary company.

- A subsidiary company cannot become a member in its holding company

- Holding Company—Sec. 2(46) of the Companies Act 2013

- Subsidiary Company – Sec.2(87) of the Companies Act 2013

Accounting for Partnership Firms

- According to Sec. 4 of Partnership Act, 1932—“Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

- Number of Partners: Minimum-2 and Maximum- 50 (as per Sec. 464 of Indian Companies Act, 2013)

- Partnership is the result of an agreement

- HUF comes into existence by the operation of law

- Agreement can be either oral or in writing

- Relationship of principal and agent

- Existence of business and profit motive

v Registration is optional

- It is not a separate legal entity

- Unlimited liability

- Non-transferability of share

- Partnerships do not have perpetual succession

Limited Liability Partnership-

- It came into existence with the enactment of LLP Act, 2008

- It is a body corporate formed and incorporated under this Act

- Separate entity

v Have perpetual succession

- Indian Partnership Act,1932 shall not apply to a LLP

v Registration is compulsory

- Created by law

- Members: Minimum- 2 and Maximum- No limit

- Limited liability

Partnership Deed-

- It is also called Articles of Partnership

- It contains terms and conditions agreed by all partners

- It may be either written or oral

Rules applicable when Partnership Deed is silent-

| Profit sharing ratio | Equal |

| Interest on Capital | No |

| Interest on Drawings | No |

| Salary to a partner | No |

| Interest on Loan | 6% |

| Admission of a new Partner | With the consent of all Partners |

Capital A/c

Fixed Capital A/c

Capitals of Partner remain same

Fluctuating Capital A/c

Capitals need not to be fixed

Capital A/c

Current/ Drawings A/c

Goodwill-

- Reputation, image, creditworthiness, good-name, popularity, famous, honour, fame

- Goodwill is intangible fixed assets

- According to ICAI, Goodwill is an intangible asset arising from trade name or reputation of an enterprise

- Goodwill is a power to attract more and more customers

- Goodwill is a tool to earn additional profit

v Nature of Goodwill- Cat, Dog, Rat

- It is the value of a business over and above the value of its assets.

- Classification of Goodwill-

1. Purchased Goodwill — Recorded

- Self-Generated Goodwill/Inherent Goodwill—No Record

Methods for Valuation of Goodwill—

- Average Profit Method

- Super Profit Method

- Capitalization Method

- Annuity MethoD

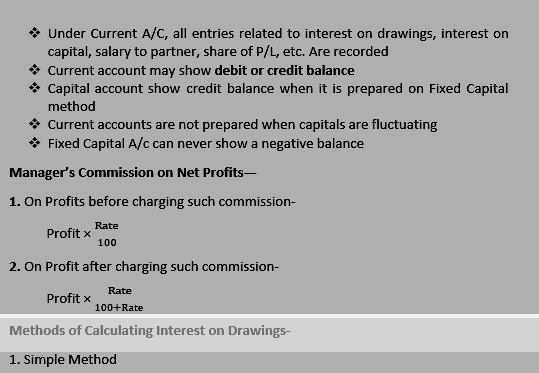

![]()

![]() Admission of a Partner—

Admission of a Partner—

- A partner gets enter into the firm due to the following reasons:

- For capital

- For goodwill

- For efficiency/experienced

- According to Section 31(1) of Indian Partnership Act, a new partner can be admitted in to the partnership firm only by the consent of all existing partners.

v Required treatment –

- Calculation of New Profit Sharing Ratio

- Treatment of Goodwill

- Preparation of Revaluation A/c

- Treatment of Accumulated Profit

- Preparation of Partner’s Capital A/c

- Balance Sheet

- Sacrifice Ratio = Old Ratio – New Ratio

- When new partner brings goodwill in the firm then this goodwill is taken by old partners in their Sacrifice Ratio

- When goodwill already given in the old Balance Sheet then this goodwill is taken by old partners in their Old Ratio

- When New Partner does not bring goodwill in cash— New Partner’s Current A/c Dr.

To Old Partner’s Capital A/c

- At the time of admission of a partner, amount of accumulated profit or loss is taken by old partners in their Old Ratio

- Revaluation A/c- Prepare at the time of admission of new partner to know profit or loss by revaluation of assets and liabilities. This account is also known as Profit & Loss Adjustment A/c. This account is Nominal A/c in nature and balance of this account is transferred to Old Partners in their Old Ratio

Retirement or Death of a Partner—

- Gaining Ratio = New Ratio – Old Ratio

- Undistributed profits will share in All Partners in their Old Ratio

- Revaluation A/c is also prepared in this case and there is only one difference that Profit or Loss of Revaluation A/c is distributed in All Partners in Old Ratio

- Treatment of Goodwill—

Remaining Partner’s Capital A/c Dr.

To Retiring Partner’s Capital A/c