Business Organization Revision E-notes

Unit-I: Nature and scope of business, Social Responsibility of Business, Size of business unit, E-business, Business Environment, Government and Business

Features of business

Everything that surrounds us is a chain of business, from a laptop to the chair we sit in. With every change in technology, human beings’ demand also changes.

Giving business persons to grow their business or start a new venture. Let’s study in detail about the business and its characteristics.

Business Definition

Business is an economic activity that involves the exchange, purchase, sale or production of goods and services with a motive to earn profits and satisfy the needs of customers. Businesses can be both profit or non-profit organizations that function to gain profits or achieve a social cause respectively

Characteristics of Business

Following are the characteristics or features of business

(1) An Economic Activity:

●A business is an economic activity which includes the purchase & sale of goods or rendering of services to earn money.

●It is not concerned with the achievement of social and emotional objectives.

Example: Wholesalers sell goods to the retailers and retailers sell goods to the customers.

2)Manufacturing or Procurement of Services and Goods

●Before offering goods to the consumer for consumption it should be manufactured or procured by businesses.

●Business enterprise converts the raw material into finished goods.

●Organisations also procure finished goods or services from the producers to meet the needs of the customers in the market.

●Goods can be a Consumer good like sugar, pen, ghee, etc. capital goods include machinery, furniture, services like transportation, banking, etc.

Example: Individual retailers buy the toffees from wholesalers in a specific quantity and sell it to the ultimate consumer.

(3)Exchange or Sale of Goods and Services for the Satisfaction of Human Needs

●Every business activity includes an exchange or transfer of services and goods to earn value.

●Producing goods for the goal of personal consumption is not included in business activity.

●So, there should be the process of sale or exchange of goods or services between the seller and the buyer.

Example: A lady who bakes pastries and cakes at home and sells it to the pastry shop is a business activity.

Social Responsibility of Business

Social responsibility is a moral obligation on a company or an individual to take decisions or actions that are in favour and useful to society. Social responsibility in business is commonly known as Corporate Social Responsibility or CSR. For any company, this responsibility indicates that they acknowledge and appreciate the goals of the society, and therefore, would support them to achieve these goals.

Advantages of Social Responsibility

A company can boost its morale and enhance work culture when they can engage their employees with some social causes. There are many factors that can have a positive impact on the business while delivering social responsibilities. Such few factors are

1.Justification for existence and growth

2.The long-term interest of the firm

3.Avoidance of government regulation

4.Maintenance of society

5.Availability of resources with business

6.Converting problems into opportunities

7.A better environment for doing business

8.Holding business responsible for social problems

Disadvantages of Social Responsibility

Like there are many advantages of social responsibility there are similarly many disadvantages for business. Few factors are mentioned below.

1.Violation of profit maximization objective

2.Burden on consumers

3.Lack of social skills

4.Lack of broad public support

Types of Social Responsibilities

Following Are the Different Types of Social Responsibilities:

(1)Economic Responsibility

Every business is engaged in economic activities. So, the prime social responsibility of every business should be economic responsibility.

Hence they should sell products and services which can satisfy the needs of the society.

(2)Legal Responsibility

The company should comply with the political and legal environment of the country. The company should consider protecting the environment.

(3)Ethical Responsibility

This type of responsibility expects a certain type of behaviour or conduct from the company. This behaviour may not be documented by law.

(4)Discretionary Responsibility

These are voluntary actions taken by the entities in case of natural calamities, helping poor people etc. They help them by providing a charitable contribution, education activities etc. It prevents investments of charitable funds into speculative activities.

E-business

E-business refers to the buying and selling of goods and services through the internet along with conducting other important business functions over the internen E-business is a broader term than e-commerce. E-business includes the management functions of planning, organising, marketing and production conducted electronically. The other functions that are covered

under e-business include inventory management, product development, human resource management and accounting and finance.

E-business scope can be explained with the following four directions.

1.B2B Commerce

2.B2C Commerce

3.C2C Commerce

4.Intra B-Commerce

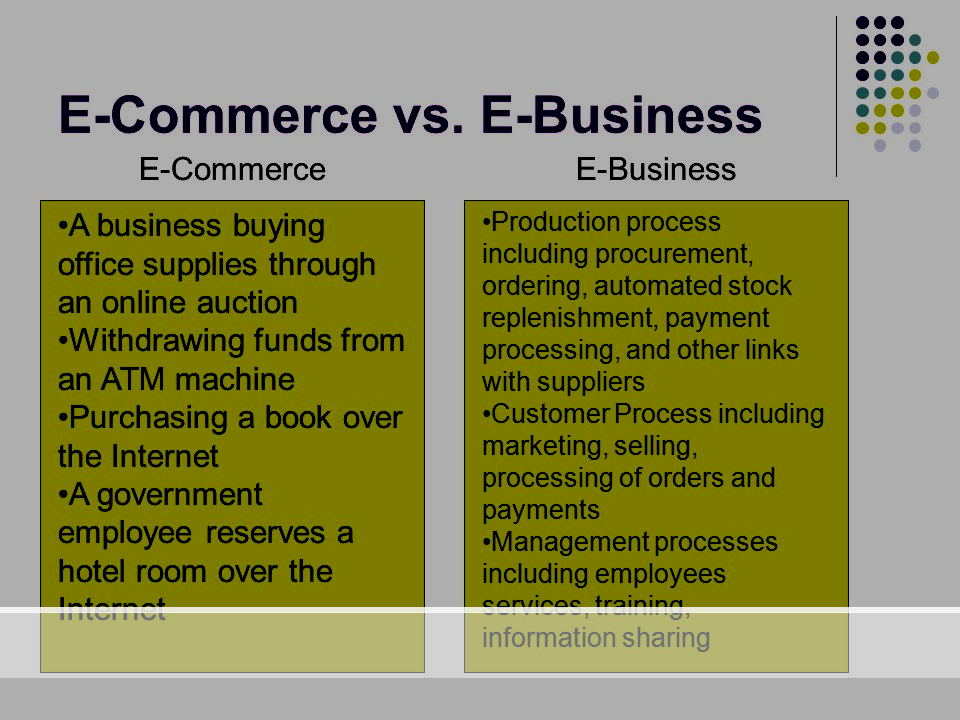

Distinguish between e-commerce and e-business.

Business Environment

Meaning:

The word ‘business environment’ indicates the aggregate total of all people,

organisations and other forces that are outside the power of industry but that may

affect its production. According to an anonymous writer- “Just like the universe, withhold from it the subset that describes the system and the rest is the environment”. Therefore, the financial, cultural, governmental, technological and different forces which work outside an enterprise are part of its environment. The individual customers or facing enterprises as well as the management, customer groups, opponents, media, courts and other establishments working outside an enterprise comprise its environment.

Importance of Business Environment:

Just like us, business operations do not survive in confinement. Every enterprise is not an island to itself; it subsists, endures and develops within the circumstances of the part and forces of its situation. While an individual enterprise is able to do a minute to change or manage these forces, it has no choice to react or modify according to them. Good knowledge of the environment by business managers allows them not only to recognise and assess but also to respond to the forces outside to their enterprises. The significance of the business environment and its perception by managers can be understood if we contemplate the below-mentioned following points:

(A) It Helps in Identifying Opportunities and Making First Mover Advantage

(B)It Helps the Firm Identify Threats and Early Warning Signals

●The business environment helps in understanding the threats which are likely to happen in the future.

●Environmental awareness can help managers identify various threats on time and serve as an early warning signal. Example: Patanjali products have become a warning signal to the rest of the FMCG

●The sector to develop similar products. Similarly, if an Indian firm finds that a foreign multinational is entering the Indian market with new substitutes; it needs to prepare accordingly.

●Chinese mobile phones have become a threat for Indian mobile phone manufacturers.

(C)It Helps in Tapping Useful Resources

●Business and industry avail the resources (inputs) from the environment and convert them into usable products (outputs) and provide to society.

●The environment provides various inputs (resources) like finance, machines, raw materials, power and water, labour, etc.

●The business enterprise provides outputs such as goods and services to the customers, payment of taxes to the government, to investors and so on.

Example: With the demand for the latest technology, manufacturers will tap the resources from the environment to manufacture LED TVs and Smart TVs rather than collecting resources for colour or Black & White TVs.

(D)It Helps in Coping With Rapid Changes

(F)It Helps in Improving Performance

●Environmental studies reveal that the success of any enterprise is closely bound with the changes in the environment.

●The enterprises which monitor and adopt suitable business practices not only improve their performance but become leaders in the industry also.

Example: Apple has been successful in maintaining its market share due to its proper understanding of the environment and making suitable innovations in its products.

Dimensions of Business Environment

Dimensions of or the agents forming the business environment involve economic, social, legal, technological and political circumstances which are contemplated properly for decision-making and enhancing the achievement of the trading concern. In distinction to the precise environment, these aspects manifest the prevailing environment, which often affects many companies at the same time.

However, the administration of every business can profit from being informed of these dimensions rather than being unbiased in them. A concise argument of the multiple factors comprising the global environment of the company is provided below:

(A)Legal Environment

It includes various laws passed by the government, administrative orders issued by government authorities, court judgments as well as decisions rendered by the central, state or local governments.

Understanding of legal knowledge is a prerequisite for the smooth functioning of business and industry.

Understanding the legal environment by business houses helps them not to fall in a legal tangle.

The legal environment includes various laws like Companies Act 2013, Consumer Protection Act 1986, Policies relating to licensing & approvals, Policies related to foreign trade etc.

Example: Labour laws followed by companies help them to keep away from penalties.

(B)Political Environment

It means that the actions were taken by the government, which potentially affect the routine activities of any business or company on a domestic or at the global level.

The success of business and industry depends upon the government’s attitude towards the business and industry, Stability of Government, Peace in the country.

Example: Political stability and central government’s attitudes towards business, industry and employment, has attracted many national and international business entrepreneurs to invest in India.

(C)Economic Environment

The economic environment consists of an economic system, economic policies and economic conditions prevailing in a country.

Interest Rates, Taxes, Inflation, Stock Market Indices, Value of Rupee, Personal Disposable Income, Unemployment rate etc. are the factors which affect the economic environment.

Example: A rise in the disposable income of people due to a decrease in tax rates in a country creates more demand for products.

(D)Social Environment

Social Environment consists of social forces like traditions, values, social trends, level of education, the standard of living etc. All these forces have a vast impact on business.

Tradition: It refers to social practices that have lasted for decades, such as Ugadi, Deepavali, Id, Christmas,etc.,

Impact: More demand during festivals provides opportunities for various businesses.

Values: It refers to moral principles prevailing in the society, such as Freedom of choice in the market, Social Justice, Equality of opportunity, Non-discriminatory practices etc.

Impact: The organisations that believe in values maintain a good reputation in society and find ease in selling their products.

Social Trends: It refers to a general change or development in the society, such as health and fitness trends among urban dwellers.

Impact: Health and fitness trend has created demand for gyms, mineral water etc.

(E)Technological Environment

It consists of scientific improvements and innovations which provide new ways of producing goods, rendering services, new methods and techniques to operate a business.

It is very important for a firm to understand the level of scientific achievements of a particular economy before introducing its products.

Technological compatibility of products also drives the demand for manufactured products by a company.

Example: E-commerce has changed the scenario of doing business, buying goods and availing services at the click of a mouse or through mobile, Digital India initiative by the government and moving towards a paperless society.

Q. [HOTs]:

(I)The Court Passed an Order That All Schools Must Have Water Purifiers for the School Children

(II)Society, in general, is More Concerned About the Quality of Life.

(III)Innovative Techniques Are Being Developed to Manufacture Water Purifiers at Competitive Rates.

(IV)Incomes Are Rising and Children at Home Are Also Drinking Purified Water.

(V)the Government is Also Showing Positive Attitude Towards the Water Purifier Business.

Identify the Different Dimensions of the Business Environment by Quoting From the Above Details. (Delhi 2013)

Answer:

Environment Quoted Lines

(I)lega Court passed an order…

(II)Social Society, in general, is more concerned

(III)TechnologicalInnovative Techniques are being developed

(IV)Economic Incomes are rising and children ….

(V)Political The Government is also showing a positive attitude

Features of Business Environment:

(A)The totality of External Forces

●Business environment includes everything which is outside the organisation.

●If we add all these forces, they will form a business environment.

Example: When Pepsi and Coca-Cola got permission to set up their business in India, it was an opportunity for them and a threat for local manufacturers like gold spot, camp-cola etc.

(B)Specific and General Forces

●Specific forces are those forces which directly affect the operational activities of the business enterprise.

●Example: Suppliers, Customers, Investors, Competitors, Financers etc.

●General forces are those forces which indirectly affect the functioning of business enterprises.

Example: The increased life expectancy of people and awareness of health consciousness has increased the demand for many health products like diet coke, olive oil, and so many health products.

(D)Dynamic Nature

The business environment is dynamic in nature and keeps on changing in terms of :

(a)Technological improvement,

(b)Shifts in consumer preferences,

(c)The entry of new competition in the market.

Example: Many established companies in the FMCG (Fast Moving Consumer goods) sector are focusing on producing the goods with natural ingredients with the entry of ‘Patanjali Products’.

(E)Uncertainty

The changes in the business environment cannot be predicted accurately because of future uncertainties.

It is very difficult to predict the changes in the economic and social environment.

Example: There has been a sharp decline in the prices of Android smartphones due to the entry of many new companies.

(F)Complexity

Why It is Important for Business Enterprises to Understand Their Environment?

A)It Benefits in Tapping Useful Resources

●Business and industry avail the resources (inputs) from the environment and convert them into usable products (output) and provide to society.

●The environment provides various inputs (resources) like finance, machines, raw materials, power and water, labour etc.

●The business enterprise provides outputs such as goods and services to the customers, payment of taxes to the government, interest/dividend to investors and so on.

Government and Business Roles of Government In Business

Entrepreneurship Role

Entrepreneurship is the ability and readiness to develop, organize and run a business enterprise, along with any of its uncertainties in order to make a profit. The most prominent example of entrepreneurship is the starting of new businesses.

In economics, entrepreneurship connected with land, labour, natural resources and capital can generate a profit. The entrepreneurial vision is defined by discovery and risk-taking and is an indispensable part of a nation’s capacity to succeed in an

ever-changing and more competitive global marketplace.

1.Transportation: Irctc,KSRTC,KSTDC itd,

2.Communication:MTNL,BSNL

3.Electricity And Power: MESCOM,BESCOM,NDPL

4.Companies Like HP,BHEL,SAIL,VISL

Regulatory Measures:

As per the free market mechanism, government intervention is prohibited for the growth of an economy. However, in a mixed economy, the government is responsible for making and implementing various regulatory measures.

Promotional Roles:

The main promotional role of a government is to increase the social and economic overhead capital for the growth of an economy.

The economic overhead can be increased by building developmental structure, which includes:

a.Development and creation of transport and communication facilities

b.Construction of irrigation facilities, such as dams, canals, and tube wells Planning Role

Planning role of the government involves setting objectives for development and defining ways and means to achieve these objectives. It involves knowing and directing the available resources in the right direction.

In a developing economy like India, planning is important to ensure that the available resources are channelized in the right direction and optimally utilized to generate desired output. Planning is also important as there is a gap between stated objectives and their achievement.

Planning helps in defining priorities as resources available with any country are limited. In India, the National Planning Committee was set-up in 1938 by the

Indian National Congress, with an objective to draft a plan for development of the country. The committee chaired by Jawahar Lal Nehru, worked on various aspects of economic planning. In 1950, the Planning Commission of India was set-up by the Government of India.

The commission was entrusted with the task of assessment of the country’s resources (human, natural and physical) and formulating a plan for optimal use of these resources for overall socio-economic development of the country.

Forms of business organisations and comparative study – Sole Proprietorship, Partnership, Joint stock company, Co-operative organisation, Limited Liability Partnership, One Person company

Forms of Business Organisations

A business owner’s first decision while starting a business is to decide what form of business he wants to venture. To choose the business type is essential because it will determine how much tax needs to be paid, the quantity of paperwork, individual liability, and how much to invest etc. The business formation is regulated by the state law where the company is established.

A business organisation is an establishment intended to carry commercial business by producing goods or services and meet the customers’ needs. Most of the organisations have a standard such as social structure, purpose goals, utilisation of resources, rules and regulations, etc. The state law regulates the establishment of the business, and IRS law controls the tax incurred for business. So, how much tax business should pay depends on what form of business one owns

There are many forms in the business world, but the most common forms of business organisation are.

Sole Proprietorship

A Sole proprietorship can be explained as a kind of business or an organization that is owned, controlled and operated by a single individual who is the sole beneficiary of all profits or loss, and responsible for all risks. It is a popular kind of business, especially suitable for small business at least for its initial years of operation. This type of businesses is usually a specialized service such as hair salons, beauty parlours, or small retail shops.

Definition of Sole Proprietorship:

●It is that type of business organization which is owned, managed and controlled by a single owner.

●The word “sole” means “only” and “proprietor” notes to “owner”.

●A sole proprietor is the beneficiary of all profits.

●All risks are to be borne by the sole proprietor.

●The sole proprietor has unconditional and full control over its business.

●Example: Beauty parlour, barbershop, general store and sweet shop run by a single owner.

Features of Sole Proprietorship:

(1)Formation and Closure

●No legal conventions are obliged to start the sole proprietorship form of organization.

●In some instances, the legal formalities are required or the owner should have a particular license or a certificate to run the business.

●The owner can close the business at his own discretion.

●Example: Goldsmith or a person running a medical shop should have a license to run this type of business.

(2)Liability

●In the sole proprietorship business, the sole owner has unlimited liability.

●In this case, the owner is himself liable to pay all the liabilities. If he takes a loan for its business then he will be liable for all the debts.

●Hence, he is personally liable for all the debt which can be recovered by his personal estate when funds are insufficient.

●Example: A loan taken by the owner of the sweet shop is solely responsible for the repayment of the loan to the bank.

(3)Sole Risk Bearer and Profit Recipient

●A sole proprietor is only the one who bears all risks which are related to its business.

●All the profits or losses which are earned from the business are to be enjoyed by the sole owner.

(4)Control

●As all the rights and responsibilities lie with the sole proprietor that is why he controls all the business activities.

●No one can interfere in the business activities of a sole proprietor.

●Hence, only the sole proprietor can modify his plans accordingly.

(5)No Separate Entity

●According to the accounting system, the owner and the business are considered as two separate entities.

●But the law does not make any distinction between the sole trader and its business.

●Hence, without the sole trader, the business has no identity because he is the only person who performs all the business activities.

(6)Lack of Business Continuity

●Death, imprisonment, physical ailment, insanity or bankruptcy of the sole proprietor will directly affect the business or it may cause shutting down of the business.

●In the case of the beneficiary, successor or legal heir of sole proprietor, he can run the business on behalf of the proprietor.

Advantages of Sole Proprietorship:

Some of the popular advantages of a sole proprietorship are.

●Quick decision making– A sole proprietor has the freedom to make any decision. Therefore, the decision would be prompt as they don’t have to take the permission of others.

●Confidentiality of information- Being only the owner of the business, it allows him/her to keep all the business information to be private and confidential.

●Direct incentive- A sole proprietor directly has the right to have all the profit or benefits of a company.

●Sense of accomplishment- He/she can have the personal satisfaction associated with working without any guidance or alone.

●Ease of formation and closure- A single proprietor can enter the business with minimum legal formalities.

Limitations of a Sole Proprietorship

Some of the primary limitations of a sole proprietorship are as follows:

(1)Limited Resources

●Resources of a sole proprietor are limited to his savings and borrowings from the relatives.

●Banks also hesitate or deny giving the long term loans or extend the limit of long term loans due to the weak financial position of the business.

●Lack of all these resources results in hindrance in the growth of the sole proprietorship business

●Above mentioned are the reason why the business generally remains small.

(2)Life of a Business Concern

●The owner and its business is the same entity and due to lack of successor or heir, the life of the business is limited.

●Due to death, insolvency, illness of a proprietor gives a detrimental impact on the business which results in closure of the business.

(3)Unlimited Liability

●The major demerit of a sole proprietorship is that the owner has unlimited liability.

●If the sole owner becomes fails to pay the debts, due to the failure of a business, the creditors would not only claim from business assets but also from his personal estate.

●Taking a large amount of loan is too risky and also put the burden on the sole owner of the business.

●Hence, this is the reason why sole traders do not intend to take the risk for the survival and growth of the business.

(4)Limited Managerial Ability

●The sole proprietor has to accept all the responsibilities to carry out its business.

●Sometimes the proprietor has to perform all the managerial functions like sales, purchase, marketing, selling, dealings with clients, etc.

●He may not be able to employ and retain aspiring employees.

Partnership

A partnership is a kind of business where a formal agreement between two or more people is made who agree to be the co-owners, distribute responsibilities for running an organization and share the income or losses that the business generates.

In India, all the aspects and functions of the partnership are administered under ‘The Indian Partnership Act 1932’. This specific law explains that partnership is an association between two or more individuals or parties who have accepted to share the profits generated from the business under the supervision of all the members or behalf of other members.

features of a partnership:

1.Agreement between Partners: It is an association of two or more individuals, and a partnership arises from an agreement or a contract. The agreement (accord) becomes the basis of the association between the partners. Such an agreement is in the written form. An oral agreement is evenhandedly legitimate. In order to avoid controversies, it is always good, if the partners have a copy of the written agreement.

2.Two or More Persons: In order to manifest a partnership, there should be at least two (2) persons possessing a common goal. To put it in other words, the minimal number of partners in an enterprise can be two (2). However, there is a constraint on their maximum number of people.

3.Sharing of Profit: Another significant component of the partnership is, the accord between partners has to share gains and losses of a trading concern. However, the definition held in the Partnership Act elucidates – partnership as an association between people who have consented to share the gains of a business, the sharing of loss is implicit. Hence, sharing of gains and losses is vital.

4.Business Motive: It is important for a firm to carry some kind of business and should have a profit gaining motive.

5.Mutual Business: The partners are the owners as well as the agent of their firm. Any act performed by one partner can affect other partners and the firm. It can be concluded that this point acts as a test of partnership for all the partners.

6.Unlimited Liability: Every partner in a partnership has unlimited liability.

Types of Partnerships

A partnership is divided into different types depending on the state and where the business operates. Here are some general aspects of the three most common types of partnerships.

General Partnership

A general partnership comprises two or more owners to run a business. In this partnership, each partner represents the firm with equal right. All partners can participate in management activities, decision making, and have the right to control the business. Similarly, profits, debts, and liabilities are equally shared and divided equally.

In other words, the general partnership definition can be stated as those partnerships where rights and responsibilities are shared equally in terms of management and decision making. Each partner should take full responsibility for the debts and liability incurred by the other partner. If one partner is sued, all the other partners are considered accountable. The creditor or court will hold the partner’s personal assets. Therefore, most of the partners do not opt for this partnership.

Limited Partnership

In this partnership, includes both the general and limited partners. The general partner has unlimited liability, manages the business and the other limited partners. Limited partners have limited control over the business (limited to his investment). They are not associated with the everyday operations of the firm.

In most of the cases, the limited partners only invest and take a profit share. They do not have any interest in participating in management or decision making. This non- involvement means they do not have the right to compensate the partnership losses from their income tax return.

Limited Liability Partnership

In Limited Liability Partnership (LLP), all the partners have limited liability. Each partner is guarded against other partners legal and financial mistakes. A limited liability partnership is almost similar to a Limited Liability Company (LLC) but different from a limited partnership or a general partnership.

Partnership at Will

Partnership at Will can be defined as when there is no clause mentioned about the expiration of a partnership firm. Under section 7 of the Indian Partnership Act 1932, the two conditions that have to be fulfilled by a firm to become a Partnership at Will are:

The partnership agreement should have not any fixed expiration date. No particular determination of the partnership should be mentioned.

Therefore, if the duration and determination are mentioned in the agreement, then it is not a partnership at will. Also, initially, if the firm had a fixed expiration date, but the operation of the firm continues beyond the mentioned date that it will be considered as a partnership at will.

Partnership Agreement

A partnership agreement is an agreement between two or more individuals who sign a contract to start a profitable business together. In the Partnership agreement, the partners are equally responsible for the debt of an organisation. Even if one person withdraws his/her partnership, they are liable for an already existing debt, and future liability if they do not provide with proper notice of retirement. Sometimes, a partnership can also exist without signing any scripted agreement, in such cases law that regulates partnership would apply.

Importance of Partnership Agreement:

A partnership agreement is vital to keep away the disagreement, confusion or any changes that might occur in the course of business tenure. Below are a few points that describe why a partnership agreement is essential:

●To form distinguished roles and responsibilities for each partner.

●To avoid tax problems, the tax status shows that the partner is dispensing profits to each partner based on accounting practice and acceptable tax.

●To avoid liability and legal issue, if there is any with any of the partners.

●It helps to deal with any lifestyle or circumstance changes of any partners. They usually deal with buy-out agreement with individual partners.

●To surpass non-compete agreements and conflict of interest with partners.

●To overrule the state law.

Partners Contribution & Percentage Distribution

●Partner contribution can be in a different amount and type, including cash, idea, partner’s time on a job. In this regard, each partner’s contribution need not necessarily be in cash. That means the partners may make uniform inputs to the business, have equal rights, but the inputs may not be in cash but other different forms.

●Since each partner has distinct responsibilities and strength, partnership share is 100 per cent impartial from a financial point of view.

●The partnership percentage can be estimated by calculating the total cash required to invest in starting a new business and dividing each partner share with that total.

●The role each partner plays in starting a company and the amount of work and time contributed can also dictate a percentage of proprietorship as much as financial offerings.

●If partners have a corporate entity, create a total stock that has equal worth as the business, if 1000 stock is 100 per cent ownership divide and calculates each partner share.

For example, to get the estimated value of a share in a business, the cost of a company should be divided by the total number of shares. If the business is worth ₹. 35,00,000/- with 1,000 shares, the share value is ₹. 3,500/-.

What is Joint Stock Company

A joint stock company is an organisation which is owned jointly by all its shareholders. Here, all the stakeholders have a specific portion of stock owned, usually displayed as a share.

Each joint stock company share is transferable, and if the company is public, then its shares are marketed on registered stock exchanges. Private joint stock company shares can be transferred from one party to another party. However, the transfer is limited by agreement and family members.

Features of Joint Stock Company

1.Separate Legal Entity – A joint stock company is an individual legal entity, apart from the persons involved. It can own assets and can because it is an entity it can sue or can be sued. Whereas a partnership or a sole proprietor, it has no such legal existence apart from the person involved in it. So the members of the joint stock company are not liable to the company and are not dependent on each other for business activities.

2.Perpetual – Once a firm is born, it can only be dissolved by the functioning of law. So, company life is not affected even if its member keeps changing.

3.Number of Members – For a public limited company, there can be an unlimited number of members but minimum being seven. For a private limited company, only two members. In general, a partnership firm cannot have more than 10 members in one business.

4.Limited Liability – In this type of company, the liability of the company’s shareholders is limited. However, no member can liquidate the personal assets to pay the debts of a firm.

5.Transferable share – A company’s shareholder without consulting can transfer his shares to others. Whereas, in a partnership firm without any approval of other partners, a partner cannot move his share.

6.Incorporation – For a firm to be accepted as an individual legal entity, it has to be incorporated. So, it is compulsory to register a firm under a joint stock company.

Types of Joint Stock Company

The joint stock company is divided into three different types.

●Chartered Company – A firm incorporated by the king or the head of the state is known as a chartered company.

●Statutory Company – A company which is formed by a particular act of parliament is known as a statutory company. Here, all the power, object, right, and responsibility are all defined by the act.

●Registered Company – An organisation that is formed by registering under the law of the company comes under a registered company.

Details Explanation:

Chartered companies:

The crown in exercise of the royal prerogative has power to create a corporation by the grant of a charter to persons assenting to be incorporated. Such companies or corporations are known as chartered companies. Examples of this type of companies are Bank of England (1694), East India Company (1600). The powers and the nature of business of a chartered company are defined by the charter which incorporates it. After the country attained independence, these types of companies do not exist in India.

(ii)Statutory companies:

A company may be incorporated by means of a special Act of the Parliament or any state legislature. Such companies are called statutory companies, Instances of statutory companies in India are Reserve Bank of India, the Life Insurance Corporation of India, the Food Corporation of India etc. The provisions of the Companies Act 1956 apply to statutory companies except where the said provisions are inconsistent with the provisions of the Act creating them. Statutory companies are mostly invested with compulsory powers.

(iii)Registered companies:

Companies registered under the Companies Act 1956, or earlier Companies Acts are called registered companies. Such companies come into existence when they are registered under the Companies Act and a certificate of incorporation is granted to them by the Registrar.

Co-operative organisation

There are different types of business organisations, one such form is of cooperative society. Cooperative societies are formed with the aim of helping their members. This type of business organisation is formed mainly by weaker sections of the society in order to prevent any type of exploitation from the economically stronger sections of the society.

Cooperative societies need to be registered under the Cooperative Societies Act, 1912 in order to function as a legal entity. Members of the society raise the capital within themselves.

Characteristics of Cooperative Society

Cooperative societies are defined by the following characteristics.

1.Voluntary Association: The membership of a cooperative society is voluntary in nature, i.e it is as per the choice of people. Any individual can join the cooperative society and can also exit the membership as per his/her desire. The member needs to serve a notice before deciding to end the association with the society.

2.Open Membership: The membership of a cooperative society is open to all i.e, membership is open to all, irrespective of their caste, creed and religion.

3.Registration: A cooperative society needs to get registered in order to be considered a legal entity. After registration it can enter into contracts and acquire property in its name.

4.Limited liability: The members of a cooperative society will have limited liability. The liability is limited to the amount of capital contributed by the member.

5.Democratic Character: Cooperative society forms a managing committee and elected members have the power to vote and choose among themselves. The managing committee is formed so as to take important decisions regarding the operations of the society.

6.Service Motive: The formation of a cooperative society is for the welfare of the weaker sections of the community. If the cooperative society earns profit it will be shared among the members as dividend.

7.Under state control: In order to safeguard the interests of society members, the cooperative society is under the control and supervision of the state government. The society has to maintain accounts, which will be audited by an independent auditor.

Types of Cooperative Societies

Following are some of the types of cooperative societies:

1.Consumer Cooperative Society: Consumer cooperative societies are formed with the objective of protecting the consumer interests. Individuals who wish to purchase products at reasonable rates most likely join consumer cooperative societies. In such type of societies, there are no middlemen involved, the product is purchased directly from the producer and sold to consumers.

2.Producer Cooperative Society: Producer cooperative societies are formed with the objective of protecting the interests of small producers. These cooperatives help producers in maintaining their profit and also to assist producers in procuring items that will be helpful in production of goods and services.

3.Credit Cooperative Society: These cooperative societies are set up with the objective of helping people by providing credit facilities. They provide loans at a minimal rate of interest and flexible repayment tenure to its members and protect them against high rates of interest that are charged by private money lenders.

4.Housing Cooperative Society: Housing cooperative societies are formed with the objective of providing housing facilities to the members of the society. This proves to be beneficial for the lower income groups as it allows them to avail housing benefits at a very affordable price.

5.Marketing Cooperative Society: These societies are formed with the objective of providing small producers a platform to sell their products at affordable prices and also eliminate middlemen from the chain, thus ensuring adequate profits.

Advantages of Cooperative Society

Following are some of the advantages of cooperative societies:

1.The products that are sold in the cooperative societies are cheaper than the market.

2.Procurement of products is done directly from the producers, which removes the middlemen, thereby generating more profit for the producers and consumers.

3.Members of the cooperative society can get quick loans.

4.There is no black marketing involved.

Disadvantages of Cooperative Society

Some of the disadvantages of cooperative societies are:

1.Due to the association of members of low income groups, the scope of raising capital is limited

2.It suffers from inefficiencies in management.

Limited Liability partnership

The full form of LLP is the Limited Liability partnership. LLP is a combination of a traditional partnership, & a business is close to a traditional partnership and also some matches with business as some of its characteristics. For instance, it offers the flexibility of a conventional partnership firm and the advantage of a company’s limited liability at a low compliance cost. It means in an LLP, participants have the flexibility to coordinate their internal strategies on the performance of a mutually negotiated arrangement, such as a partnership firm, and even the partners have limited liability where the liability of every partner is restricted.

●Besides that, in an LLP, one party is not liable or charged for the neglect, wrongdoing or misconduct of another party.

●It’s a hybrid between a partnership & an organisation. In comparison, an LLP is required to have at least one “General Partner” with unlimited liability in individual nations.

●In businesses where liability is limitless, the partners’ private properties can be sold off in order to pay for the damages or to cover the dues.

●The Government has adopted Act LLP2008, which entered into force on 1 April 2009, to resolve this restriction.

●LLP is also a legal entity since it has to be licenced with the ROC (Registrars of Companies) and is regulated by the 2008 LLP Act.

Advantages of LLP

●It is distinct from its partners, or partners are distinct from the company. No one can contact property rights if a business causes massive casualties. Only the sum they invested in companies will be affected.

●The liabilities are restricted and are still in proportion to the equity of the capital of the partners. Besides, all partners must be Limited Liability Partnership agents and not other partners.

●It allows the versatility to make the necessary changes. It gives members the freedom to coordinate their internal operations, as is the case in a collaboration company, based on a shared agreement.

●Easy to set up. The partners are expected to visit & signature the LLP agreement at the branch of the ROC (Registrar of Companies).

●It also has endless succession, that ensures the corporation will not break if either of the partners expires or go bankrupt.

●There should be at least two partners, at least one of whom should be a citizen of India, but the maximum number of partners is not restricted and foreign partners are also permitted.

●For charity or nonprofit purposes, an LLP could not be created.

One Person company

The corporate laws in India got revolutionized by The Companies Act, 2013 with the introduction of various new concepts that were non-existent previously. The introduction of the concept of One Person Company was one of the game-changers. A whole new way of starting businesses was recognized which granted flexibility that an entity like a company could offer. It also protected limited liability that was lacking in partnerships and sole proprietorships.

The ability of individuals to form a company was already identified by various other countries like the USA, China, Singapore, UK and Australia before the new Companies Act 2013 was enacted.

Definition of One Person Company

One-person Company is a company that has only one person as its member according to Subsection 62 of Section 2 of the Companies Act, 2013. Because members of a company are recognized as the company’s shareholders or the subscribers to its Memorandum of Association, One Person Company (OPC) is functionally a company with only one shareholder as its member.

OPCs are usually formed when the business has just one founder or promoter. Due to the many advantages that OPCs offer, entrepreneurs whose businesses are at a nascent stage give more preference to the creation of OPCs rather than sole proprietorships.

Difference Between One Person Company and Sole Proprietorships

An OPC and a sole proprietorship form of business might come across to be alike since both the forms of businesses have a single person involved who owns the business, but in reality, they are quite different from each other. The nature of the liabilities carried by both of them is the major difference between the two forms.

OPC being a separate legal entity on its own which is distinctive from its promoter has its own liabilities and assets. The promoter cannot be held liable personally to pay off the debts of the company.

Whereas, the sole proprietorship and its proprietor is the same. So, in the case of non- fulfilment of the liabilities of the business, the promoter’s assets are attached and sold by the law.

Features of a One Person Company

The general features of a One-Person Company are as follows.

Private Company

Section 3(1)(c) of the Companies Act, 2013 states that a company can be formed by a single person for any purpose recognized by the law. OPCs are further described as private companies.

Single – Member

Unlike other private companies, OPCs can have only one shareholder or member.

Nominee

The sole member of the company nominates a nominee during the registration of the company. This is a feature unique to OPCs and this distinguishes it from all other types of companies.

No Perpetual Succession

The death of the only member of the company allows the nominee to either reject or choose to become its sole member. In other kinds of companies, the concept of perpetual succession is followed.

Minimum One Director

Minimum one person needs to be the director of OPCs, which is the member in this case. There can be a maximum of 15 directors.

No Minimum Paid-up Share Capital

For OPCs, any minimum paid-up share capital has not been prescribed by the Companies Act, 2013.

Special Privileges

Many privileges and exemptions are enjoyed by the OPCs under the Companies Act that other types of companies are not entitled to.

Formation of One Person Companies

An OPC can be created by a single person by subscribing his name to the Memorandum of Association and fulfilling the other prerequisites prescribed by the Companies Act, 2013. The MoA also needs to declare all the details of a nominee who would go on to become the sole member of the company in case of death of the original member or he becomes incapable to enter any contract.

The MoA and the nominee’s consent to his nomination are to be submitted to the Registrar of Companies in addition to the application of registration. That nominee is allowed to withdraw his name at any given point of time by submitting the required application to the Registrar. The member is also entitled to cancel his nomination later.

Membership in One Person Companies

In India, only natural individuals who are the citizens and residents of the country are eligible to create an OPC. The nominees of OPCs are also guided by the same directive. Also, such a natural person is not allowed to be a member or nominee of more than one OPC at any given point of time.

One significant point is that only a natural person can become a member of an OPC which doesn’t apply in case of companies. Companies can themselves be members and own shares of the companies. Additionally, minors are prohibited by the law from becoming members or nominees of OPCs.

Conversion of One Person Company (OPCs) Into Other Companies

Regulations monitoring the formation of OPCs explicitly impede the conversion of OPCs into companies under Section 8, the ones that have philanthropic objectives. Until the expiry of two years from the date of their incorporation, OPCs can’t convert into other types of companies voluntarily.

Privileges of One Person Companies

●One-Person Companies benefit from the following privileges and exemptions under the Companies Act:

●OPCs don’t have to conduct annual general meetings.

●Cash flow statements need not be included in their financial statements.

●Directors could sign the annual returns too; a company secretary is not mandatorily required.

●Provisions in regards to the independent directors are not applied to OPCs.

●Directors can take home more remuneration as compared to other companies.

Unit-III

Meaning of Business Combination

Business communication refers to the combination of two or more independent businesses for attaining same objective. This association of business with one another is either temporary or permanent and is meant for pooling production, finance, marketing and profit. Such association of firms is carried out both at local and international level.

For combining together these firms enter into an agreement that is done either in oral form or a written form. Business combination helps firms in eliminating the competition and maximizing their profit. Firms by merging together as one unit are able to enjoy a monopoly position in market.

It enables them in sharing knowledge and ideas with one other which help in achieving better efficiency. This imparts greater health and stability to firms for surviving during tough business cycles. Combination result in joint investment by firms in research and development activities that leads to better innovative products.

Types of Business Combination Circular Combination

Circular combination is a combination of those businesses which belong to different

industry and produce differentiated products. It is also known as mixed combination as two different firms comes together through it. This combination helps firms in taking benefits of administrative integration. Diagonal Combination

It is the one in which two or more firms providing auxiliary services combines with the

main firm involved in main line of production. Diagonal combination is also termed as service combination. Its main aim is to increase the business size and to make it self-sufficient so that it may not be dependent on any outside firms. Example under this category is combination of firms manufacturing automobiles with those providing spare parts and repairs services.

Vertical Combination

It means combining various department of same business unit to bring under same management. Vertical combination refers to the integration of different stages of firm involved in production of product. Here all steps from conversion of raw material to finished product are linked together.

Horizontal Combination

Horizontal combination is an integration of business units of similar nature producing identical product. They are under one management and serve same geographical market. Integration of two shoe industry or two textile industry is an example of this combination.

Rationalisation and Automation

Methods of remuneration

Labour remuneration methods have an effect on:

The cost of finished products and services. The morale and efficiency of employees.

Time-based pay

Time rates are used when employees are paid for the amount of time they spend at work.

The usual form of time rate is the weekly wage or monthly salary. Usually the time rate is fixed in relation to a standard working week (e.g. 35 hours per week). The employment contract for a time-rate employee will also stipulate the amount of paid leave that the employee can take each year (e.g. 5 weeks paid holiday).

Time worked over this standard is known as overtime. Overtime is generally paid at a higher rate than the standard time-rate – reflecting the element of sacrifice by an employee. However, many employees who are paid a monthly salary do not get paid overtime. This is usually the case for managerial positions where it is generally accepted that the hours worked need to be sufficient to fulfil the role required.

The main advantages of time-rate pay are:

Time rates are simple for a business to calculate and administer

They are suitable for businesses that wish to employ staff to provide general roles (e.g. financial management, administration, maintenance) where employee productivity is not easy to measure It is easy to understand from an employee’s perspective

The employee can budget personal finance with some certainty

Makes it easier for the employer to plan and budget for employee costs (e.g. payroll costs will be a function of overall headcount rather than estimated output)

The main disadvantages of time-rate pay are:

Does little to encourage greater productivity – there is no incentive to achieve greater output

Time-rate payroll costs have a tendency to creep upwards (e.g. due to inflation-related pay rises and employee promotion

Piece Rate System Of Wage Payment

The piece rate system is that system of wage payment in which the workers are paid on the basis of the units of output produced. Piece rate system does not consider the time spent by the workers. Piece rate system is the method of remunerating the workers according to the number of unit produced or job completed. It is also known as payment by result or output. Piece rate system pays wages at a fixed piece rate for each unit of output produced. The total wages earned by a worker is calculated by using the following formula.

Total Wages Earned= Total units of outputs produced x Wage rate per unit of output. OR,

Total Wages Earned= Output x Piece Rate Advantages Of Piece Rate System

The following are some important advantages of piece rate system of wage payment.

*Piece rate system pays wages according to the output produced by the workers. It encourages efficient workers.

*Piece rate system helps to reduce idle time.

*Piece rate system gives incentives to the workers to adopt a better method of production for increasing their production and earning.

*Piece rate system helps the management to determine the exact labor cost per unit for submitting quotation.

*Piece rate system reduces per unit cost of production due to increased volume of production.

*Piece rate system requires less supervision cost. Disadvantages Of Piece Rate System

The following are the notable disadvantages of piece rate system

*Piece rate system does not help in producing quality output as the workers are concentrated more on quantity instead of quality.

*Piece rate system does not help for a uniform flow of production and makes difficult to regulate the production schedule.

Stock Exchange

Stock exchange is a market where stocks are bought and sold and traded. In stock exchanges those who are willing to purchase or sell their stocks or bonds need to perform that through an intermediary called the broker. Brokers are individuals who are licensed for performing trading of bonds and stocks in a stock exchange.

the securities are bought and sold as per well-structured rules and regulations. Securities mentioned here includes debenture and share issued by a public company that is correctly listed at the stock exchange, debenture and bonds issued by the government bodies, municipal and public bodies.

Typically bonds are traded Over-the-Counter (OTC), but a few corporate bonds are sold in a stock exchange. It can enforce rules and regulation on the brokers and firms that are enrolled with them. In other words, a stock exchange is a forum where securities like bonds and stocks are purchased and traded. This can be both an online trading platform and offline (physical location).

Functions of Stock Exchange

Following are some of the most important functions that are performed by stock exchange:

Role of an Economic Barometer: Stock exchange serves as an economic barometer that is indicative of the state of the economy. It records all the major and minor changes in the share prices. It is rightly said to be the pulse of the economy, which reflects the state of the economy.

Valuation of Securities: Stock market helps in the valuation of securities based on the factors of supply and demand. The securities offered by companies that are profitable and growth- oriented tend to be valued higher. Valuation of securities helps creditors, investors and government in performing their respective functions.

Transactional Safety: Transactional safety is ensured as the securities that are traded in the stock exchange are listed, and the listing of securities is done after verifying the company’s position. All companies listed have to adhere to the rules and regulations as laid out by the governing body.

Contributor to Economic Growth: Stock exchange offers a platform for trading of securities of the various companies. This process of trading involves continuous disinvestment and reinvestment, which offers opportunities for capital formation and subsequently, growth of the economy.

Making the public aware of equity investment: Stock exchange helps in providing information about investing in equity markets and by rolling out new issues to encourage people to invest in securities.

Offers scope for speculation: By permitting healthy speculation of the traded securities, the stock exchange ensures demand and supply of securities and liquidity.

Facilitates liquidity: The most important role of the stock exchange is in ensuring a ready platform for the sale and purchase of securities. This gives investors the confidence that the existing investments can be converted into cash, or in other words, stock exchange offers liquidity in terms of investment.

Better Capital Allocation: Profit-making companies will have their shares traded actively, and so such companies are able to raise fresh capital from the equity market. Stock market helps in better allocation of capital for the investors so that maximum profit can be earned.

Encourages investment and savings: Stock market serves as an important source of investment in various securities which offer greater returns. Investing in the stock market makes for a better investment option than gold and silver.

Features of Stock Exchange:

A market for securities- It is a wholesome market where securities of government, corporate companies, semi-government companies are bought and sold.

Second-hand securities- It associates with bonds, shares that have already been announced by the company once previously.

Regulate trade in securities- The exchange does not sell and buy bonds and shares on its own account. The broker or exchange members do the trade on the company’s behalf.

Dealings only in registered securities- Only listed securities recorded in the exchange office can be traded.

Transaction- Only through authorised brokers and members the transaction for securities can be made.

Recognition- It requires to be recognised by the central government.

Measuring device- It develops and indicates the growth and security of a business in the index of a stock exchange.

Operates as per rules– All the security dealings at the stock exchange are controlled by exchange rules and regulations and SEBI guidelines.

What Is a Commodity Market?

A commodity market is a marketplace for buying, selling, and trading raw materials or primary products.

Commodities are often split into two broad categories: hard and soft commodities. Hard commodities include natural resources that must be mined or extracted—such as gold, rubber, and oil, whereas soft commodities are agricultural products or livestock—such as corn, wheat, coffee, sugar, soybeans, and pork.

KEY TAKEAWAYS

A commodity market involves buying, selling, or trading a raw product, such as oil, gold, or coffee.

There are hard commodities, which are generally natural resources, and soft commodities, which are livestock or agricultural goods.

Spot commodities markets involve immediate delivery, while derivatives markets entail delivery in the future.

Investors can gain exposure to commodities by investing in companies that have exposure to commodities or investing in commodities directly via futures contracts.

Types of Commodity Markets

Generally speaking, commodities trade either in spot markets or derivatives markets. Spot markets are also referred to as “physical markets” or “cash markets” where buyers and sellers exchange physical commodities for immediate delivery.

Derivatives markets involve forwards, futures, and options. Forwards and futures are derivatives contracts that use the spot market as the underlying asset. These are contracts that give the owner control of the underlying at some point in the future, for a price agreed upon today. Only when the contracts expire would physical delivery of the commodity or other asset take place, and often traders will roll over or close out their contracts in order to avoid making or taking delivery altogether. Forwards and futures are generically the same, except that forwards are customizable and trade over-the-counter (OTC), whereas futures are standardized and traded on exchanges.

Commodity Market Trading vs. Stock Trading

For most individual investors, accessing commodities markets, whether spot or derivatives, is untenable. Direct access to these markets typically requires a special brokerage account and/or certain permissions. Because commodities are considered an alternative asset class, pooled funds that traded commodities futures, such as CTAs, typically only allow accredited investors. Still, ordinary investors can gain indirect access to commodities via the stock market itself.

Stocks on mining or materials companies tend to be correlated with commodities prices, and there are various ETFs now that track various commodities or commodities indexes.

Investors looking to diversify their portfolio can look to these ETFs, but for most long-term investors stocks and bonds will make up the core of their holdings. Moreover, because commodity prices tend by more volatile than stocks and bonds, commodities trading is often most suited for those with higher risk tolerance and/or longer time horizon.

Unit iv

Process of Organizing

Organizing is one of the toughest and most important functions of management.

Process of Organizing

First, let us understand the concept of organizing. Organizing essentially consists of establishing a division of labor. The managers divide the work among individuals and group of individuals. And then they coordinate the activities of such individuals and groups to extract the best outcome.

Organizing also involves delegating responsibility to the employees along with the authority to successfully accomplish these tasks and responsibilities. One major aspect of organizing is delegating the correct amounts of responsibilities and authority.

1]Identifying the Work

The obvious first step in the process of organizing is to identify the work that has to be done by the organization. This is the ground level from which we will begin. So the manager needs to identify the work and the tasks to be done to achieve the goals of the organization.

Identification of the work helps avoid miscommunication, overlapping of responsibilities and wastage of time and effort.

2]Grouping of Work

For the sake of a smooth flow of work and smooth functioning of the organization, similar tasks and activities should be grouped together. Hence we create departments within the company and divisions within each department. Such an organization makes the functioning of the company way more systematic.

Depending on the size of the organization and the volume of work, an organization can have several department and divisions. And every department has a manager representing them at the top-level of the management.

In smaller organizations sometimes these departments are clubbed together under one manager.

3]Establish Hierarchy

The next step in the process of organizing is to establish the reporting relationships for all the individual employees of the company. So a manager establishes the vertical and horizontal relationships of the company.

This enables the evaluation and control over the performances of all the employees in a timely manner. So if rectifications need to be made, they can be made immediately.

4]Delegation of Authority

Authority is basically the right an individual has to act according to his wishes and extract obedience from the others. So when a manager is assigned certain duties and responsibilities, he must also be delegated authority to carry out such duties effectively.

If we only assign the duties, but no authority he will not be able to perform the tasks and activities that are necessary. So we must always assign authority and clearly specify the boundaries of the duties and the authority which has been delegated.

5]Coordination

Finally, the manager must ensure that all activities carried out by various employees and groups are well coordinated. Otherwise, it may lead to conflicts between employees, duplication of work and wastage of time and efforts. He must ensure all the departments are carrying out their specialized tasks and there is harmony in these activities. The ultimate aim is to ensure that the goal of the organization is fulfilled.

Importance of Organizing Efficient Administration

It brings together various departments by grouping similar and related jobs under a single specialization. This establishes coordination between different departments, which leads to unification of effort and harmony in work.

Resource Optimization

Organizing ensures effective role-job-fit for every employee in the organization. It helps in avoiding confusion and delays, as well as duplication of work and overlapping of effort.

Benefits Specialization

It is the process of organizing groups and sub-divide the various activities and jobs based on the concept of division of labor. This helps in the completion of maximum work in minimum time ensuring the benefit of specialization.

Promotes Effective Communication

Organizing is an important means of creating coordination and communication among the various departments of the organization. Different jobs and positions are interrelated by structural relationship. It specifies the channel and mode of communication among different members.

Creates Transparency

The jobs and activities performed by the employees are clearly defined on the written document called job description which details out what exactly has to be done in every job. Organizing fixes the authority-responsibility among employees. This brings in clarity and transparency in the organization.

Expansion and Growth

When resources are optimally utilized and there exists a proper division of work among departments and employees, management can multiply its strength and undertake more activities. Organizations can easily meet the challenges and can expand their activities in a planned manner.

14 Principles of an Organization

1.Principle of Objective:

The enterprise should set up certain aims for the achievement of which various departments should work. A common goal so devised for the business as a whole and the organization is set up to achieve that goal. In the absence of a common aim, various departments will set up their own goals and there is a possibility of conflicting objectives for different departments. So there must be an objective for the organization.

2.Principle of Specialisation:

The organization should be set up in such a way that every individual should be assigned a duty according to his skill and qualification. The person should continue the same work so that he specialises in his work. This helps in increasing production in the concern.

3.Principles of Co-ordination:

The co-ordination of different activities is an important principle of the organization. There should be some agency to co-ordinate the activities of various departments. In the absence of co-ordination there is a possibility of setting up different goals by different departments. The ultimate aim of the concern can be achieved only if proper co-ordination is done for different activities.

4.Principle of Authority and Responsibility:

The authority flows downward in the line. Every individual is given authority to get the work done. Though authority can be delegated but responsibility lies with the man who has been given the work. If a superior delegates his authority to his subordinate, the superior is not absolved of his responsibility, though the subordinate becomes liable to his superior. The responsibility cannot be delegated under any circumstances.

5.Principle of Definition:

The scope of authority and responsibility should be clearly defined. Every person should know his work with definiteness. If the duties are not clearly assigned, then it will not be possible to fix responsibility also. Everybody’s responsibility will become nobody’s responsibility. The relationship between different departments should also be clearly defined to make the work efficient and smooth.

6.Span of Control:

Span of control means how many subordinates can be supervised by a supervisor. The number of subordinates should be such that the supervisor should be able to control their work effectively. Moreover, the work to be supervised should be of the same nature. If the span of control is disproportionate, it is bound to affect the efficiency of the workers because of slow communication with the supervisors.

7.Principle of Balance:

The principle means that assignment of work should be such that every person should be given only that much work which he can perform well. Some person is over worked and the other is under-worked, then the work will suffer in both the situations. The work should be divided in such a way that everybody should be able to give his maximum.

8.Principle of Continuity:

The organization should be amendable according to the changing situations. Everyday there are changes in methods of production and marketing systems. The organization should be dynamic and not static. There should always be a possibility of making necessary adjustments.

9.Principle of Uniformity:

The organization should provide for the distribution of work in such a manner that the uniformity is maintained. Each officer should be in-charge of his respective area so as to avoid dual subordination and conflicts.

10.Principle of Unity of Command:

There should be a unity of command in the organization. A person should be answerable to one boss only. If a person is under the control of more than one person then there is a like-hood of confusion and conflict. He gets contradictory orders from different superiors. This principle creates a sense of responsibility to one person. The command should be from top to bottom for making the organization sound and clear. It also leads to consistency in directing, coordinating and controlling.

11.Principle of Exception:

This principle states that top management should interfere only when something goes wrong. If the things are done as per plans then there is no need for the interference of top management. The management should leave routine things to be supervised by lower cadres. It is only the exceptional situations when attention of top management is drawn. This principle relieves top management of many botherations and routine things. Principle of exception allows top management to concentrate on planning and policy formulation. Important time of management is not wasted on avoidable supervision.

12.Principle of Simplicity:

The organizational structure should be simple so that it is easily understood by each and every person. The authority, responsibility and position of every person should be made clear so that there is no confusion about these things. A complex organizational structure will create doubts and conflicts among persons. There may also be over-lapping’s and duplication of efforts which may otherwise be avoided. It helps in smooth running of the organization.

13.Principle of Efficiency:

The organization should be able to achieve enterprise objectives at a minimum cost. The standards of costs and revenue are pre-determined and performance should be according to these goals. The organization should also enable the attainment of job satisfaction to various employees.

14.Scalar Principle:

This principle refers to the vertical placement of supervisors starting from top and going to the lower level. The scalar chain is a pre-requisite for effective and efficient organization.

Types of Organisation Structure What is Organisation

Organisation refers to a collection of people who are working towards a common goal and objective. In other words, it can be said that organisation is a place where people assemble together and perform different sets of duties and responsibilities towards fulfilling the organisational goals.

Types of Organisation and their Structure

There are two broad categories of organisation, which are:

1.Formal Organisation

2.Informal Organisation

Formal Organisation: Formal organisation is that type of organisation structure where the authority and responsibility are clearly defined. The organisation structure has a defined delegation of authority and roles and responsibilities for the members.

The formal organisation has predefined policies, rules, schedules, procedures and programs. The decision making activity in a formal organisation is mostly based on predefined policies.

Formal organisation structure is created by the management with the objective of attaining the organisational goals.

There are several types of formal organisation based on their structure, which are discussed as follows:

1.Line Organisation

2.Line and Staff Organisation

3.Functional Organisation

4.Project Organisation

5.Matrix Organisation

Let us learn about these organisation structures in detail in the following lines.

Line Organisation: Line organisation is the simplest organisation structure and it also happens to be the oldest organisation structure. It is also known as Scalar or military or departmental type of organisation.

In this type of organisational structure, the authority is well defined and it flows vertically from the top to the hierarchy level to the managerial level and subordinates at the bottom and continues further to the workers till the end.

There is a clear division of accountability, authority and responsibility in the line organisation structure.

Advantages of Line organisation

1.Simple structure and easy to run

2.Instructions and hierarchy clearly defined

3.Rapid decision making

4.Responsibility fixed at each level of the organisation.

Disadvantages of Line organisation:

1.It is rigid in nature

2.It has a tendency to become dictatorial.

3.Each department will be busy with their work instead of focusing on the overall development of the organisation.

Line and Staff Organisation: Line and staff organisation is an improved version of the line organisation. In line and staff organisation, the functional specialists are added in line. The staff is for assisting the line members in achieving the target effectively.

Advantages of Line and Staff organisation

1.Easy decision making as work is divided.

2.Greater coordination between line and staff workers.

3.Provides workers the opportunity for growth.

Disadvantages of Line and Staff Organisation

1.Conflict may arise between line and staff members due to the improper distribution of authority.

2.Staff members provide suggestions to the line members and decision is taken by line members, it makes the staff members feel ignored.

Functional Organisation: Functional organisation structure is the type of organisation where the task of managing and directing the employees is arranged as per the function they specialise. In a functional organisation, there are three types of members, line members, staff members and functional members.

Advantages of Functional organisation

1.Manager has to perform a limited number of tasks which improves the accuracy of the work.

2.Improvement in product quality due to involvement of specialists.

Disadvantages of Functional organisation

1.It is difficult to achieve coordination among workers as there is no one to manage them directly.

2.Conflicts may arise due to the members having equal positions.