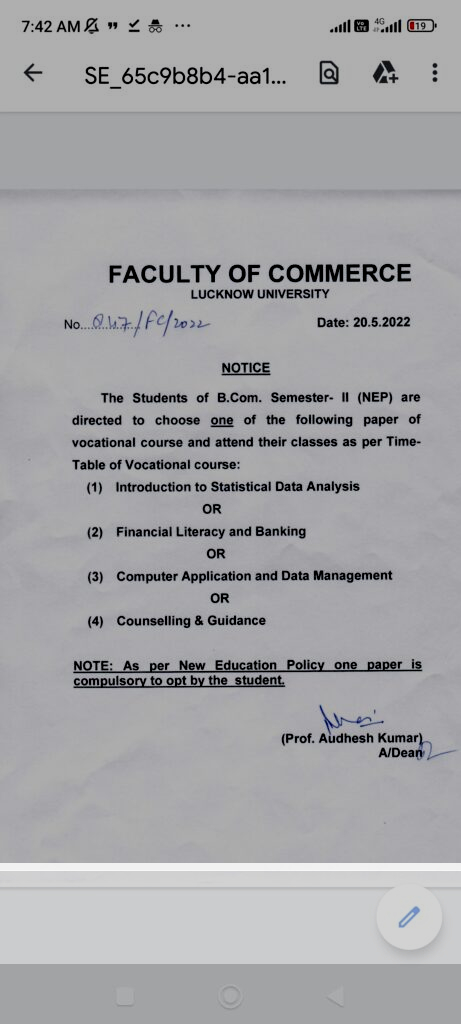

LU BA,BSC,BCOM NEP Vocational Papers Sem II Syllabus 2022

The Lucknow University (LU) has launched a new and flexible 4-year bachelors degree course with integrated research programme as a part of the National Education Policy (NEP) 2020.

This undergraduate programme will consist of three years of bachelors degree curriculum along with an additional year for research study in any stream relevant to the course.

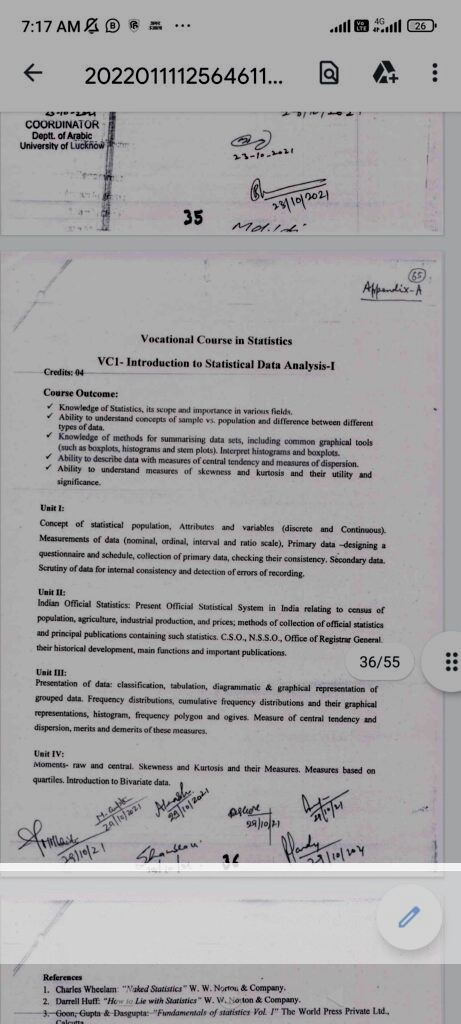

Subject:Introduction to Statistical Data Analysis

Unit 1:

Concept of statistical population, Attributes and variables (discrete and Continuous). Measurements of data (nominal, ordinal, interval and ratio scale), Primary data-designing a questionnaire and schedule, collection of primary data, checking their consistency. Secondary data, Scrutiny of data for internal consistency and detection of errors of recording.

Unit II:

Indian Official Statistics: Present Official Statistical System in India relating to census of population, agriculture, industrial production, and prices; methods of collection of official statistics and principal publications containing such statistics. C.S.O., N.S.S.O., Office of Registrar General. their historical development, main functions and important publications.

Unit III

Presentation of data: classification, tabulation, diagrammatic & graphical representation of grouped data. Frequency distributions, cumulative frequency distributions and their graphical representations, histogram, frequency polygon and ogives. Measure of central tendency and dispersion, merits and demerits. these measures.

Unit IV:

Moments- raw and central. Skewness and Kurtosis and their Measures. Measures based on quartiles. Introduction to Bivariate data.

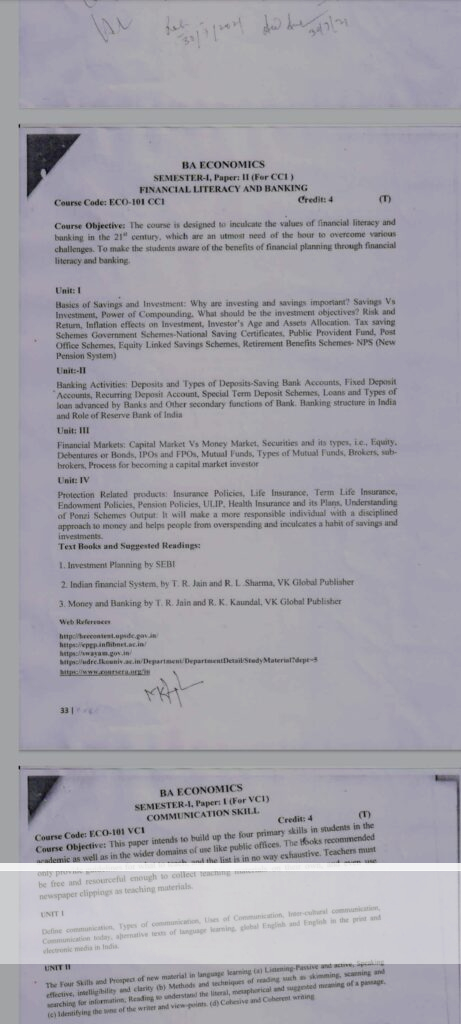

Subject: FINANCIAL LITERACY AND BANKING

Unit: 1

Basics of Savings and Investment: Why are investing and savings important? Savings Vs Investment, Power of Compounding. What should be the investment objectives? Risk and Return, Inflation effects on Investment, Investor’s Age and Assets Allocation. Tax saving Schemes Government Schemes-National Saving Certificates, Public Provident Fund, Post Office Schemes, Equity Linked Savings Schemes, Retirement Benefits Schemes- NPS (New Pension System)

Unit:-II

Banking Activities: Deposits and Types of Deposits-Saving Bank Accounts, Fixed Deposit “Accounts, Recurring Deposit Account, Special Term Deposit Schemes, Loans and Types of lean advanced by Banks and Other secondary functions of Bank Banking structure in India and Role of Reserve Bank of India

Unit: III

Financial Markets: Capital Market Vs Money Market, Securities and its types, ie, Equity, Debentures or Bonds, IPOs and FPOs, Mutual Funds, Types of Mutual Funds, Brokers, sub-brokers, Process for becoming a capital market investor

Unit: IV

Protection Related products: Insurance Policies, Life Insurance, Term Life Insurance, Endowment Policies, Pension Policies, ULIP, Health Insurance and its Plans, Understanding of Ponzi Schemes Output: It will make a more responsible individuals with a disciplined approach to money and helps people from overspending and inculcates a habit of savings and investments

Subject: COMPUTER APPLICATION IN DATA MANAGEMENT

Unit I:Computer Fundamentals

Introduction to Computers; Classification of Digital Computer, Meaning and Concept Hardware, Software and Types of Software Operating System Meaning and Functions; Memory RAM and ROM, Input-Output Devices MS Office: MS-Word and MS PowerPoint ,

Unit:II Data Processing Techniques MS Excel

Concept of Data Record and File Types of Data-Data Entry- File handling and Operations like opening, appending and cascading-closing and attribute controls-Data Storage and Retrieval Graphical Representation of Data

Unit-III: Application of MS-Excel Summarizing and analysis of data. Descriptive Statistics (Mean, median, mode, standard deviation, CV, dewness Comparison of means, Conetation and Regression analysis Estimation of Growth Rates Trends of Forecasting. Testing the significance of parameters

Unit-IV: Introduction to Statistical Software and Estimation

Basics of Data Analysis-Data Entry in SPSS R-Computing with SPSS/R-Preparation of Graphs with SPSS R-Distribution Functions and Density Functions-Statistical Package handling and command description for SPSS/ R-Reports Descriptive-Sutistics, Compare Means, Time Series Analysis, Correlation and Regression Models

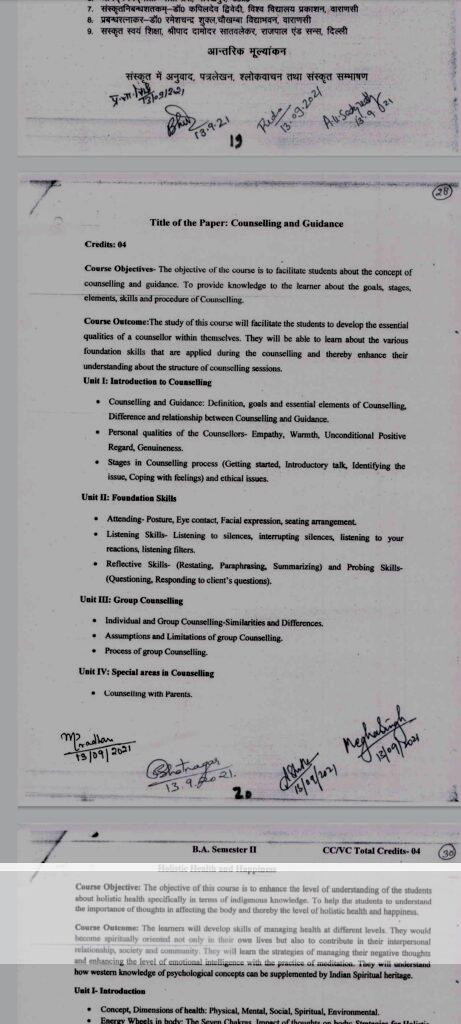

SUBJECT: Counselling and Guidance

Unit 1: Introduction to Counselling

°Counselling and Guidance: Definition, goals and essential elements of Counselling. Difference and relationship between Counselling and Guidance.

° Personal qualities of the Counsellors Empathy, Warmth, Unconditional Positive Regard, Genuineness.

°Stages in Counselling process (Getting started, Introductory talk, Identifying the issue, Coping with feelings) and ethical issues.

Unit II: Foundation Skills

°Attending- Posture, Eye contact, Facial expression, seating arrangement

°Listening Skills- Listening to silences, interrupting silences, listening to your reactions, listening filters.

°Reflective Skills (Restating. Paraphrasing. Summarizing) and Probing Skills (Questioning, Responding to client’s questions).

Unit III: Group Counselling

°Individual and Group Counselling-Similarities and Differences.

°Assumptions and Limitations of group Counselling.

• Process of group Counselling.

Unit IV: Special areas in Counselling

Counselling with Parents

Department Notification🔔