Solved Question Paper Micro Economics BCOM SEM I BY AASHI GUPTA

Watch Complete Video Solution of MICRO Economics

Q1.Critically Examine the Definition of Economics. Also, Differentiae the Micro economics & Macro Economics. (Most Important)

Ans: Economics, social science that seeks to analyze and describe the production, distribution, and consumption of wealth. It studies how individuals, businesses, governments, and nations make choices about how to allocate resources. Economics focuses on the actions of human beings, based on assumptions that humans act with rational behavior, seeking the most optimal level of benefit or utility.

The Classical View of Economics

The Classical economists viewed economics as a science of wealth. Adam Smith, the father ofeconomics, in his book titled: ‘An Enquiry into the Nature and Causes of Wealth of Nations’, defined economics as the science of wealth. According to Adam Smith, economics makes inquiries into thefactors that determine the wealth and growth of a nation. So to Adam Smith what forms the subjectmatter of economics is the production and expansion of wealth. However, Ricardo shifted emphasisfrom wealth production to wealth distribution. According to a French classical economist, J. B Say,economics is the science of production, distribution and consumption of wealth. Other classicaleconomists such J.S. Mill, defines economics as the law that governs mankind in the production ofwealth. The wealth definition means that wealth was considered to be an end in itself.

Critical Evaluation of the Classical Economists View

The classical economists narrowed the scope of economics by defining it as the science that dealswith only material wealth. They do not regard the services of those who produce non-material goodsbecause their services do not relate to production of tangible goods. This view or conception by theclassical economists attracted a lot of criticisms. Critics pointed out that economics studies not onlymaterial goods and wealth, but also includes non-material goods such as services of teachers, doctors, lawyers. These services provided by human resources fulfill human wants and should be regarded aspart of wealth. Secondly, the classical economists emphasized the importance of wealth rather than human beings ineconomic life. The critics observed that wealth was given primary role while human life was givensecondary role, but on the contrary, human life should play a primary role and so cannot be sacrificedfor wealth.According to the classical economists, wage to labour is the only source of wealth to a nation, but thecritics are of the view that there are other sources of wealth such as natural resources, humanresources and capital resources.

The Neo- Classical View of Economics

The neo-classical economists led by Alfred Marshal gave economics a respectable place among social sciences. Marshall defined economics as the study of mankind in the ordinary business of life; it examines that part of individual and the social action which is most closely connected with the attainment and use of material wellbeing Wealth was regarded not as an end in itself but a means to an end because it was seen as the source of human welfare. Major propositions of Marshall’s welfare definition are economics is the science of material welfare.

Secondly, economics is a social science because it is a study of men as they live and move and thinkin the ordinary business of life and thirdly that economics is the study of rational behavior of people as they maximize their material welfare This means that Economics is concerned with economic activities that promote material welfare but excludes all non-economic activities that are socially undesirable like stealing, prostitutions, etc.

Critical Evaluation of the Neo-Classical Economists

The neo-classical definition of economics was criticized by Lionel Robbins because of the distinctionbetween material and non-material activities. According to Robbins, the use of the word ‘material’narrows down the scope of economics because there are many things in the world which areimmaterial, but are useful for promoting human welfare. Robbins regards all goods and serviceswhich command a price as economic activity whether they are material or non-material. To say services are non–material is misleading because services have value. Their definition of Economicsfrom the material point of view is a misrepresentation of the science of Economics.To the neo-classical economists, economics is concerned with material welfare. According toRobbins, the word welfare should not be used along with material activities because there are manyactivities which are regarded as economic activities but they do not promote human welfare. Forexample, the production and sale of tobacco, drugs and alcohol are economic activities but harmful tohuman health.Robbins has also objected to the word ‘welfare’ in the neo-classical definition. Welfare is a subjectivething and varies from person to person, from age to age. According to Robbins, it cannot be said inobjective term which things will promote welfare and the ones that will not. Robbins believes thateconomics is not concerned with welfare rather he explains economics as the problem that havearisen because of scarcity of resources.

Scarcity and Choice Definition by Lionel Robbins

Robbins criticized Marshall’s definition and provided his own definition in his book, “An Essay onthe Nature and Significance of Economic Science” in 1932. According to Robbins, economics is thescience which studies human behaviour as a relationship between ends and scarce means which havealternative uses. This means that economics is a human science. It involves maximizing satisfactionfrom scarce resource and the means available for satisfying these ends (wants) are scarce or limited insupply. Also the scarce means are capable of alternative uses, that is, the use of scarce resource forone end prevents its use for any other purpose at that point in time. The ends are of varyingimportance which necessarily leads to the problem of choice in selecting the uses to which scarceresources can be put to. It is the various alternative uses of the resources that we have to decide on thebest allocation of resources. It should be noted that Robbins definition stands on three major facts namely: Unlimited wants,scarcity of resources and alternative uses of the resources. Robbins economics studies man’s activitiesin regards to all goods and services, without distinguishing them as material and non-material;provided they satisfy human wants. In other words, economic problem is one of allocating scarcemeans in relation to numerous ends.

Critical Evaluation of Robbins Definition

Robbins definition is no doubt popular among economists because it points out the basic economicproblems confronting the society. But Robbins definition has also been criticized on several grounds.According to the critics, Robbins definition also talks about welfare which he formally criticized. Infact in Robbins definition the idea of welfare is present because it involves the allocation of resourcesto maximize satisfaction. But this maximum satisfaction is nothing but welfare. Also Robbins assumption fails to explain fully the nature of ‘end’ and the difficulties associated withit. The idea of definite ends is also not acceptable because immediate ends many act as intermediariesto further ends. It is difficult to separate ends from means because immediate ends may be the meansto the achievement of further ends. Robbins definition is also criticized for not analyzing the theory of economic growth anddevelopment rather it talks about the theory of product and factor pricing. The theory of economicgrowth and development studies how national income and per capita income increase and whatcauses the increase. Robbins takes the resources as given while the theory of economic growth isconcerned with reducing the scarcity of resources through accumulation of capital and wealth.Therefore, Robbins definition though applicable to fully employed economy is not realistic foranalyzing the economic problems of the real world. Economic problems arise not only due to scarcitybut due to under, miss or over utilization of resources.

Samuelson’s Growth Oriented Definition

The present trend in the world is the establishment of welfare states and improvement in the standardof living through reduction in poverty, unemployment and income inequality. In line with this trendSamuelson has given a definition of economics based on growth aspects. According to Samuelson,“Economics is the study of how people and society end up choosing with or without the use ofmoney, to employ scarce productive resources that could have alternative uses to produce variouscommodities over time and distribute them for consumption, now or in the future, among variousperson or groups in the society”. Samuelson’s definition is an improvement over Robbins scarcitydefinition based on the following facts:

- Samuelson regards economics as a social science which emphasized the problem of scarcer sources and the idea of alternative uses of resources

- He emphasized on the consumption and distribution of various commodities for the present and future economic growth thereby highlighting the study of macroeconomics.

- Samuelson lays emphasis on the use of modern technique of cost-benefit analysis to evaluate the development programmed for the use of limited resources.

- Samuelson’s definition of economics has superiority over that of Robbins because of the inclusion of time element thereby making the scope of economics dynamic

Differences Between Microeconomics And Macroeconomics

Let us look at some of the points of difference between Microeconomics and Macroeconomics

| Microeconomics | Macroeconomics |

| Meaning | |

| Microeconomics is the branch of Economics that is related to the study of individual, household and firm’s behaviour in decision making and allocation of the resources. It comprises markets of goods and services and deals with economic issues. | Macroeconomics is the branch of Economics that deals with the study of the behaviour and performance of the economy in total. The most important factors studied in macroeconomics involve gross domestic product (GDP), unemployment, inflation and growth rate etc. |

| Area of study | |

| Microeconomics studies the particular market segment of the economy | Macroeconomics studies the whole economy, that covers several market segments |

| Deals with | |

| Microeconomics deals with various issues like demand, supply, factor pricing, product pricing, economic welfare, production, consumption, and more. | Macroeconomics deals with various issues like national income, distribution, employment, general price level, money, and more. |

| Business Application | |

| It is applied to internal issues. | It is applied to environmental and external issues. |

| Scope | |

| It covers several issues like demand, supply, factor pricing, product pricing, economic welfare, production, consumption, and more. | It covers several issues like distribution, national income, employment, money, general price level, and more. |

| Significance | |

| It is useful in regulating the prices of a product alongside the prices of factors of production (labour, land, entrepreneur, capital, and more) within the economy. | It perpetuates firmness in the broad price level, and solves the major issues of the economy like deflation, inflation, rising prices (reflation), unemployment, and poverty as a whole. |

| Limitations | |

| It is based on impractical presuppositions, i.e., in microeconomics, it is presumed that there is full employment in the community, which is not at all feasible. | It has been scrutinised that the misconception of composition’ incorporates, which sometimes fails to prove accurate because it is feasible that what is true for aggregate (comprehensive) may not be true for individuals as well. |

Q2. Explain the Following

1)Economics is a positive science & Normative Science

What is Positive Economics?

Positive Economics is a part of economics that contemplates the explanation and elucidation of economic occurrence. It concentrates on certainty and cause-and-effect behavioural association, and incorporates the development and trial of economics thesis.

It is the study of economics grounded on the intentional analysis. Today most economists concentrate on the positive economic analysis, which follows what is and what has been materialising in an economy as the rationality for any statement about the upcoming days. Positive economics stands in contradiction to normative economics, which uses value discernment.

What is Normative Economics?

Normative economics is an outlook on economics that contemplates normative or ideologically dictatorial, discernment toward economic enhancement, statements, investment projects and framework. Disparate to positive economics, which depends on intentional data analysis, normative economics decisively solicitude itself with value discernment and statements of ‘what has to be’ rather than certitude based on cause-and-effect declarations.

2)Scarcity and Growth Oriented

| Definition of Wealth – Adam Smith (1776) | |

Adam Smith “Economics is the science of wealth” | This definition was given by Adam Smith.He is also known as the ‘father of economics.According to this definition, economics is a science of the study of wealth only.It deals with production, distribution, and consumption.This wealth-centred definition deals with the causes behind the creation of wealth. |

|

| Definition of Welfare – Alfred Marshall (1890) | |

Alfred Marshall “Economics is the study of man in the ordinary business of life” | This definition was put forward by Alfred Marshall.According to Alfred Marshall, economics is the study of man in the ordinary business of life.It examines how a person gets his income and how he invests it.Thus, on one side, it is a study of wealth.On the other most important side, it is a study of well-being (welfare). |

|

| Definition of Scarcity – Lionel Robbins (1932) | |

Lionel Robbins Economics is the aspect of scarcity in all economic behaviour | This definition was put forward by Lionel Robbins.According to him, economics is a science that studies human behaviour as a relationship between end and scarce means that have alternative uses.Features:The wants of a human are unlimited.It has an alternative use of scarce resources.It is an efficient use of resources.It is needed for optimisation, i.e., best allocation of resources. |

|

| Definition of Growth – Paul. A. Samuelson (1948) | |

Paul. A. Samuelson Economics is concerned with determining the pattern of employment of scarce resources to produce commodities ‘over time’. | This definition was introduced by Paul A. Samuelson.According to him, “economics is the study of how people and society choose, with or without the use of money, to employ scarce productive resources which could have alternative uses, to produce various commodities over time and distribute them for consumption now and in the future among various persons and groups of society”.It analyses the costs and benefits of improving patterns of resource allocation.This definition is the combination of welfare and scarcity definition. |

|

Economics uses two methods: deduction and induction.

a. Deductive Method of Economic Analysis It is also named as analytical or abstract method. It consists in deriving conclusions from general truths; it takes few general principles and applies them to draw conclusions. The classical and neo-classical school of economists notably, Ricardo, Senior, J.S.Mill, Malthus, Marshall, Pigou, applied the deductive method in their economic investigations.

Steps of Deductive Method

Step 1: The analyst must have a clear and precise idea of the problem to be inquired into. S

tep 2: The analyst clearly defines the technical terms used in the analysis. Further, assumptions of the theory are to be precise.

Step 3: Deduce hypothesis from the assumptions taken.

Step 4: Hypotheses should be verified through direct observation of events in the real world and through statistical methods. (eg) There exists an inverse relationship between price and quantity demanded of a good.

b. Inductive Method of Economic Analysis Inductive method, also called empirical method, is adopted by the “Historical School of Economists”. It involves the process of reasoning from particular facts to general principle.

Economic generalizations are derived in this method, on the basis of (i) Experimentations; (ii) Observations; and, (iii) Statistical methods.

Step 1: Data are collected about a certain economic phenomenon. These are systematically arranged and the general conclusions are drawn from them.

Step 2: By observing the data, conclusions are easily drawn.

Step 3: Generalization of the data and then Hypothesis Formulation

Step 4: Verification of the hypothesis (eg.Engel’s law)

According to Engel’s Law “The proportion of total expenditure incurred on food items declines as total expenditure [which is proxy for income] goes on increasing.”

Economists today are of the view that both these methods are complementary. Alfred Marshall has rightly remarked: “Inductive and Deductive methods are both needed for scientific thought, as the right and left foot are both needed for walking”.

Unit :II

Q1.a)Discuss the Various types of Elasticity of Demand How Would You Measure it.

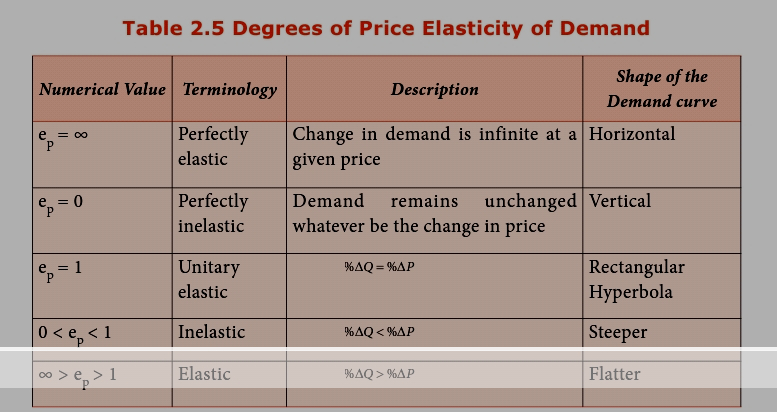

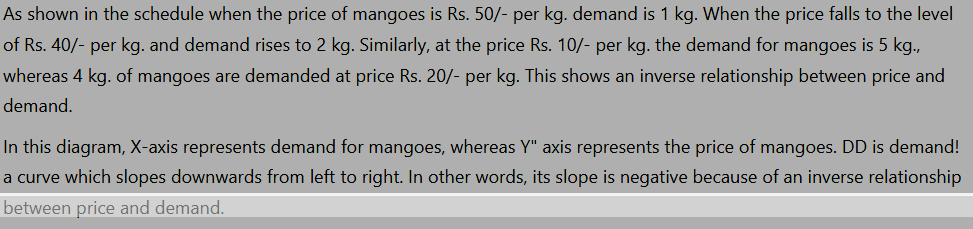

The Law of Demand explains the direction of change in demand due to change in the price. It fails to explain the rate of change in demand due to a given change in price. Elasticity of demand explains the rate of change in quantity demanded due to a given change in price.

“Elasticity of demand is, therefore, a technical term used by the Economists to describe the degree of responsiveness of the Quantity demand for a commodity to a change in its price”.- Stonier And Hague

Price elasticity of demand

Price elasticity of demand is commonly known as elasticity of demand. This is because price is the most influential factor affecting demand. “Elasticity of demand measures the responsiveness of the quantity demanded to changes in the price”.

1.Price Elasticity of Demand: The price elasticity of demand, commonly known as the elasticity of demand refers to the responsiveness and sensitiveness of demand for a product to the changes in its price.

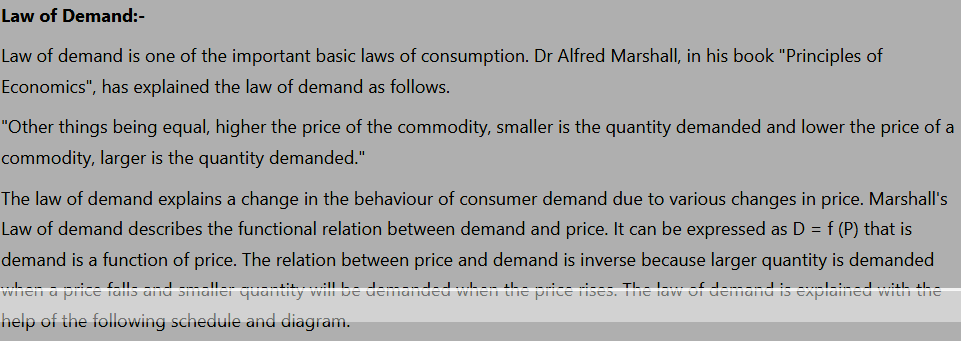

B)Explain the law of Demand & Explain the Exception of Demand.(with the help of diagram)

Q2.Expalin the indifference Curve & Also Explain the price Effect & Income Effect.(Most Important)

An indifference curve, with respect to two commodities, is a graph showing those combinations of the two commodities that leave the consumer equally well off or equally satisfied—hence indifferent—in having any combination on the curve.

Indifference curves are heuristic devices used in contemporary microeconomics to demonstrate consumer preference and the limitations of a budget. Economists have adopted the principles of indifference curves in the study of welfare economics.

An indifference curve shows a combination of two goods that give a consumer equal satisfaction and utility thereby making the consumer indifferent.

Along the curve, the consumer has an equal preference for the combinations of goods shown—i.e. is indifferent about any combination of goods on the curve.

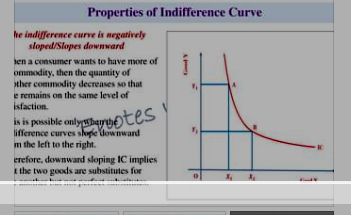

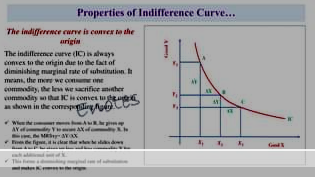

Typically, indifference curves are shown convex to the origin, and no two indifference curves ever intersect.

Indifference Curve Analysis

Indifference curves operate under many assumptions; for example, typically each indifference curve is convex to the origin, and no two indifference curves ever intersect. Consumers are always assumed to be more satisfied when achieving bundles of goods on indifference curves that are farther from the origin.

As income increases, an individual will typically shift their consumption level because they can afford more commodities, with the result that they will end up on an indifference curve that is farther from the origin—hence better off.

Many core principles of microeconomics appear in indifference curve analysis, including individual choice, marginal utility theory, income, substitution effects, and the subjective theory of value. Indifference curve analysis emphasizes marginal rates of substitution (MRS) and opportunity costs. Indifference curve analysis typically assumes all other variables are constant or stable.

Most economic textbooks build upon indifference curves to introduce the optimal choice of goods for any consumer based on that consumer’s income. Classic analysis suggests that the optimal consumption bundle takes place at the point where a consumer’s indifference curve is tangent with their budget constraint.

The slope of the indifference curve is known as the MRS. The MRS is the rate at which the consumer is willing to give up one good for another. If the consumer values apples, for example, the consumer will be slower to give them up for oranges, and the slope will reflect this rate of substitution.

Q3. Critically Examine the Cardinal Approach & Ordinal Approach

Utility is a physiological fact that implies the wanting the satisfying power of a good or service. It differs from person to person, as it relies on a person’s mental attitude. The measurability of utility is always a controversial subject. The two primary theories for utility are Ordinal Utility and Cardinal Utility. Many traditional economists proposed a view that utility is measured quantitatively like length, height, weight, temperature, etc. This concept is termed a Cardinal Utility. On the other hand, Ordinal Utility expresses the utility of a commodity in terms of more than or less than. Read the article below to understand the difference between Cardinal Utility and Ordinal Utility.

What is an Ordinal Utility?

Ordinal Utility states that the satisfaction a consumer gets after consuming a good or service cannot be scaled in numbers, whereas, these things can be arranged in the order of preference. Two English economists, John Hicks and R.J. Allen 1930 argued that the consumer behavior theory should be introduced based on Ordinal Utility. According to the ordinal approach, utility is a psychological phenomenon like happiness, satisfaction, and welfare. The ordinal theory is highly subjective and differs across individuals. Therefore, it cannot be measured in quantifiable terms.

The function that represents utility of a product according to its preference, but does not provide any numerical figure, is known as an Ordinal Utility. In simpler words, this theory affirms that it is relevant to ask which item is better as compared to others instead of how good is that product. For example, a BMW car is favored more than a Toyota car, but it cannot be determined by what percentage.

Apart from showing a mathematical function, a consumer’s preference can be demonstrated graphically through indifference curves. It becomes easy when there are two types of commodities x and y. Each indifference curve provides coordinates (x,y) when (x1, y1) and (x2, y2) lie on the same curve line and (x1, y1) ~ (x2, y2).

This is an example of an indifference curve map where the preference of goods are shown but not their quantity. Each of the curves represents a combination of two services or goods. The consumers are equally satisfied with the goods and services. The more distant a curve is from the origin, the higher its utility level.

The utility according to this approach can be measured in relative terms such as less than and greater than. This approach states that consumer behavior can be explained in terms of preferences or rankings. For example, a consumer may prefer soft drinks over hard drinks. In such a case, the soft drink would have 1st rank, while 2nd rank would be given to hard drinks

Therefore, as per the Ordinal Utility approach, a consumer observes different pairs of two commodities which would provide him/her the same level of satisfaction. Among these pairs, he/she may prefer one commodity over the other based on how he/she ranks them in order of utility. This implies that utility can be ranked qualitatively rather than quantitatively.

Do you know: In 1934 John Hicks and Roy Allen produced the first paper which declared Ordinal Utility.

(Image will uploaded soon)

What is Cardinal Utility?

According to classical economists, utility is a quantitative concept that can be measured in terms of a number. Hence they introduced the concept of measuring utility using a cardinal approach. According to this concept, the utility can be expressed similarly to how weight and height are expressed. However, the economists lacked a precise unit for utility. Hence, they derived a psychological unit termed as ‘Util’. Util is not regarded as a standard unit because it varies from person to person, place to place, and time to time. For example, if a person assigns 30 utils to a pizza and 20 utils to a chowmein, we can understand that the pizza has double the capacity to satisfy what humans want.

As util is not a standard unit for measuring utility, many economists, including Alfred Marshall suggested measurement of utility in terms of money that consumers are willing to pay for a commodity. If each rupee is equal to 1 util, a pizza worth Rs 30 has 30 utils and a chow min worth Rs 20 has 20 utils. Hence, the consumer who consumes burgers will yield utility of 30 utils and those who consume chow min will yield utility of 20 utils.

The supply and demand of a product decide its price. Moreover, a person’s desire for a product depends on these three factors:

- Price of the item

- Income of a person

- The cost of other related items

Application of Cardinal Utility

Following are the different applications of Cardinal Utility:

Welfare Economics: Under this structure, the production of goods and providing services are judged by the personal wealth of an individual. This means that it presents a way to comprehend the “greatest good to the greatest number of persons”. For example, by this act, a person’s utility decreases by 75 utils and increases two other persons each by 50 utils. However, the overall increase is 25 utils which is a positive offering.

Marginalism: In cardinal theory, a product’s marginal utility sign is alike for all the mathematical forms, but its magnitude is not the same. This applies to the second derivative of a differentiable utility as well.

Expected Utility Theory: This framework works for settlements that are to be made under risks. Suppose there are a few lottery tickets that will provide outcomes. Here, it is possible to plot preferences in real numbers so that numerical representation can be done.

Intertemporal Utility: In various representations of utility, where people deduct the upcoming values of utility, cardinality comes into play. With the use of this, it is feasible to generate proper utility functions.

Differentiate between Cardinal and Ordinal Utility in Tabular Form

| Basis of Comparison | Cardinal Utility | Ordinal Utility |

| Meaning | Cardinal Utility is the utility where the satisfaction derived by consuming a product can be expressed numerically. | Ordinal Utility is the utility where the satisfaction derived by consuming a product cannot be expressed numerically. |

| Approach | Quantitative | Qualitative |

| Evaluation | Utils | Ranks |

| Examination | Marginal Utility Analysis | Indifference Curve Analysis |

| Promoted By | Traditional and Neo Classical Economist | Modern Economist |

| Realistic | Less | More |

Key Difference between Cardinal Utility and Ordinal Utility:

- Cardinal Utility is a utility that determines the satisfaction of a commodity used by an individual and can be supported with a numeric value. On the other hand, Ordinal Utility defines that satisfaction of user goods can be ranked in order of preference but cannot be evaluated numerically.

- The measuring term for cardinal and Ordinal Utility is utils and ranks respectively. Utils is the unit of utility and ranks determine the preference of a product compared to other products in the market.

- Ordinal Utility measures the utility of goods subjectively, but Cardinal Utility evaluates objectively.

- Cardinal Utility is not much realistic as compared to the Ordinal Utility as quantitative evaluation of utility is not practicable. Ordinal Utility depends on qualitative measurement, which makes it more realistic.

- Another difference between ordinal and Cardinal Utility is that the former one is based on indifference curve analysis, and the latter is based on marginal utility evaluation.

- Alfred Marshall and his admirers presented the Cardinal Utility approach, and Hicks and Allen pioneered the Ordinal Utility idea.

Another point that can be considered as a difference between cardinal and Ordinal Utility is that ordinal evaluation is sure to give outcomes. The Ordinal Utility is preferred more because it provides more robust results. Conversely, the concept of Cardinal Utility is obsolete, but still, it is used for contexts like discounted utilities, making settlements under risk and utilitarian welfare calculations.

Conclusion

Cardinal and Ordinal Utility are two important theories of utility. Cardinal Utility provides a value of utility to different alternatives. In other words, it enables consumers to rank the magnitude of how much they prefer one good over another. On the other hand, Ordinal Utility ranks in the order of preference. The Ordinal Utility does not permit consumers to rank the magnitude of how much they prefer one good over another.

Unit: III

Q1.Define monopoly and perfect competition And also Examine the price discrimination under monopoly.

The word monopoly has been derived from the combination of two Greek words i.e., ‘Mono’ and ‘Poly’. Mono refers to a single and “poly” to seller. In this way, monopoly refers to a market situation in which there is only one seller of a commodity. Hence, there is no scope for competition. (Still some economists observe that there will always be potential threat to the monopolists).

Monopoly is a market structure characterized by a single seller, selling the unique product with the restriction for a new firm to enter the market. Monopoly is a form of market where there is a single seller selling a particular commodity for which there are no close substitutes.

Features of monopoly

1.There is a single producer / seller of a product;

- The product of a monopolist is unique and has no close substitute;

- There is strict barrier for entry of any new firm;

- The monopolist is a price-maker;

- The monopolist earns maximum profit/ abnormal profit.

Sources of Monopoly Power

- Natural Monopoly: Ownership of the natural raw materials [Eg.Gold mines (Africa), Coal mines, Nickel (Canada) etc.]

- State Monopoly: Single supplier of some special services (Eg.Railways in India)

- Legal Monopoly: A monopoly firm can get its monopoly power by getting patent rights, trade mark from the government.

Price Discrimination under monopoly

A discriminating monopoly is a single entity that charges different prices for different consumers. Higher price will be charged for price inelastic consumers and vice versa

There are three types of price discrimination.

(i) Personal – Different prices are charged for different individuals (for example, the railways give tickets at concessional rate to the ‘senior citizens’ for the same journey).

(ii) Geographical – Different prices are charged at different places for the same product (for example, a book sold within India at a price is sold in a foreign country at lower price). On their basis, China drops its goods in Indian market. As a result, watch and toys industries closed down their business.

(iii) On the basis of Use – Different prices are charged according to the use of a product (for example, lower rates are charged by Tamil Nadu Electricity Board for domestic uses of electricity and higher rates are charged for commercial and industrial uses).

Degrees of Price Discrimination

Price discrimination has become widespread in almost all monopoly markets. According to A.C.Pigou, there are three degrees of price discrimination.

(i) First degree price discrimination

A monopolist charges the maximum price that a buyer is willing to pay. This is called as perfect price discrimination. This price wipes out the entire consumer’s surplus. This is maximum exploitation of consumers. Joan Robinson named it as “Perfect Discriminating Monopoly”

(ii) Second degree price discrimination

Under this degree, buyers are charged prices in such a way that a part of their consumer’s surplus is taken away by the sellers. This is called as imperfect price discrimination. Joan Robinson named it as “Imperfect Discriminating Monopoly”. Under this degree, buyers are divided into different groups and a different price is charged for each group. For example, in cinema theatres, prices are charged for same film show from viewers of different classes. In a theatre the difference between the first row of first class and the last row in the second class is smaller as compared to the differences in charges.

(iii)Third degree price discrimination

The monopolist splits the entire market into a few sub-market and charges different price in each sub-market. T he groups are divided on the basis of age, sex and location. For example, railways charge lower fares from senior citizens. Students get discounts in museums, and exhibitions.

Perfect Competition

It is an ideal but imaginary market. 100% perfect competition cannot be seen. Perfect Competition market is that type of market in which the number of buyers and sellers is very large, all are engaged in buying and selling a homogenous product at uniform price without any artificial restrictions and possessing perfect knowledge of the market at a time.

According to Joan Robinson, “Perfect competition prevails when the demand for the output of each producer is perfectly elastic”.

Features of the Perfect Competition:

a. Large Number of Buyers and Sellers

‘A large number of buyers’ implies that each individual buyer buys a very, very small quantum of a product as compared to that found in the market. This means that he (he includes she also) has no power to fix the price of the product. He is only a price-taker and not a price-maker.

b. Homogeneous Product and Uniform Price The product sold and bought is homogeneous in nature, in the sense that the units of the product are perfectly substitutable. All the units of the product are identical (ie) of the same size, shape, colour, quality etc. Therefore, a uniform price prevails in the market.

c. Free Entry and Exit

In the short run, it is possible for the very efficient producer, producing the product at a very low cost, to earn super normal profits. Attracted by such a profit, new firms enter into the industry. When large number of firms enter, the supply (in comparison to demand) would increase, resulting in lower price. An inefficient producer, who is unable to bring down the cost incurs loss. Disturbed by the loss, the existing loss-incurring firms quit the market. If it happens, supply will then decrease, price will go up. Existing firms could earn more profit.

d. Absence of Transport Cost

The prevalence of the uniform price is also due to the absence of the transport cost.

e. Perfect Mobility of Factors of Production

The prevalence of the uniform price is also due to the perfect mobility of the factors of production. As they enjoy perfect freedom to move from one place to another and from one occupation to another, the price gets adjusted.

f. Perfect Knowledge of the Market

All buyers and sellers have a thorough knowledge of the quality of the product, prevailing price etc.

g. No Government Intervention

There is no government regulation on supply of raw materials, and in the determination of price etc.

Q2.What do You Mean by product curve. how does a producer establish his equilibrium with the help of iso-quant curve?

Ans: Product curve is used to measure the relationship between innovation and increased production and how they are used in production possibility curves to help businesses maintain profitable production.

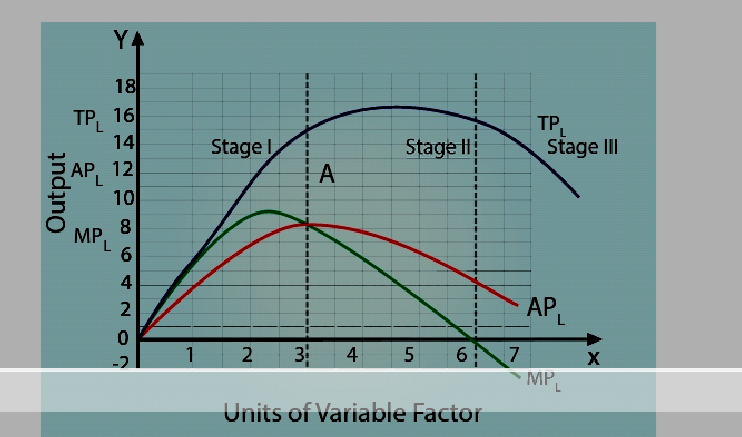

Total Product (TP)

It refers to the total amount of commodity produced by the combination of all inputs in a given period of time. Summation of marginal products, i.e. TP = ∑MP where, TP= Total Product, MP= Marginal Product

Average Product (AP)

It is the result of the total product divided by the total units of the input employed. In other words, it refers to the output per unit of the input.

Mathematically, AP = TP/N

Where, AP= Average Product TP= Total Product N= Total units of inputs employed

Marginal Product (MP)

It is the addition or the increment made to the total product when one more unit of the variable input is employed. In other words, it is the ratio of the change in the total product to the change in the units of the input. It is expressed as MP=ΔTP/ΔN where, MP = Marginal Product ΔTP = Change in total product ΔN = Change in units of input It is also expressed as MP = TP (n) – TP (n-1) Where, MP = Marginal Product TP(n) = Total product of employing nth unit of a factor TP(n-1) = Total product of employing the previous unit of a factor, that is, (n-1)th unit of a factor.

An equal product curve represents all those combinations of two inputs which are capable of producing the same level of output. An iso-product curve can be drawn with the help of isoquant schedule.

Q3.Explain the Following.

A)Law of Variable Proportions

The law states that if all other factors are fixed and one input is varied in the short run, the total output will increase at an increasing rate at first instance, be constant at a point and then eventually decrease. Marginal product will become negative at last.

According to G.Stigler, “As equal increments of one input are added, the inputs of other productive services being held constant, beyond a certain point, the resulting increments of product will decrease, i.e., the marginal product will diminish”.

Assumptions

The Law of Variable Proportions is based on the following assumptions.

a. Only one factor is variable while others are held constant.

b. All units of the variable factor are homogeneous.

c. The product is measured in physical units.

d. There is no change in the state of technology.

e. There is no change in the price of the product.

B)short run and long run cost

The Short-run Cost is the cost which has short-term implications in the production process, i.e. these are used over a short range of output. These are the cost incurred once and cannot be used again and again, such as payment of wages, cost of raw materials, etc.

Long run costs are accumulated when firms change production levels over time in response to expected economic profits or losses. In the long run there are no fixed factors of production. The land, labour, capital goods, and entrepreneurship all vary to reach the long run cost of producing a good or service. The long run is a planning and implementation stage for producers. They analyse the current and projected state of the market in order to make production decisions. Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost. Examples of long run decisions that impact a firm’s costs include changing the quantity of production, decreasing or expanding a company, and entering or leaving a market.

C)Explicit Cost and Implict cost

Explicit Cost (Paid out cost) Payment made to others for the purchase of factors of production is known as Explicit costs. It refers to the actual expenditures of the firm to purchase or hire the inputs the firm needs. Explicit cost includes, i) wages, ii) payment for raw material, iii) rent for the building, iv) interest for capital invested, v) expenditure on transport and advertisement vi) other expenses like license fee, depreciation and insurance charges, etc. It is also called Accounting Cost or Out of Pocket Cost or Money Cost.

Implicit Cost Payment made to the use of resources that the firm already owns, is known as Implicit Cost. In simple terms, Implicit Cost refers to the imputed cost of a firm’s self-owned and self-employed resources. A firm or producer may use his own land, building, machinery, car and other factors in the process of production. These costs are not recorded under normal accounting practices as no cash payment takes place. However, the value of the own services are imputed and considered for preparing the profit and loss accounts. Implicit Cost is also called as Imputed Cost or Book Cost.

Unit: IV

Q. 1 Explain the following theories :

a)Marginal productivity theory of wages

The application of general theory of distribution to wage fixation is the marginal productivity theory of wages. According to this theory, wages are determined by the marginal productivity of labour and equal to it at the point of equilibrium. Under perfect competition wage is paid equal to marginal product of labour (wage = MPL) But in real world where there is imperfect competition, there is exploitation of labour and wage is less than MPL

b)Ricardian Theory of rent

The Classical Theory of Rent is called “Ricardian Theory of Rent”. “Rent is that portion of the produce of the earth which is paid to the landlord for the use of the original and indestructible powers of the soil”. David Ricardo David Ricardo explained the theory of rent thus:

Assumptions

Ricardian theory of rent assumes the following:

1.Land differs in fertility.

- The law of diminishing returns operates in agriculture.

- Rent depends upon fertility and location of land.

- Theory assumes perfect competition.

- It is based on the assumption of long period.

- There is existence of marginal land or no-rent land.

- Land has certain “original and indestructible powers”.

- Land is used for cultivation only.

- Most fertile lands are cultivated first.

Criticisms

the limitations of Ricardian theory of rent are as follows

- The order of cultivation from most fertile to least fertile lands is historically wrong.

- This theory assumes that, rent does not enter into price. But in reality, rent enters into price.

c)Loanable Funds Theory/Neo Classical theory

The Loanable Funds Theory, also known as the “Neo–Classical Theory”, was developed by Swedish economists like Wicksell, Bertil Ohlin, Viner, Gunnar Myrdal and others. According to this theory, interest is the price paid for the use of loanable funds. The rate of interest is determined by the equilibrium between demand for and supply of loanable funds in the credit market.

Demand for Loanable Funds

The demand for loanable funds depends upon the following:

- Demand for Investment (I) T he most important factor responsible for the loanable funds is the demand for investment. Bulk of the demand for loanable funds comes from business firms which borrow money for purchasing capital goods.

- Demand for Consumption (C) T he demand for loanable funds comes from individuals who borrow money for consumption purposes also.

- Demand for Hoarding (H) The next demand for loanable funds comes from hoarders. Demand for hoarding money arises because of people’s preference for liquidity, idle cash balances and so on. The demand for C, I and H varies inversely with interest rate.

Supply of Loanable Funds

The supply of loanable funds depends upon the following four sources:

1.Savings (S) Loanable funds come from savings. According to this theory, savings may be of two types, namely, a. Savings planned by individuals are called “ex-ante savings”. E.g. LIC premium, EMI payment etc. b. The unplanned savings are called, “ex-post savings”. Savings is left out after spending are ex post saving.

2.Bank Credit (BC) The bank credit is another source of loanable funds. Commercial banks create credit and supply loanable funds to the investors.

3.Dishoarding (DH) Dishoarding means bringing out the hoarded money into use and thus it constitutes a source of supply of loanable funds. In India,after 1991,Public sector undertakings are being sold to private people to mobilize more funds.This is also called disinvestment.

4.Disinvestment(DI) Disinvestment is the opposite of investment. In other words disinvestment means not providing sufficient funds for depreciation of equipment. It gives rise to the supply of loanable funds. All the four sources of supply of loanable funds vary directly with the interest rate.

Equilibrium

The rate of interest is determined by the equilibrium between the total demand for and the total supply of loanable funds. Supply of and Demand for Loanable Funds Supply of loanable funds Demand for loanable funds No RentLa = Savings + Bank Credit + Dishoarding + Disinvestment = S + BC + DH + DI = Investment + Consumption + Hoarding = I + C + H

Criticism

1.Many factors have been included in this theory. Still there are many more factors.Two such factors are 1)Asymmetric Information and 2) Moral Hazard.In practice larger firms, due to their political powers, are able to get huge bank credit at lower interest rates.But due to NPAs, (Non-Performing Assets) small firms and depositors lose their interest income. The loanable funds theory is “indeterminate”’ unless the income level is already known.

2.It is very difficult to combine real factors like savings and investment with monetary factors like bank credit and liquidity preference.

d)Theory of Profit

Profit is a return to the entrepreneur for the use of his entrepreneurial ability. It is the net income of the organizer. In other words, profit is the amount left with the entrepreneur after he has payments made for all the other factors (land, labour and capital) used by him in the production process.

There are four theories of profit discussed below

1.Dynamic theory

2.Innovation theory

3.Risk bearing theory

4.Uncertainty bearing theory

Dynamic Theory of Profit

This theory was propounded by the American economist J.B.Clark in 1900. To him, profit is the difference between price and cost of production of the commodity. Hence, profit is the reward for dynamic changes in society. Further he points out that, profit cannot arise in a static society. Static society is one where everything is stationary or stagnant and there is no change at all. Therefore, there is no role for an entrepreneur in a static society. The price of the commodities in a static society would be equal to their cost of production. So, there would be no profit for the entrepreneur. T he entrepreneur only gets wages for management and interest on his capital. At present several changes are taking place in a dynamic society. Changes are permanent. According to Clark, the following five main changes are taking place in a dynamic society. 1. Population is increasing 2. Volume of Capital is increasing. 3. Methods of production are improving. 4. Forms of industrial organization are changing. 5. The wants of consumer are multiplying.

Innovation Theory of Profit

Innovation theory of profit was propounded by Joesph. A.Schumpeter. To Schumpeter, an entrepreneur is not only an undertaker of a business, but also an innovator in the process of production. To him, profit is the reward for “innovation”. Innovation means invention put into commercial practice. According to Schumpeter, an innovation may consist of the following: 1. Introduction of a new product. 2. Introduction of a new method of production. 3. Opening up of a new market. 4. Discovery of new raw materials 5. Reorganization of an industry / firm. When any one of these innovations is introduced by an entrepreneur, it leads to reduction in the cost of production and thereby brings profit to an entrepreneur. To obtain profit continuously, the innovator needs to innovate continuously. The real innovators do so. Imitative entrepreneurs cannot innovate.

Risk Bearing Theory of Profit

Risk bearing theory of profit was propounded by the American economist F.B.Hawley in 1907. According to him, profit is the reward for “risk taking” in business. Risk taking is an essential function of the entrepreneur and is the basis of profit. It is a well known fact that every business involves some risks. Since the entrepreneur undertakes the risks, he receives profits. If the entrepreneur does not receive the reward, he will not be prepared to undertake the risks. Thus, higher the risks, the greater are the profit. Every entrepreneur produces goods in anticipation of demand. If his anticipation of demand is correct, then there will be profit and if it is incorrect, there will be loss. It is the profit that induces the entrepreneurs to undertake such risks.

Uncertainty Bearing Theory of Profit

Uncertainty theory was propounded by the American economist Frank H.Knight. To him, profit is the reward for “uncertainty bearing”. He distinguishes between “insurable” and “non-insurable” risks.

Insurable Risks

Certain risks are measurable or calculatable. Some of the examples of these risks are the risk of fire, theft and natural disasters. Hence, they are insurable. Such risks are compensated by the Insurance Companies.

Non-Insurable Risks

There are some risks which are immeasurable or incalculatable. The probability of their occurrence cannot be anticipated because of the presence of uncertainty in them. Some of the examples of these risks are competition, market condition, technology change and public policy. No Insurance Company can undertake these risks. Hence, they are non- insurable. The term “risks” covers the first type of events (measurables – insurable) and the term “uncertainty” covers the second type of events (unforeseeable or incalculatable or not measurable or non-insurable).According to Knight, profit does not arise on account of risk taking, because the entrepreneur can guard himself against a risk by taking a suitable insurance policy. But uncertain events cannot be guarded against in that way. When an entrepreneur takes himself the burden of facing an uncertain event, he secures remuneration. That remuneration is “profit”.