Business Finance Revision eNotes

Q2.Revision Class Business Finance Unit I

Q1. What You Do Mean By Business Finance, Nature and Significance of Business Finance & Also Explain the Objective of Business Finance.

Business Finance Meaning

The raising and management of funds by the business organizations is called business finance. Planning the financial need, analyzing the requirement, controlling the operations are the responsibilities of the financial manager, this person is closely related to the top-level management team.

In large firms, major financial decisions are taken by this financial committee, they are responsible for the annual budget and so forth.

While, in small companies, the owner-manager conducts the financial operations all by themselves. The business finance which requires day-to-day attention is conducted by the lower level staff. They work in the sections of handling the cash, receipts, disbursements, borrowings from the commercial banks and this is done on a regular and continuous basis and they also form cash budgets.

Nature of Business Finance

The nature of the business finance is enumerated in the points mentioned below –

1.Business Finance consists of different kinds of funds – short, medium and long term as and when required by the business.

2.Any type of business needs this business finance, it is utmost for the organization.

3.The volume required differs from business to business, small business requires less business finance in contrast to the large business firms.

4.In different times of the business season, requirements differ. In peak seasons business demands for huge business finance.

5.The amount of business finance determines the scale of operations conducted by the company.

Significance of Business Finance

To highlight the significance of business finance, we point the following as mentioned:

1.A firm with a good amount of business finance will require less time and hassles to start the business venture.

2.With the business finance in hand, the owners can buy the raw materials as needed for production.

3.The business firm can easily pay his dues and other payments with the help of business finance.

4.Uncertain risk and Contingencies can be tackled with business finance in hand.

5.Good financial capacity of the business will attract talented workforce, also highly efficient technology can also be availed with strong financial background.

Scope of Business Finance

Business finance helps in studying, analyzing and allocating the business funds and other covers done by the business is done as mentioned:

1.Analysis and Research of Financial Statement

2.Financial Planning and Controlling

3.Capital Structure Management

4.Raising Capital

5.Investing Capital

6.Managing the finance risk.

Need and Importance of Sources of Business Finance

The main resources of Business Finance are revenues from business operations, investor’s own finances, venture capital, loans from financial institutions. Businesses need finances to meet their day-to-day finances which can be covered by these sources.

The importance of the sources of business finance are:

1.Meeting Goals.

2.Short term activities

3.Long term activities

4.Achieving financial goals.

All such activities are governed and administered by the financial department in each organization. Businesses need this finance to sustain their growth. Companies pool money from the public in return of shares of the company, this also a type of procurement of business finance

Financial Business Objectives

Prior to start a successful business, it is important for entrepreneur to set business objective, vision and mission. In simple words it is, what business will achieve in short term and long term. Business owners need to set different type of business objectives, one of them are financial business objectives which provide solid plan in the long term. There are different financial objectives of a business, some of them are

Increase in Revenue Profit Margin

Sustainability

Return on Investment

Revenue Growth

One of the most basic objective of business is to generate revenue and increase it gradually with the time. Mainly marketing and sales are responsible for the growth in revenue. Company set goals for increasing in revenue in the shape of percentile rather than a certain amount. For example few months back Mr. A started a business, now his objective is to increasing sales by 15 percent every year for the first five years.

Profit Margins

The term project is different from the term revenue generation. Profit is that money which is left after excluding all the expenses (salaries and commission paid, administrative and operational expense etc.) from revenue. There are variety of way to utilize these profits for example reinvestment plans it means to reinvest all or part of profits in business, business expansion (opening new branches and franchises or aiming for new plants etc. dividend or profit sharing is another example of utilizing business profits.

Profit maximization is based on revenue and secondly on cost. Management must try to keep the cost low by applying different tools and technique “effective and efficient work environment” and take benefits from economies of scale.

Sustainability

There are times, when companies’ priorities are to focus on suitability and survival in the industry. Retrenching “reduce cost and spending” is totally a marketing strategy and based on financial objective. It attempts to keep the brand running and sustain both the revenue and profit from decreasing during the decline stage of product or brand.

Return on Investment

It is financial ration which is related to capital expenditures. There are two basic situations for Return on Investment ROI.

First, ROI is based on return comes from real property and productive equipment investment. Here the entrepreneur want ensure to

generate sufficient revenue from the buildings, equipment and machinery.

Secondly, the other application of ROI are investment in shares, bond etc. Basic principles are the same but there is no physical but paper form of assets. Investor can get dividends, interest and capital gains.

Q2.What are the main main purpose for a financial manager strive.What are the main function of a financial manger.

regardless of their mission, all organizations can benefit from the work that a financial manager does. Financial managers generally oversee the financial health of an organization and help ensure its continued viability. They supervise important functions, such as monitoring cash flow, determining profitability, managing expenses and producing accurate financial information.

Whether charged with oversight of an entire financial operation or a specific aspect of finance, such as credit or risk management, financial managers are key to organizational success. Pursuing an online master’s degree in accountancy is one way to obtain the knowledge and skills to prepare for a career in financial management.

Financial managers have an extensive range of responsibilities, and what financial managers do largely depends on the type of organization. In a small business, a financial manager may be responsible for the entire financial operation, while in a large corporation, a financial manager may be more likely to specialize in a

particular aspect of finance, such as financial reporting or cash management.

Common responsibilities of a financial manager include: Producing accurate financial reports and information

Developing cash flow statements

Projecting profit Managing credit

Providing advice in making financial decisions Directing investments

Making financial forecasts Budgeting

Managing risk of financial loss

To carry out their responsibilities, financial managers need to maintain knowledge of legal and regulatory requirements. Changes in laws, accounting pronouncements and taxation can all have a significant effect on the financial position of an organization and how it manages its finances. Therefore, financial managers need to remain well informed about the regulatory environments for their employers.

Q1. Explain Financial Market What Are the Difference Between Primary Market & Secondary Market?

Meaning of Financial Markets

A financial market is a word that describes a marketplace where bonds, equity, securities, currencies are traded. Few financial markets

do a security business of trillions of dollars daily, and some are small-scale with less activity. These are markets where businesses grow their cash, companies decrease risks, and investors make more cash.

A Financial Market is referred to space, where selling and buying of financial assets and securities take place. It allocates limited resources in the nation’s economy. It serves as an agent between the investors and collector by mobilising capital between them.

In a financial market, the stock market allows investors to purchase and trade publicly companies share. The issue of new stocks are first offered in the primary stock market, and stock securities trading happens in the secondary market.

Functions of Financial Market

Mentioned below are the important functions of the financial market.

It mobilises savings by trading it in the most productive methods.

It assists in deciding the securities price by interaction with the investors and depending on the demand and supply in the market.

It gives liquidity to bartered assets.

Less time-consuming and cost-effective as parties don’t have to spend extra time and money to find potential clients to deal with securities. It also decreases cost by giving valuable information about the securities traded in the financial market.

Primary Market: Meaning

A primary market is a marketplace where corporations imbibe a fresh issue of shares for being contributed by the public for soliciting capital to meet their necessary long-term funds like extending the current trade or buying a unique entity. It plays a motivational part in the mobilisation of savings in the economy.

Multiple types of issues made by the establishment are – Offer for sale, public issue, issue of Indian Depository Receipt (IDR), bonus Issue, right issue, etc.

Secondary Market: Meaning

A secondary market is a prototype of the capital market where debentures, current shares, options, bonds, treasury bills, commercial papers, etc., of the enterprises are patronised amongst the investors.

The secondary market can be an auction business where the business of bonds is functioned through a dealer market or the stock exchange, usually called over the counter.

Primary market Secondary market

Definition

A primary market is a marketplace where corporations imbibe a fresh issue of shares for being contributed by the public for soliciting capital to meet their necessary long-term funds like extending the current trade or buying a unique entity. A secondary market is a prototype of the capital market where debentures, current shares, options, bonds, treasury bills, commercial papers, etc., of the enterprises are patronised amongst the investors.

Also known as

New issue market (NIM) Aftermarket

Purchasing type

Direct purchase Indirect purchase

Parties of buying and selling

Buying and selling takes place between the company and the investors. Buying and selling takes place between the investors.

To whom it provides financing

It provides financing to the existing companies for facilitating growth and expansion. It does not provide any kind of financing.

Intermediaries involved

Underwriters Brokers

Price levels

Remain fixed Price level varies with variations in demand and supply

Unit-II

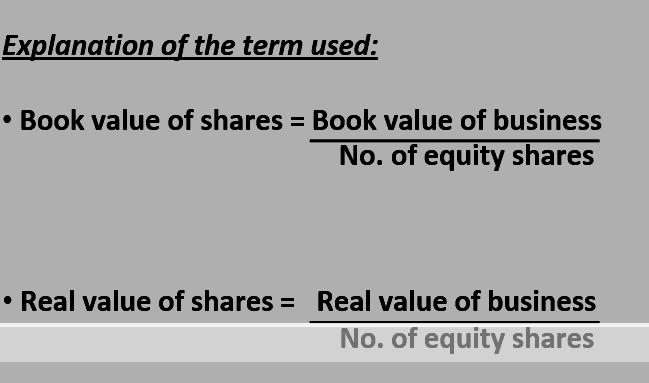

Capitalisation is one of the most important parts of financial decision, which is related to the total amount of capital employed in the business concern.

Understanding the concept of capitalisation leads to solve many problems in the field of financial management, because there is a confusion among the capital, capitalisation and capital structure.

Meaning

Capitalisation refers to the process of determining the quantum of funds that a firm needs to run its business.

Capitalisation is only the par value of share capital and debenture and it does not include reserve and surplus.

Defination

According to Guthman and Dougall, “Capitalisation is the sum of the par value of outstanding stocks and the bonds.”

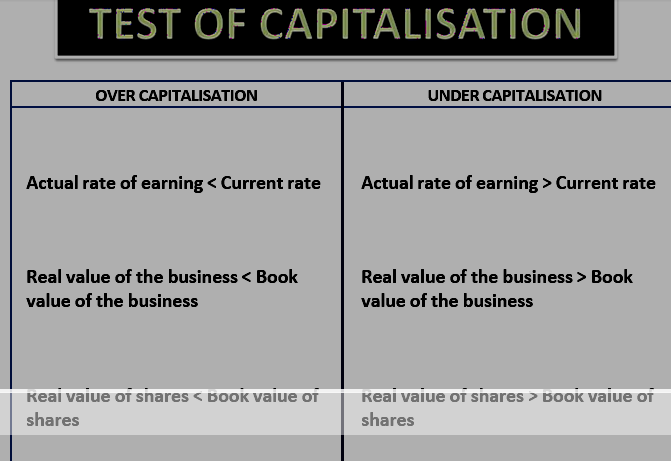

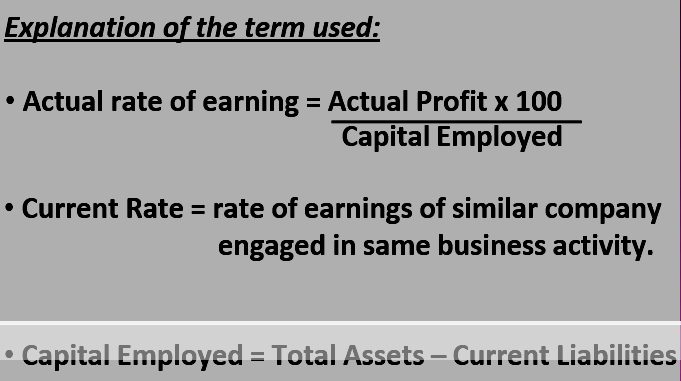

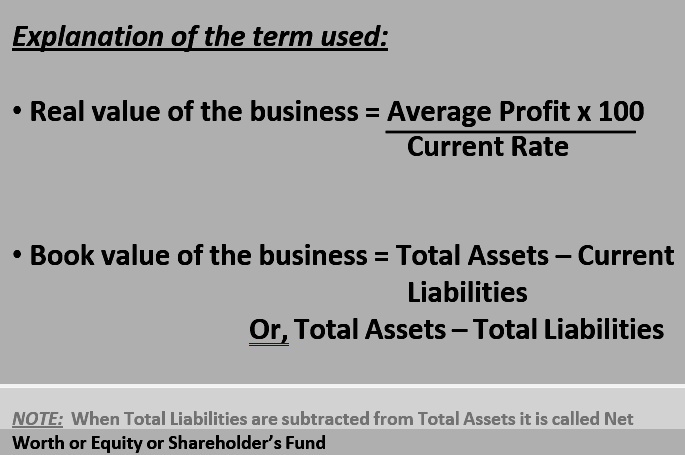

Types Of Capitlization

Capitalisation may be classified into the following two important types based on its nature:

Over Capitalisation

Under Capitalisation

Over Capitalisation

Over capitalisation refers to the company which possesses an excess of capital in relation to its activity level and requirements. In simple means, over capitalisation is more capital than actually required and the funds are not properly used.

According to Bonneville, Dewey and Kelly, over capitalisation means, “when a business is unable to earn fair rate on its outstanding securities”.

Causes of Over Capitalisation

Over capitalisation arise due to the following important causes:

Over issue of capital by the company.

Borrowing large amount of capital at a higher rate of interest.

Providing inadequate depreciation to the fixed assets.

Excessive payment for acquisition of goodwill.

High rate of taxation.

Under estimation of capitalization rate.

Effects of Over Capitalisation

Over capitalisation leads to the following important effects:

Reduce the rate of earning capacity of the shares.

Difficulties in obtaining necessary capital to the business concern.

It leads to fall in the market price of the shares.

It creates problems on re-organization.

It leads under or misutilisation of available resources.

Remedies for Over Capitalisation

Over capitalisation can be reduced with the help of effective management and systematic design of the capital structure. The following are the major steps to reduce over capitalisation.

Efficient management can reduce over capitalisation.

Redemption of preference share capital which consists of high rate of dividend.

Reorganization of equity share capital.

Reduction of debt capital.

Undercapitalization

Under capitalisation is the opposite concept of over capitalisation and it will occur when the company’s actual capitalisation is lower than the capitalisation as warranted by its earning capacity. Under capitalisation is not the so called inadequate capital.

Under capitalisation can be defined by Gestenberg, “a corporation may be under capitalised when the rate of profit is exceptionally high in the same industry”.

Hoagland defined under capitalisation as “an excess of true assets value over the aggregate of stocks and bonds outstanding”.

Causes of Under Capitalisation

Under capitalisation arises due to the following important causes:

Under estimation of capital requirements.

Under estimation of initial and future earnings.

Maintaining high standards of efficiency.

Conservative dividend policy.

Desire of control and trading on equity.

Effects of Under Capitalisation

Under Capitalisation leads certain effects in the company and its shareholders.

It leads to manipulate the market value of shares.

It increases the marketability of the shares.

It may lead to more government control and higher taxation.

Consumers feel that they are exploited by the company.

It leads to high competition

Remedies of Under Capitalisation

Under Capitalisation may be corrected by taking the following remedial measures:

Under capitalisation can be compensated with the help of fresh issue of shares.

Increasing the par value of share may help to reduce undercapitalisation.

Under capitalisation may be corrected by the issue of bonus shares to the existing shareholders.

Reducing the dividend per share by way of splitting up of shares.

Unit-III

Long term and short term

Meaning of Long-term and Short-term sources of Finance

Sources of Finance are the means used for raising funds by business for carrying out their activities. Every business always need some amount of money for ensuring their continuity. They acquire these funds using different sources of funds available in market. Business chooses a particular source of finance according to their needs and capacity.

Sources of funds are classified on various bases such as on time-period, control, source of generation and ownership. On time-period basis these sources are further classified into long term and short term source of finance.

Short-term sources of finance are those which are used for raising funds for short period of time that is less than one year. Money raised through short term source is required to be paid back within one year. Long-term sources of finance are those which help in getting funds for longer period that is more than one year.

Funds raised through these can be paid back over many years. Short-Term Sources of Finance

Short-term sources of funds: Money acquired must be paid back within one year. These sources are used for fulfilling short-term funds requirements.

Commercial Paper

Commercial paper is an unsecured promissory note issued by high creditworthy companies for raising short-term funds. The maturity period of this source ranges from 91 to 180 days. Commercial papers are issued by companies to banks,

insurance companies, or business funds at discount on face value and are redeemed at their face value on maturity.

Trade Credit

It means credit provided to the business by the supplier of raw materials or goods for the short term. Trade credit helps businesses in continuing their operations without interruption as it helps them in getting supplies without any immediate payment. Businesses are not required to pay any interest amount on trade credit.

Bank Overdraft

Bank overdraft is a credit facility extended by the bank to their account holders for a shorter period. Under this facility, customers can overdraw the amount from their account up to a certain limit set by the bank. Customers need to pay interest over the overdrawn amount to the bank.

Bill Of Exchange

Bill of exchange is a financial instrument which is drawn by the creditor upon his debtor. It is a written negotiable instrument which contains an unconditional order for paying the mentioned amount to the holder of the instrument. This instrument is either payable on-demand or on the maturity of a particular time period.

Bank Loan

It means borrowing from the bank at a specific rate of interest for a particular period of time. Bank grants loan to borrower against some sort of security which they need to deposit at the time of taking the loan. Customers need to pay interest regularly to bank on the sanctioned amount. A loan is repaid to the bank either in lump sum amount or in instalment as may be decided at the time of entering the contract.

Certificates Of Deposit

It is an unsecured negotiable instrument issued by commercial banks or financial institutions to investors. Certificate of deposit is issued to depositors against the amount deposited by them for a fixed maturity period. The maturity period of these instruments is decided in accordance with the needs of depositors and ranges from 90 to 365 days.

Long-Term Sources of Finance

Long-term sources of fund: Fund raised through these instruments can be paid back over many years. It enables in fulfilling money requirements needed for longer time period.

Various types of long-term sources of fund are as described below:- Equity Shares

It is the capital market instrument issued by companies for acquiring funds for a

long period of time. These shares represent ownership capital in the business. Equity shareholders are real owners of the business and have full voting rights. They have full control over the functioning of the company and also elect directors.

Preference Shares

Companies can issue another type of shares for raising long-term funds known as preference shares. These shares carriers some preferential rights over ordinary or equity shares. Preferential shareholders are eligible to get a fixed rate of dividend on their shareholdings and that too before paying any dividend to equity shareholders. In addition to this, these shareholders are paid back their capital amount before the equity shareholders.

Debentures

A debenture is a debt instrument issued by the company for raising long-term funds. It represents debt capital and holders of these instruments are creditors of company who possess no voting rights. On debentures, fixed rate of interest is paid irrelevant of whether profit earned or not by the company.

Retained Earnings

It means reinvesting the profit earned by the company back into its activities for expansion and growth. Companies instead of disturbing all of their earnings among shareholders, retain some part of it for investing it back into their operations. This is also termed as ploughing back of profits.

Term Loans

It refers to long term loans taken by business from commercial banks or other financial institutions. Lending institutions require some sort of security for approving the loan amount. Borrowers need to pay a fixed rate of interest regularly to the lending company and full borrowed amount before the period of maturity.

1.Ratio analysis consists of the calculation of ratios from financial statements and is a foundation of financial analysis.

2.A financial ratio, or accounting ratio, shows the relative magnitude of selected numerical

values taken from those financial statements.

3.The numbers contained in financial statements need to be put into context so that investors can better understand different aspects of the company’s operations. Ratio analysis is one method an investor can use to gain that understanding.

Key Terms

1.liquidity: Availability of cash over short term: ability to service short-term debt.

2.ratio: A number representing a comparison between two things.

3.ratio analysis: the use of quantitative techniques on values taken from an enterprise’s financial statements

4.shareholder: One who owns shares of stock

Unit-IV

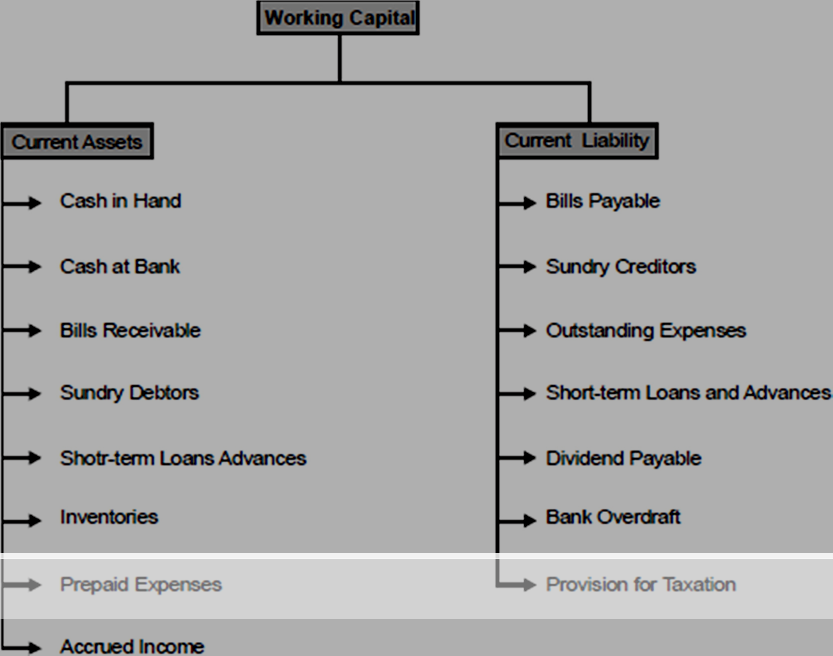

Working Capital is another part of the capital which is needed for meeting day to day requirement of the business concern. For example, payment to creditors, salary paid to workers, purchase of raw materials etc., normally it consists of recurring in nature. It can be easily converted into cash. Hence, it is also known as short-term capital. It is concerned with short-term finance of the business concern which is a closely related trade between profitability and liquidity. Efficient working capital management leads to improve the operating performance of the business concern and it helps to meet the short term liquidity. Hence, study of working capital management is not only an important part of financial management but also are overall management of the business concern.

Definitions

According to the definition of Mead, Baker and Malott, “Working Capital means Current Assets”.

According to the definition of J.S.Mill, “The sum of the current asset is the working capital of a business”.

According to the definition of Weston and Brigham, “Working Capital refers to a firm’s investment in short-term assets, cash, short-term securities, accounts receivables and inventories”.

CONCEPT OF WORKING CAPITAL

Gross Working Capital

Gross Working Capital is the general concept which determines the working capital concept. Thus, the gross working capital is the capital invested in total current assets of the business concern. Gross Working Capital is simply called as the total current assets of the concern.

GWC = CA

Net Working Capital

Net Working Capital is the specific concept, which, considers both current assets and current liability of the concern. Net Working Capital is the excess of current assets over the current liability of the concern during a particular period. If the current assets exceed the current liabilities it is said to be positive working capital; it is reverse, it is said to be Negative working capital.

NWC = C A – CL

Component of Working Capital

Working capital constitutes various current assets and current liabilities

NEEDS OF WORKING CAPITAL

Working Capital is an essential part of the business concern. Every business concern must maintain certain amount of Working Capital for their day-to-day requirements and meet the short-term obligations.

Working Capital is needed for the following purposes.

1.Purchase of raw materials and spares: The basic part of manufacturing process is, raw materials. It should purchase frequently according to the needs of the business concern. Hence, every business concern maintains certain amount as Working Capital to purchase raw materials, components, spares, etc.

2.Payment of wages and salary: The next part of Working Capital is payment of wages and salaries to labour and employees. Periodical payment facilities make employees perfect in their work. So a business concern maintains adequate the amount of working capital to make the payment of wages and salaries.

3.Day-to-day expenses: A business concern has to meet various expenditures regarding the operations at daily basis like fuel, power, office expenses, etc.

4.Provide credit obligations: A business concern responsible to provide credit facilities to the customer and meet the short-term obligation. So the concern must provide adequate Working Capital.

FACTORS DETERMINING WORKING CAPITAL REQUIREMENTS

Working Capital requirements depends upon various factors. There are no set of rules or formula to determine the Working Capital needs of the business concern. The following are the major factors which are determining the Working Capital requirements.

1.Nature of business: Working Capital of the business concerns largely depend upon the nature of the business. If the business concerns follow rigid credit policy and sell goods only for cash, they can maintain lesser amount of Working Capital. A transport company maintains lesser amount of Working Capital while a construction company maintains larger amount of Working Capital.

2.Production cycle: Amount of Working Capital depends upon the length of the production cycle. If the production cycle length is small, they need to maintain lesser amount of Working Capital. If it is not, they have to maintain large amount of Working Capital.

3.Business cycle: Business fluctuations lead to cyclical and seasonal changes in the business condition and it will affect the requirements of the Working Capital. In the booming conditions, the Working Capital requirement is larger and in the depression condition, requirement of Working Capital will reduce. Better business results lead to increase the Working Capital requirements.

4.Production policy: It is also one of the factors which affects the Working Capital requirement of the business concern. If the company maintains the continues production policy, there is a need of regular Working Capital. If the production policy of the company depends upon the situation or conditions, Working Capital requirement will depend upon the conditions laid down by the company.

5.Credit policy: Credit policy of sales and purchase also affect the Working Capital requirements of the business concern. If the company maintains liberal credit policy to collect the payments from its customers, they have to maintain more Working Capital. If the company pays the dues on the last date it will create the cash maintenance in hand and bank.

6.Growth and expansion: During the growth and expansion of the business concern, Working Capital requirements are higher, because it needs some additional Working Capital and incurs some extra expenses at the initial stages.

7.Availability of raw materials: Major part of the Working Capital requirements are largely depend on the availability of raw materials. Raw materials are the basic components of the production process. If the raw material is not readily available, it leads to production stoppage. So, the concern must maintain adequate raw material; for that purpose, they have to spend some amount of Working Capital.

8.Earning capacity: If the business concern consists of high level of earning capacity, they can generate more Working Capital, with the help of cash from operation. Earning capacity is also one of the factors which determines the Working Capital requirements of the business concern.

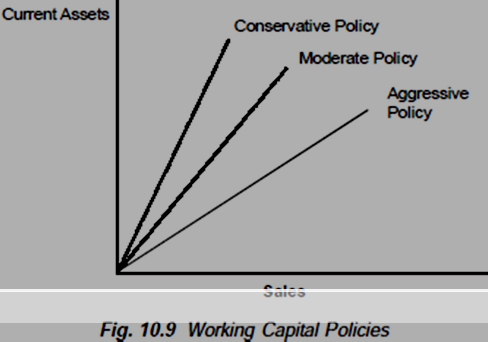

WORKING CAPITAL MANAGEMENT POLICY

Working Capital Management formulates policies to manage and handle efficiently; for that purpose, the management established three policies based on the relationship between Sales and Working Capital.

1.Conservative Working Capital Policy.

2.Moderate Working Capital Policy.

3.Aggressive Working Capital Policy.

1.Conservative working capital policy: Conservative Working Capital Policy refers to minimize risk by maintaining a higher level of Working Capital. This

type of Working Capital Policy is suitable to meet the seasonal fluctuation of the manufacturing operation.

2.Moderate working capital policy: Moderate Working Capital Policy refers to the

moderate level of Working Capital maintainance according to moderate level of sales. It means one percent of change in Working Capital, that is Working Capital is equal to sales.

3.Aggressive working capital policy: Aggressive Working Capital Policy is one of the high risky and profitability policies which maintains low level of

Aggressive Working Capital against the high level of sales, in the business concern during a particular period.