Micro Economics Revision E-NOTES By Aashi Gupta

INTRODUCTION

The term ‘Economics’ is derived from two words of Greek language, namely, Oikos (household) and Nemein (to manage), meaning thereby household management

Earlier, it used to be called as Political Economy. In fact, Indian scholar and philosopher, Chanakya (Kautilya) in his famous book ‘Arth-Shastra’ has examined both kinds of activities, i.e. economics and political. Greek philosopher Aristotle had used the term economics to mean the management of ‘family and the state’.

Dr. Marshall was the first to use the term ‘economics’ in 1890 in his famous work “Principles of Economics”.

Economics is barely 200 year old. Adam Smith, the Founder of Modern Economics, shaped the form in which we study Economy today. His famous book “An Enquiry into the Nature and Causes of Wealth of Nations”, published in 1776, is still acclaimed even today Till the end of 18th and the mid of the 19th century (1776 – 1850), several great Economists like Ricardo, Malthus, J. B. Say, etc., had fully supported the thoughts of Adam Smith. These economists 20th century (1850-1930) economists like Menger, Walras, Cournot, Marshal, Pigou, etc., had made significant contributions to the development of the study of Economics.

In 1933, Prof. Ragnar Frisch, a famous economist of Oslo University, Norway, divided the study of economics into two parts:

i) Micro Economics

ii) Macro Economics

Microeconomics study deals with what choices people make, what factors influence their choices and how their decisions affect the goods markets by affecting the price, the supply and demand.

Economics is essentially a study of the usage of resources under specific constraints, all bound with an audacious hope that the subject under scrutiny is a rational entity which seeks to improve its overall well-being.

Microeconomics is the study of individuals, households and firms’ behaviour in decision making and allocation of resources. It generally applies to markets of goods and services and deals with individual and economic issues.

Two branches within the subject have evolved thus: microeconomics (individual choices) which deals with entities and the interaction between those entities, while macroeconomics (aggregate outcomes) deals with the entire economy as a whole.

DEFINING ECONOMICS:

It is difficult to give an accurate definition of economics. A good definition delimits boundaries of the subject clearly and correctly. And there are plenty of definitions of Economics. In order to facilitate their study, definitions of Economics have been broadly divided into four parts:

Wealth Definition Adam Smith

Welfare Definition Marshall

Scarcity Definition Robbins

Growth Definition Samuelson

SCARCITY-CENTERED DEFINITIONS OF ECONOMICS:

According to Lord Robbins: “Economics is a science that studies human behaviour as a relationship between ends and scarce means which have alternative uses.”

In the words of Scitovosky: “Economics is a science concerned with the administration of scarce resources.”

According to Stonier and Hague: “Economics is fundamentally a study of scarcity and the problems which scarcity gives rise.”

In the words of Harvey: “Economics is the study of how men allocate their limited resources to provide for their wants.”

The Economic Problem: Scarcity and Choice The Problem of Scarcity:

We live in a world of scarcity. People want and need variety of goods and services. This applies equally to the poor and the rich people. It implies that human wants are unlimited but the means to fulfil them are limited. At any one time, only a limited amount of goods and services can be produced. This is because the existing supplies of resources are extremely inadequate. These resources are land, labour, capital and entrepreneurship.

These factors of production or inputs are used in producing goods and services that are called economic goods which have a piece. These facts explain scarcity as the principal problem of every society and suggest the Law of Scarcity, The law states that human wants are virtually unlimited and the resources available to satisfy these wants are limited.

The Problem of Choice:

Since are live in a world of scarcity, a society can produce only a small portion of goods and services that its people want. Therefore, scarcity of resources gives rise to the fundamental economic problem of choice. As a society cannot produce enough goods and services to satisfy all the wants of its people, it has to make choices.

A decision to produce one good requires a decision to produce less of some other good. So choice involves sacrifice. Thus every society is faced with the basic problem of deciding what it is willing to sacrifice to produce the goods it wants the most.

Central Problems of an Economy:

The resources are scarce; the society has to make a number of choices.

1.What to goods and services produce and in what quantities?

2.How to produce these goods and services?

3.For whom to product them?

4.How efficiently are the resources being utilized?

Opportunity Cost and production possibility frontier:

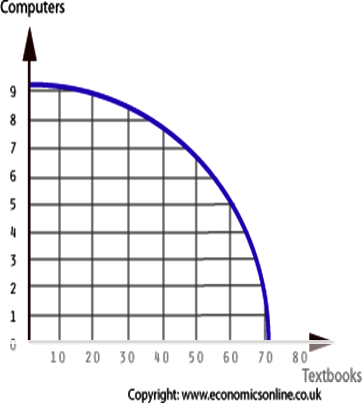

An opportunity cost will usually arise whenever an economic agent chooses between alternative ways of allocating scarce resources. The opportunity cost of such a decision is the value of the next best alternative use of scarce resources. Opportunity cost can be illustrated by using production possibility frontiers (PPFs) which provide a simple, yet powerful tool to illustrate the effects of making an economic choice.

Production possibilities

Mythica, which is a hypothetical economy, produces only two goods – textbooks and computers. When it uses all of its resources, it can produce five million computers and fifty five million textbooks. In fact, it can produce all the following combinations of computers and books.

Positive and Normative Economics:

Some economics textbooks begin by distinguishing between positive and normative economics. Positive economics deals with what is i.e., with objective explanations of the working of the economy.

Normative economics is about what ought to be i.e., it puts forward views based on personal value judgments. Thus, positive economics deals with questions which, in principle at least, are testable

Dynamic Economic:

The concept of dynamics is nearer to reality. In dynamic economics we study the economic variables like consumption function, income and investment in a dynamic state.

According to Prof. Harrod, “Economic dynamics is the study of an economy in which rates of output are changing.”

Meaning and Definition of Utility

Utility is the power of goods and services to satisfy human wants. In economics, utility is devoid of all the legal, illegal, social or ethical implications. Example: Wine possesses utility for a drunkard and cigarette possesses utility for a smoker. Food, clothes, fruits, milk etc., possess utility for all.

Utility is a subjective and relative phenomenon because the degree of satisfaction derived from the use of a particular commodity differs from person to person and time to time. Example: A cup of tea provides great satisfaction to one person, very little satisfaction to another person and no satisfaction at all to a third person

The term ‘utility’ has been defined as under:

1.“For an economist, utility means the capability to satisfy wants.”

-Prof.Waugh

2.“In economics, utility means the satisfaction or pleasure or benefit derived by a person out of consumption of wealth or assets.”

-Prof. Edward

3.“It (utility) refers to the satisfaction or gratification derived from an article to which it satisfies his wants.”

- Taussig

Thus, it may be concluded that utility means the capability of goods and services to satisfy the wants of a person.

Characteristics of Utility

1.Utility is a Psychological Concept

2.Utility is a Relative Term

3.Utility is Emotional and not Physical

4.Utility is Different from Usefulness

5.Utility is Different from Satisfaction

Cardinal Utility Approach of Marshall

Dr. Alfred Marshall, propounded the cardinal approach of utility. According to him, utility can be measured in terms of money. It can be measured and the exact measurement can be given by assigning definite number such as 1,2,3,… etc. In terms of money, utility of a commodity is the money that we are ready to pay for it. Example: A student is ready to pay Rs. 10 for a pen, the utility of pen for him will be equal to Rs. 10. In terms of units, utility of a commodity is measured in terms of utils (as propounded by Prof. Fisher). Example: Mr. A derives utility a cup of tea, utility of cup of tea for him will be 10 units.

Meaning and Definition of Marginal Utility

Marginal utility is the utility derived from the consumption of an additional unit of a commodity. In other words, marginal utility is the addition to total utility resulting from adding one unit to the consumption of a commodity. Example: A person consumes 6 chapaties at a time. In this case, 6th chapati will be the marginal unit and marginal utility will be the utility derived by him from the consumption of 6th chapati.

It has been defined as under:

1.“Marginal utility of any quantity of a commodity is the increase in total utility which results from a unit increase in consumption.” – Prof. K.E. Boulding

2.“Marginal utility is the utility of marginal unit of stock of a commodity available with a person form him.” -Prof. Ely

Thus, it may be concluded that marginal utility is the utility derived from the consumption of an additional unit of a particular commodity. It is measured by comparing total utility of two levels of consumption

Meaning and Definition of Total Utility

Total utility is the sum total of utility derived from the consumption of certain units of a particular commodity. In other words, total satisfaction derived from the consumption or possession of a commodity is called total utility. It has been defined as under:

1.“Total utility is the sum of marginal utilities associated with the consumption of successive units.” – Prof.A.L. Mayers

2.“Total utility is the amount of satisfaction derived from the consumption or possession of a good.” -Prof.A.K. Mayers

Thus, it may be concluded that total utility is the total of marginal utilities derived from consumption of all the units of a commodity.

At initial stage, total utility goes on increasing with every successive unit, but after a certain point, it starts to decline. The point at which total utility is maximum, is called the point of maximum satisfaction.

Relationship Between Marginal Utility and Total Utility

1.Marginal utility explains the rate of change in total utility while total utility is the sum of marginal utilities.

2.Marginal utility goes on diminishing, but total utility goes on increasing. After a certain point, total utility also starts to decline.

3.The point at which total utility is maximum, consumer gets maximum satisfaction. This point is called the point of maximum satisfaction.

Demand

The demand for a commodity is the quantity of it which consumers wish and are able to buy at a given price in a given period.

Thus, demand in economics implies two things: The desire to purchase and

The ability to pay for the good

If the desire for a thing is not backed by the ability to buy, there will be no effective demand. Similarly, if one is capable of buying one thing but he does not wish to buy that thing there will be no demand from his side.

Demand = Desire + Ability to pay + Will to spend

Definition of Demand

Demand implies three things (i) Desire to possess a thing, (ii) Means of purchasing it;

(iii) Willingness to use those means for purchasing it.” –Penson

“Demand means always demand at a price, the term has no significance unless a price is stated”. –Benham

Types of Demand

Direct Demand: Consumer’s demand is a direct demand as it directly gives satisfaction to the consumer. Consumption goods have direct demand

Derived Demand: Producer’s demand for factor-inputs is a derived demand as it is derived from the demand for the final output. All capital goods is a direct demand.

For instance; the demand for house is a direct demand while the demand for bricks, cement is a derived demand.

Individual Demand: It refers to the demand for a commodity from an individual. That quantity of a commodity a consumer would buy at a given price during a given period of time is his individual demand for that particular commodity.

Market Demand: it refers to the total demand of all the individual buyers taken together. How much quantity the consumers in general would buy at a given price during a given period of time constitutes the total market demand for the product. Market demand is the sum of individual demands

Price Demand: It is that demand which refers to the various quantities of a commodity or service that a consumer would purchase at a given time in a market at various prices.

Income Demand: It refers to the various quantities of goods which will be purchased by the consumer at various levels of income.

Cross Demand: Here the quantities of goods which will be purchased with reference to changes in the price not of this goods but of other related goods. These goods are either substitutes or complementary goods

Demand Curve

A demand curve is a graphical presentation of a demand schedule. When price quantity information of a demand schedule on a graph, a demand curve is drawn. Demand curve thus depicts the picture of the data contained in the demand schedule.

A demand curve is drawn by representing the price variable on the Y axis and the demand variable on the X axis.

“Demand curve is a snapshot at a moment in time and represents the maximum quantity that would be purchased at alternative prices.”

—Prof Milton Friedman

Law of Demand

If other things remain the same, the amount demanded increases with a fall in and diminishes with a rise in price.”

—Prof Alfred Marshall

The law may be stated as: “Other things being equal, the higher the price of a commodity, the smaller is the quantity demanded and lower the price, larger is the quantity demanded.”

•The law of demand, however, relates to the much simplified demand function:

D = f(P)

Where, D represents demand, P the price and f connotes a functional relationship. It however, assumes that other determinants of demand are constant and only price is the variable and influencing factor. The relation between price and quantity of demand is usually an inverse or negative relation, indicating a large quantity demanded at a lower price and a smaller quantity demanded at a higher price.

Explanation to the Law of Demand

It is the view of economists that the Law of Demand is based on Diminishing Marginal Utility. This law simply states that as the price of a commodity increases demand reduces and vice versa. Consumer wants to pay the price of a commodity up to the extent of marginal utility. Therefore, an increase in the quantity of a commodity, its utility diminishes, slowly and consumer likes to pay less price of that commodity.

Exceptions to the Law Of Demand

Sometimes it may be observed that with a fall in price, demand also falls and with a rise in a price, demand also rises. This is a situation which is contrary to the Law of Demand and is referred to as exceptions to the law of demand. The demand curve will be an upward sloping.

DD is an upward sloping demand curve. It shows that demand rises with increase in price. In the figure drawn, DD is the demand curve which slopes upward from left to right. It appears that when OP1 is the price, QR1 is the demand and when prices rise to OP2, demand also expands to OQ2. Thus, the upward sloping demand curve expresses a direct functional relationship between price and demand.

The upward sloping demand curve thus refers to the exceptions to the Law of Demand.

Following are certain situations when the price of the commodity increases the demand also increases. These situations are:

Future expectations in prices Giffen goods

Fashion goods Consumer’s ignorance In case of emergency Snob appeal Speculation

Consumer’s psychological bias or illusion: People do not buy when there is a stock clearance sale at reduced prices, thinking the goods are of bad quality.

THE THEORY OF PRODUCTION

Production involves transformation of inputs such as capital, equipment, labor, and land into output – goods and services

In this production process, the manager is concerned with efficiency in the use of the inputs – technical vs. economical efficiency

MARGINAL RATE OF SUBSTITUTION

MRS is defined as the units of one input factor that can be substituted for a single unit of the other input factor.

So MRS of x2 for one unit of x1 is = Number of unit of replaced resource (x2)Number of unit of added resource (x1)

Price Ratio (PR) = Cost per unit of added resource .Cost per unit of replaced resource = Price of x1Price of x2

Therefore the least cost combination of two inputs can be obtained by equating MRS with inverse price ratio x2 * P2 = x1 * P1

You will see that basic production theory is simply an application of constrained optimization:

the firm attempts either to minimize the cost of producing a given level of output

or

to maximize the output attainable with a given level of cost.

Both optimization problems lead to same rule for the allocation of inputs and choice of technology

PRODUCTION FUNCTION

A production function is purely technical relation which connects factor inputs & outputs. It describes the transformation of factor inputs into outputs at any particular time period.

Q = f( L,K,R,Ld,T,t)

where

Q = output R= Raw Material

L= Labour Ld = Land

K= Capital T = Technology

t = time

For our current analysis, let’s reduce the

inputs to two, capital (K) and labor (L):

Q = f(L, K)

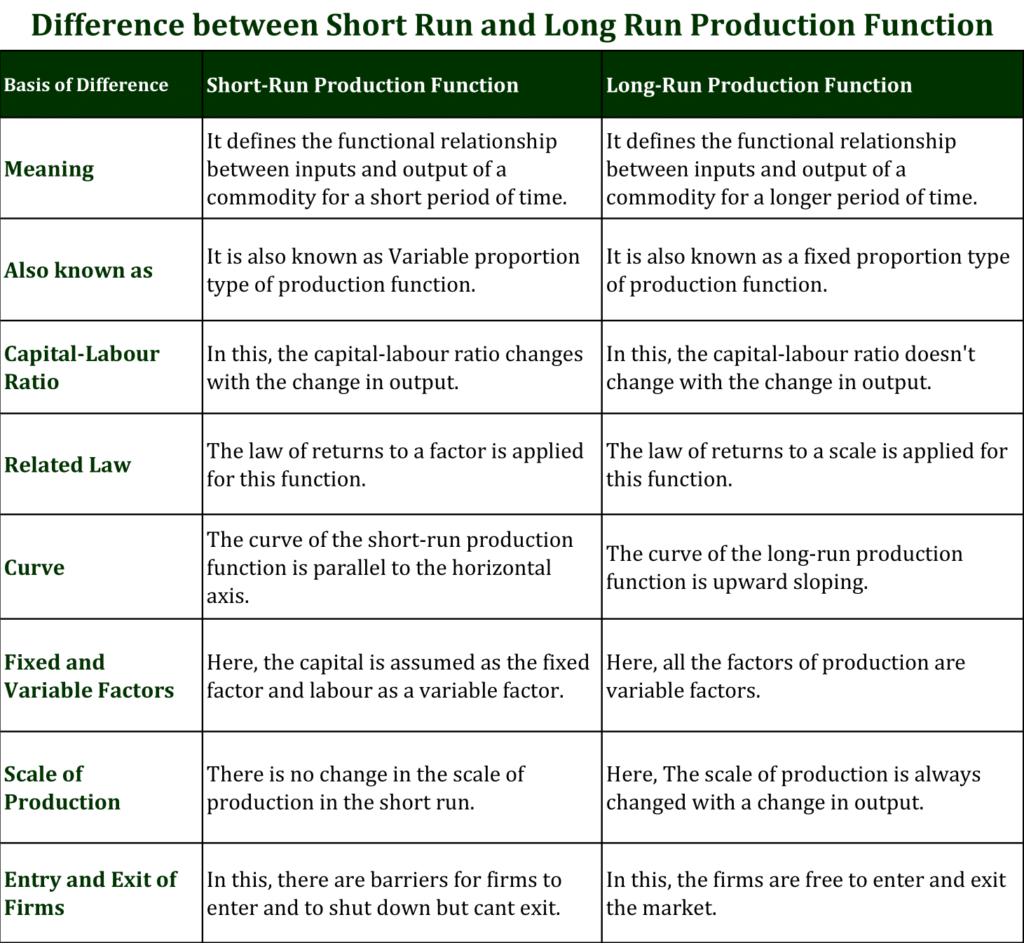

SHORT-RUN AND LONG-RUN PRODUCTION

Based on the name alone, you may assume that short-run production is simply a shorter production cycle than its long counterpart. However, short-run production actually has a different meaning. The term “short-run production” refers to a production cycle in which at least one factor is fixed.

Most companies have multiple factors that they use to produce goods or services. Also known as input factors, they can consist of labor, materials, equipment, capital and real property. Some of these factors may remain fixed, meaning they won’t change throughout the course of production. Other factors may fluctuate. In short-term production, at least one of these factors remains fixed.

What Is Long-Run Production?

Long-run production, on the other hand, occurs when all factors of production fluctuate. Regardless of which factors a company uses to produce its goods or services, they are considered variable factors in long-run production. Companies can’t accurately predict how many units of each input factor they’ll consume. Long-run production involves the exclusive use of variable factors that can fluctuate.

In many cases, short-term production cycles have a shorter length than long-run production cycle. Many companies perform short-run production in a period of six months or less. In comparison, long-run production may extend anywhere from six months to one year.

It’s important to note that short-run and long-run aren’t the only types of production cycles. There’s also very long-run production. Very long-run production occurs when both the internal and external factors of production fluctuate. It doesn’t just take into account a company’s internal factors. It looks at external factors as well. Regulatory changes, for instance, are considered an external factor. In long-run production, a change of regulation is something that’s outside of a company’s control.

LAW OF DIMINISHING RETURNS

(DIMINISHING MARGINAL PRODUCT)

The law of diminishing returns states that when more and more units of a variable input are applied to a given quantity of fixed inputs, the total output may initially increase at an increasing rate and then at a constant rate but it will eventually increases at diminishing rates.

Assumptions. The law of diminishing returns is based on the following assumptions:

Assumptions

•State of technology is given.

•One factor of production must always be kept constant at a given level.

•The law is not applicable when two inputs are used in a fixed proportion.

•Labour is homogenous and

•Input prices are given

APPLICATION OF LAW OF DIMINISHING RETURNS

It helps in identifying the rational and irrational stages of operations.

It gives answers to question – How much to produce?

What number of worker

s to apply to a given fixed inputs so that the output is maximum?

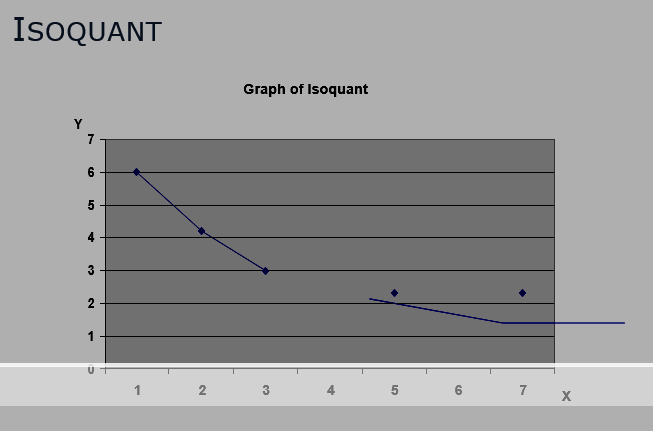

PROPERTIES OF ISOQUANTS

Isoquants have a negative slope.

Isoquants are convex to the origin.

Isoquants cannot intersect or be tangent to each other.

Upper Isoquants represents higher level of output

LAWS OF RETURNS TO SCALE

It explains the behavior of output in response to a proportional and simultaneous change in input.

When a firm increases both the inputs, there are three technical possibilities –

(i)TP may increase more than proportionately – Increasing RTS

(ii)TP may increase proportionately – constant RTS

(iii)TP may increase less than proportionately – diminishing RTS

The meaning and source of ‘profit’ has always been a centre of controversy. “The word ‘profit’ has different meanings to businessmen, accountants, tax collectors, workers and economists…” For example, ‘profit to a layman means all incomes that go to the capitalist class’. To an accountant, profit means the excess of revenue over all paid-out costs including both manufacturing and overhead expenses. For all accounting purposes, businessmen also use accountants’ definition of profit. But, on the question as to whether a businessman should stay in his present business or move to another, his concept of profit differs from the one

used in accountancy. The term ‘profit’ in the accounting sense does not include the opportunity cost— the earning that a businessman foregoes to earn a given profit in his present occupation. But a businessman does consider his opportunity cost in his calculation of his satisfactory profit that must be large enough to cover his opportunity cost. Concept of Pure Profit. Economists’ concept of profit is of ‘pure profit’. It is also called ‘economic profit’ or ‘just profit’. The word ‘profit’ in this unit

means ‘pure profit’. ‘Pure profit’ is a return over and above opportunity cost, i.e., the payment that would be “necessary to draw forth the factors of production from their most remunerative alternative employment.” Pure profit may thus be defined as “a residual left over after all contractual costs have been met, including the transfer costs of management, insurable risks, depreciation, and payments to shareholders sufficient to maintain investment at its current level.” In other words,

pure profit equals net profit less opportunity costs of management, insurable risk, depreciation of capital, necessary minimum payments to shareholders than can prevent them from withdrawing their capital from its current use. The pure profit, so defined, may not be necessarily positive for a single firm in a single year; rather there may be negative profit (i.e., loss). What is important is the return over time. In the long-run, in a competitive system, however, pure profit is presumed to be equal to zero. That is, pure profit is non-existent in the long-run An important question regarding ‘pure profit’ is ‘to whom does it belong

and in what form?’ It is common knowledge that pure profit belongs to the entrepreneur, the owner of the firm. But the question arises: how does it accrue to the entrepreneur? For, if an entrepreneur is treated as a separate factor of production, pure profit must equal the value of its marginal product. But marginal value of product cannot be logically equated to pure profit, because as concluded above, pure profit is a ‘residual’. In fact, this problem has been the source of controversy which led to various profit theories. We now turn to discuss the various theories of profit.

Theories of Profit

In this section, we will discussed some important theories of profit. Profit theories reveal, in fact, only the source of profit, not the determination of profit rate.

Modern Theory of Wages:

Wage is the payment made for the services of labour. Modern theory of wages has been propounded to determine the wage. It takes into consideration the demand for labour and supply of labour for the determination of wages. It is also called demand and supply theory of wages. Wage determination is a specific form of general theory of value.

Ricardian Theory of Rent

David Ricardo propounded original theory of rent. His idea was that ‘nature has been very generous to human beings and has endowed the land with some ‘original and indestructible powers’ for their use. Due to those powers, output from the land would exceed the total of payment to all kinds of inputs. Thus, after compensating all other factors of production involved in agriculture, there would remain a surplus. The owner of the land can rightfully claim that ‘surplus’.

Intrest

Capital is a factor of production made by human beings. They transform some free gifts of nature into such tools and implements, which help them in producing things that satisfy some of their wants. Had they not diverted some time and worked to perfection of those implements, they could have produced more goods. Thus, if some are making implements, they is forgoing some opportunity to produce some consumption goods. However, at a later stage, when human beings used implements, they were able to produce a larger quantity of consumers’ goods quickly. Capital enhances productivity of labour and this is helpful in the process of production. Therefore, we regard it as a factor of production. We have further enlarged the notion of capital to include all machinery, buildings, factories etc., which help in the process of production. Even the money needed to continue operations of an enterprise smoothly, called working capital, may include some stock of raw materials and some inventory of finished goods as well. Raw materials ensure smooth functioning of manufacturing while some inventories are needed to ensure regular supply to the customers. We can say that initially capital was defined with respect to tools and implements, but now it encompasses buildings housing those implements/machinery as well as whatever stock etc., may be regarded as necessary for smooth functioning of the enterprise. The reward for the services of capital is called interest.

Theories of Profits

Economists have, over the years, developed several theories regarding profits. For example, Joseph Schumpeter attributed profits to innovation. But Frank Knight

associated them with uncertainty.

a) Profits as Rewards for Innovation Schumpeter regards profit a phenomenon, which is related to a dynamic economy only. He identifies five types of changes that lead to economic development or make the society dynamic. These changes are:

i) Introduction of new products

ii) Introduction of new methods of production

iii) Discovery of new raw materials

iv) Discovery of new markets

v) Introduction of new forms of organisation

Innovations are actual application of some new body of knowledge to real business situation. An innovator need not be an inventor. But she uses some invention to change her production function or the relationship between inputs and output. Such innovation might be in form of new technique of production, may involve reaching out to new markets, involving all the activities pertaining to marketing etc.

Schumpeter is of the opinion that one who innovates is able to earn more profits, and thus gets more incentive to innovate further. She will soon attract followers or imitators. These people, very soon catch up with original innovator. As a consequence, she makes more efforts to stay ahead. Thus, innovation leads to profits and profits make it possible to innovate (acting as incentive)